Introduction: The stock market is a dynamic entity that constantly evolves based on various factors such as economic conditions, political events, and investor sentiment. In this article, we delve into the current sentiment analysis of the US stock market, providing insights into what drives investor behavior and potential market trends.

Understanding Stock Market Sentiment

Stock market sentiment refers to the overall mood or outlook of investors towards the market. It is crucial to analyze this sentiment as it can significantly impact market movements. Sentiment analysis involves studying investor behavior, news, and economic indicators to gauge market sentiment.

Factors Influencing Current US Stock Market Sentiment

Economic Indicators: The US economy's performance plays a vital role in shaping investor sentiment. Key economic indicators like GDP growth, unemployment rate, and inflation are closely monitored by investors to predict market trends.

Political Events: Political stability or instability can influence investor confidence. Recent events such as elections, trade disputes, and policy changes can lead to fluctuations in market sentiment.

Technological Advancements: The rapid pace of technological advancements has become a significant driver of market sentiment. Companies at the forefront of innovation often attract investor interest, while those lagging behind may face negative sentiment.

Coronavirus Pandemic: The COVID-19 pandemic has had a profound impact on the stock market. As the situation evolves, investor sentiment continues to fluctuate, with sectors like healthcare and technology experiencing increased demand.

Current Sentiment Analysis

Optimism in Tech Stocks: The technology sector has emerged as a beacon of optimism amidst the pandemic. Companies like Apple, Amazon, and Google have seen significant growth, driven by increased demand for their products and services.

Volatility in Energy Stocks: The energy sector has faced volatility due to the pandemic's impact on oil demand. However, recent signs of economic recovery have led to a slight rebound in energy stocks.

Mixed Sentiment in Financial Stocks: Financial stocks have experienced mixed sentiment, with investors weighing the potential for economic recovery against the challenges posed by the pandemic.

Impact of Inflation Concerns: Rising inflation concerns have caused some uncertainty in the market. Investors are closely monitoring the Federal Reserve's policies to determine how inflation will impact the stock market.

Case Studies

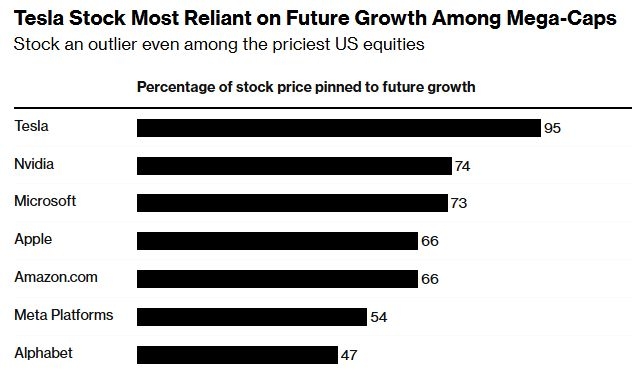

Tesla's Stock Surge: Tesla's stock has seen remarkable growth, driven by its innovative electric vehicles and renewable energy solutions. This case highlights the impact of technological advancements on market sentiment.

Bank of America's Stock Performance: Bank of America's stock has experienced mixed sentiment, with investors weighing the potential for economic recovery against the challenges posed by the pandemic.

Conclusion:

The current US stock market sentiment is shaped by a combination of economic indicators, political events, technological advancements, and the ongoing impact of the COVID-19 pandemic. By analyzing these factors, investors can gain valuable insights into market trends and make informed decisions. However, it is essential to stay updated with the latest news and developments to adapt to the ever-changing market landscape.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....