In the dynamic world of finance, identifying stocks that have the potential to become multibaggers is a crucial task for investors. A multibagger, as the name suggests, is a stock that has the potential to increase in value by multiples of its initial price. This article delves into the top multibaggers US stocks to watch out for in 2025, offering insights and analysis to help you make informed investment decisions.

1. Technology Stocks: The Powerhouse of Innovation

The technology sector has always been a hotspot for multibagger stocks. With the rapid advancements in artificial intelligence, blockchain, and cloud computing, several tech stocks have the potential to deliver substantial returns.

Tesla, Inc. (TSLA): As the world's leading electric vehicle manufacturer, Tesla has been at the forefront of innovation. With its plans to expand its global footprint and introduce new products, TSLA remains a top pick for multibagger potential.

Amazon.com, Inc. (AMZN): As the e-commerce giant continues to dominate the online retail market, its vast ecosystem of services and products provides a strong foundation for sustained growth. AMZN is a strong candidate for multibagger status in the coming years.

2. Healthcare Stocks: Nurturing the Future

The healthcare sector is another area where multibaggers can be found. With the global population aging and advancements in medical technology, healthcare stocks have a bright future.

Moderna, Inc. (MRNA): Known for its groundbreaking mRNA technology, Moderna has been a key player in the COVID-19 vaccine landscape. With its potential for further breakthroughs in the field of medicine, MRNA is a multibagger stock to watch.

AbbVie Inc. (ABBV): A leader in biopharmaceuticals, AbbVie has a strong pipeline of innovative drugs and therapies. With its commitment to research and development, ABBV has the potential to become a multibagger stock in 2025.

3. Renewable Energy Stocks: Embracing the Future

The shift towards renewable energy sources is a trend that is here to stay. As the world moves towards a greener future, renewable energy stocks have significant multibagger potential.

SolarEdge Technologies, Inc. (SEDG): A leader in solar inverters, SolarEdge provides innovative solutions that increase the efficiency and reliability of solar power systems. With the global solar market expanding, SEDG is a multibagger stock to consider.

Tesla, Inc. (TSLA): Once again, Tesla's focus on renewable energy, particularly through its solar products, makes it a compelling multibagger stock for 2025.

4. Financial Stocks: Powering the Economy

The financial sector plays a vital role in the global economy. With several financial stocks showing strong growth potential, investors should keep an eye on these companies.

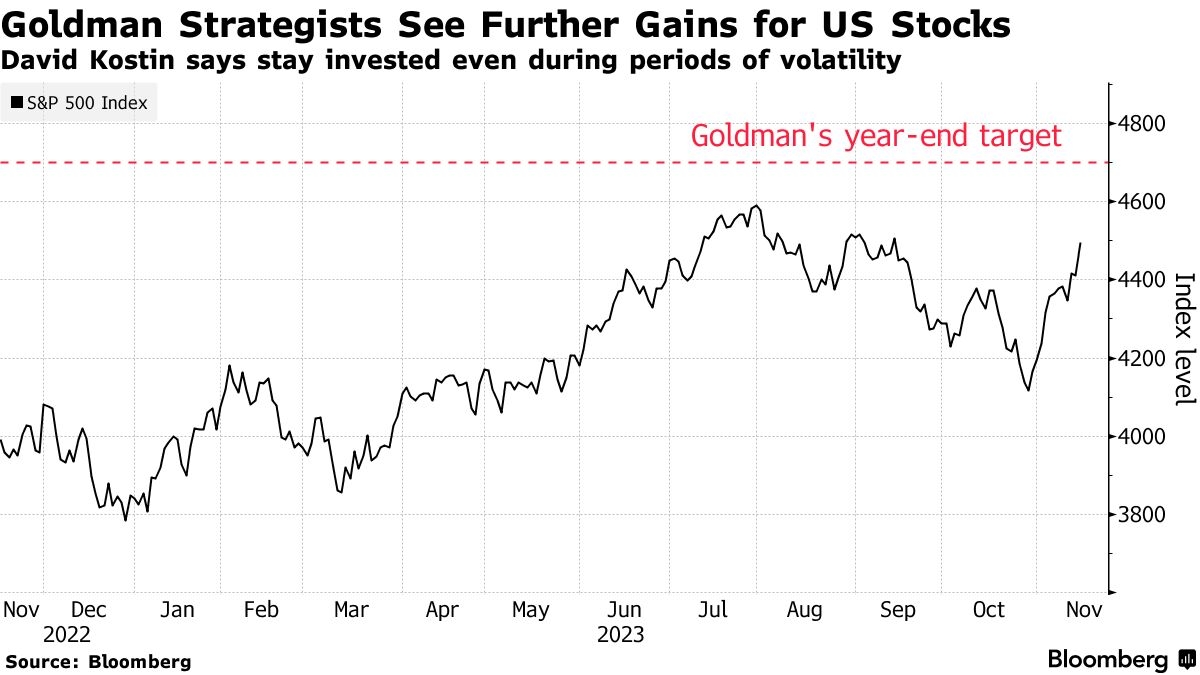

Goldman Sachs Group, Inc. (GS): As one of the world's leading investment banks, Goldman Sachs has a diverse portfolio of services and products. With its strong position in the financial sector, GS is a multibagger stock to watch.

Visa Inc. (V): As the world's largest digital payments network, Visa has the potential to continue its growth trajectory. With its focus on innovation and expansion into new markets, V is a multibagger stock worth considering.

In conclusion, multibagger stocks offer investors the opportunity to achieve substantial returns. By focusing on sectors like technology, healthcare, renewable energy, and financial services, investors can identify stocks with high growth potential. As you evaluate your investment strategy for 2025, consider these multibagger stocks to build a diversified and potentially profitable portfolio.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....