In the ever-evolving world of technology and finance, the stock price of Apple Inc. (AAPL) has consistently captured the attention of investors and tech enthusiasts alike. As one of the most valuable companies in the world, Apple's stock performance is a key indicator of the tech industry's health and consumer demand for its products. In this article, we'll delve into the current trends, historical analysis, and future outlook for Apple's US stock price.

Current Trends in Apple's Stock Price

As of the latest data, Apple's stock price has been on a rollercoaster ride. The company's market capitalization has reached unprecedented heights, making it the most valuable company in the world. However, the stock price has experienced significant fluctuations over the past few years. Several factors have contributed to these trends:

- Product Launches: Apple's stock price often experiences a surge in anticipation of new product launches, such as the iPhone, iPad, and MacBook. These launches not only generate excitement but also drive increased sales and revenue for the company.

- Economic Conditions: The global economy plays a crucial role in Apple's stock performance. During periods of economic growth, consumers tend to spend more on technology products, positively impacting Apple's stock price.

- Competitive Landscape: The tech industry is highly competitive, with numerous companies vying for market share. Apple's stock price can be influenced by the success or failure of its competitors, as well as the overall health of the industry.

Historical Analysis of Apple's Stock Price

Looking back at Apple's stock price history, we can observe several patterns and milestones:

- Initial Public Offering (IPO): Apple went public in 1980, with its stock initially priced at $22 per share. Since then, the stock has experienced numerous splits and has grown exponentially in value.

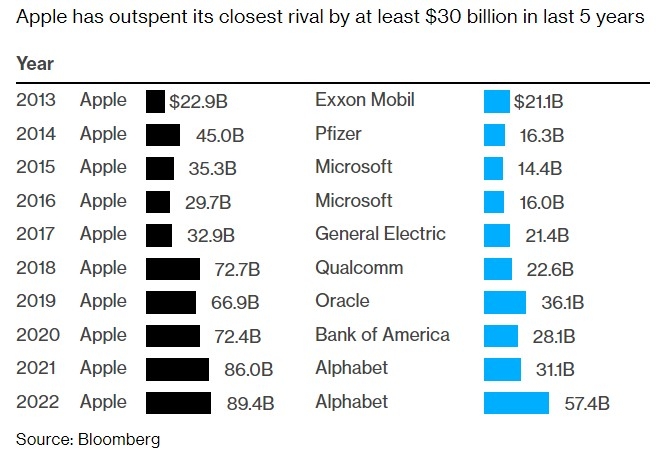

- Milestones: Over the years, Apple has reached several milestones, such as the $1 trillion market capitalization in 2018 and the introduction of groundbreaking products like the iPhone, iPad, and Apple Watch.

- Volatility: Despite its long-term growth, Apple's stock price has been subject to significant volatility, particularly during periods of economic uncertainty or market downturns.

Future Outlook for Apple's Stock Price

Predicting the future of Apple's stock price is challenging, but several factors could influence its performance:

- Product Innovation: Apple's ability to innovate and introduce new products will continue to be a key driver of its stock price. The company has a strong track record of launching successful products that generate significant revenue and market share.

- Global Expansion: As Apple expands its presence in emerging markets, such as China and India, the company could see a boost in sales and revenue, positively impacting its stock price.

- Economic Conditions: The global economy will remain a critical factor in Apple's stock performance. Economic growth, consumer confidence, and trade policies could all have a significant impact.

Case Study: The iPhone 12 Launch

A prime example of how product launches can influence Apple's stock price is the introduction of the iPhone 12 series in 2020. In the weeks leading up to the launch, Apple's stock price experienced a significant increase, driven by investor optimism and anticipation. Following the launch, the stock price continued to rise as the company reported strong sales and revenue from the new product line.

In conclusion, Apple's US stock price is influenced by a variety of factors, including product launches, economic conditions, and the competitive landscape. While predicting future performance is challenging, investors and tech enthusiasts will continue to closely monitor Apple's stock price as it remains a key indicator of the tech industry's health and consumer demand for its products.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....