The opening bell of 2025 echoed a note of caution as major US stock indexes began the year with declines. This article delves into the reasons behind the downward trend and its implications for investors and the broader market.

Economic Factors Contributing to the Decline

Several economic factors contributed to the initial downturn in the US stock market. Inflation concerns remained a major issue, with the Consumer Price Index (CPI) rising to a multi-year high. This has led to the Federal Reserve increasing interest rates, which can have a negative impact on stocks as higher borrowing costs can squeeze corporate profits.

Geopolitical Uncertainties

Geopolitical tensions also played a significant role in the market's decline. The ongoing conflict in Eastern Europe and the potential for broader geopolitical instability added to investor uncertainty. Companies with significant exposure to international markets felt the brunt of these concerns, leading to declines in their stock prices.

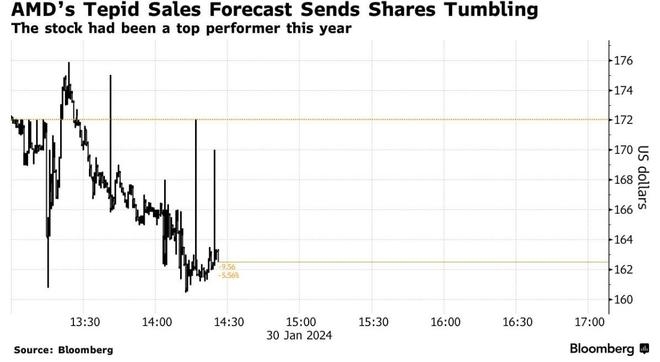

Technological Sector Under Pressure

The technology sector, which has been a key driver of the stock market's growth in recent years, faced significant headwinds. Valuations in the sector had reached historic highs, leading to concerns about overvaluation. Additionally, regulatory scrutiny and competition from new entrants have added to the sector's challenges.

Case Study: Apple Inc.

A prime example of the technology sector's struggles is Apple Inc. The tech giant's stock price saw a significant decline, as investors worried about the company's future growth prospects. Apple's reliance on international markets, particularly in China, has made it vulnerable to global economic uncertainties.

Impact on Small and Mid-Cap Stocks

The downturn in major stock indexes had a particularly pronounced impact on small and mid-cap stocks. These companies often have less diversified revenue streams and are more vulnerable to economic downturns. As a result, their stock prices saw larger declines compared to their larger counterparts.

Investor Sentiment and Market Recovery

Despite the initial declines, investor sentiment remained cautiously optimistic. Many investors believe that the market's current downturn is a temporary phenomenon and that the fundamentals of the economy remain strong. As a result, the market has shown signs of recovery in recent weeks.

Conclusion

The opening of 2025 with declines in major US stock indexes highlighted the potential risks that investors face in the current economic environment. While the market has shown signs of recovery, investors should remain vigilant and consider diversifying their portfolios to mitigate risks.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....