2018 marked a challenging year for the US stock market, with a series of events culminating in what many are calling the worst year of the decade. This article delves into the reasons behind this downturn, the impact on investors, and the lessons learned.

The Stock Market Downturn

The US stock market experienced a tumultuous year in 2018, with major indices like the S&P 500 and the Dow Jones Industrial Average witnessing significant declines. The S&P 500, which had been on a bull run for nearly a decade, saw its worst performance since 2008, while the Dow Jones Industrial Average experienced its worst year since 2008 as well.

Several factors contributed to this downturn. The Federal Reserve's aggressive interest rate hikes were a major factor, as investors worried about the potential for higher borrowing costs and inflation. Additionally, global economic uncertainties, including trade tensions between the US and China, and concerns about slowing growth in key economies like China and Europe, weighed on investor sentiment.

Impact on Investors

The downturn in the stock market had a significant impact on investors. Many were caught off guard by the sudden decline, leading to panic selling and significant losses. For those who had accumulated substantial gains over the previous decade, 2018 was a year of reckoning.

However, the downturn also presented opportunities for investors who were willing to take on risk. Value investors and contrarian investors found attractive entry points in beaten-down sectors like energy and financials.

Lessons Learned

The downturn in 2018 provided several valuable lessons for investors. Diversification remains a key strategy for managing risk, as no single asset class can guarantee positive returns in all market conditions. Additionally, risk management is crucial, especially when markets are volatile.

Investors also learned the importance of staying the course during turbulent times. Market timing is a difficult endeavor, and trying to predict the direction of the market can lead to missed opportunities and significant losses.

Case Studies

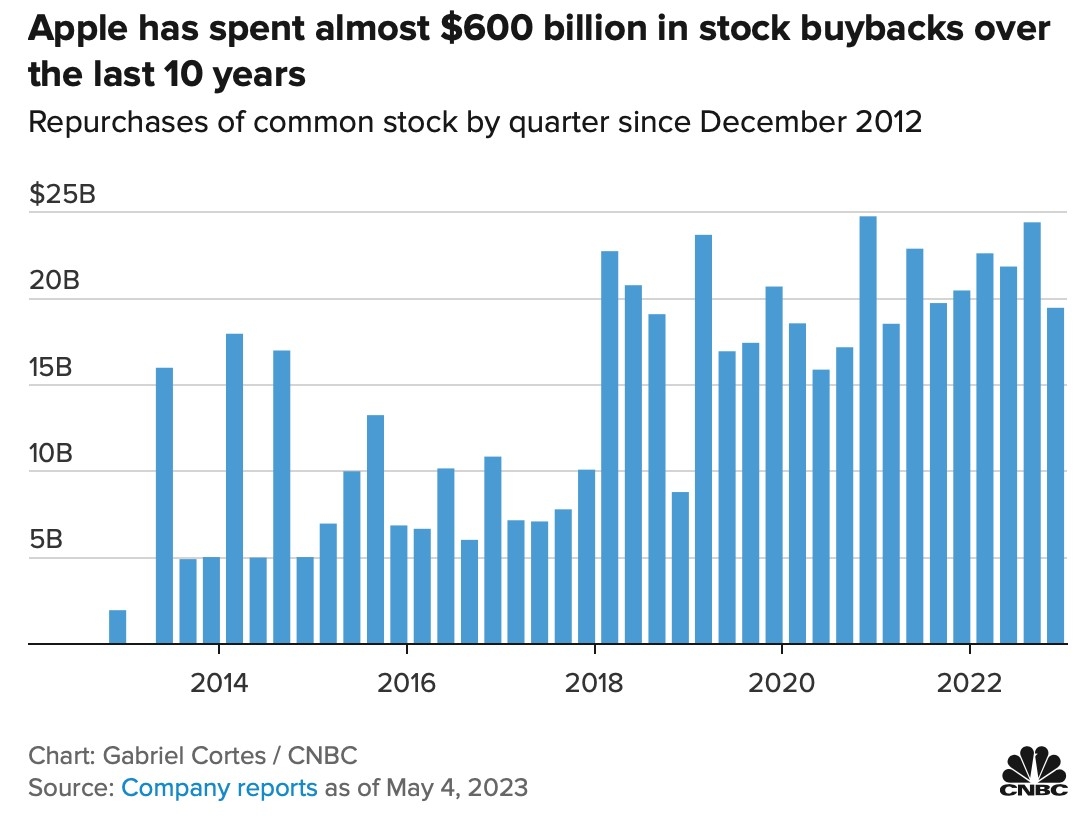

Several high-profile companies experienced significant declines in 2018. For instance, Walmart saw its stock price decline by nearly 10% during the year, despite strong sales growth. Similarly, Apple saw its stock price fall by nearly 30%, despite reporting strong revenue growth.

These cases highlight the importance of long-term investing and the potential for short-term volatility. While these companies remain strong players in their respective industries, their stock prices were affected by broader market conditions.

In conclusion, 2018 was a challenging year for the US stock market, with significant declines across major indices. However, the downturn also provided valuable lessons for investors, including the importance of diversification, risk management, and long-term investing. While the market may face further challenges in the future, investors who learn from the lessons of 2018 can position themselves for success.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....