In the fast-paced world of stock trading, identifying the best momentum stocks is crucial for investors looking to capitalize on market trends. This week, we take a deep dive into the top-performing large-cap stocks in the United States that have demonstrated significant momentum. From cutting-edge technology companies to well-established financial giants, these stocks have caught the eye of Wall Street and savvy investors alike.

Top Performing Stocks:

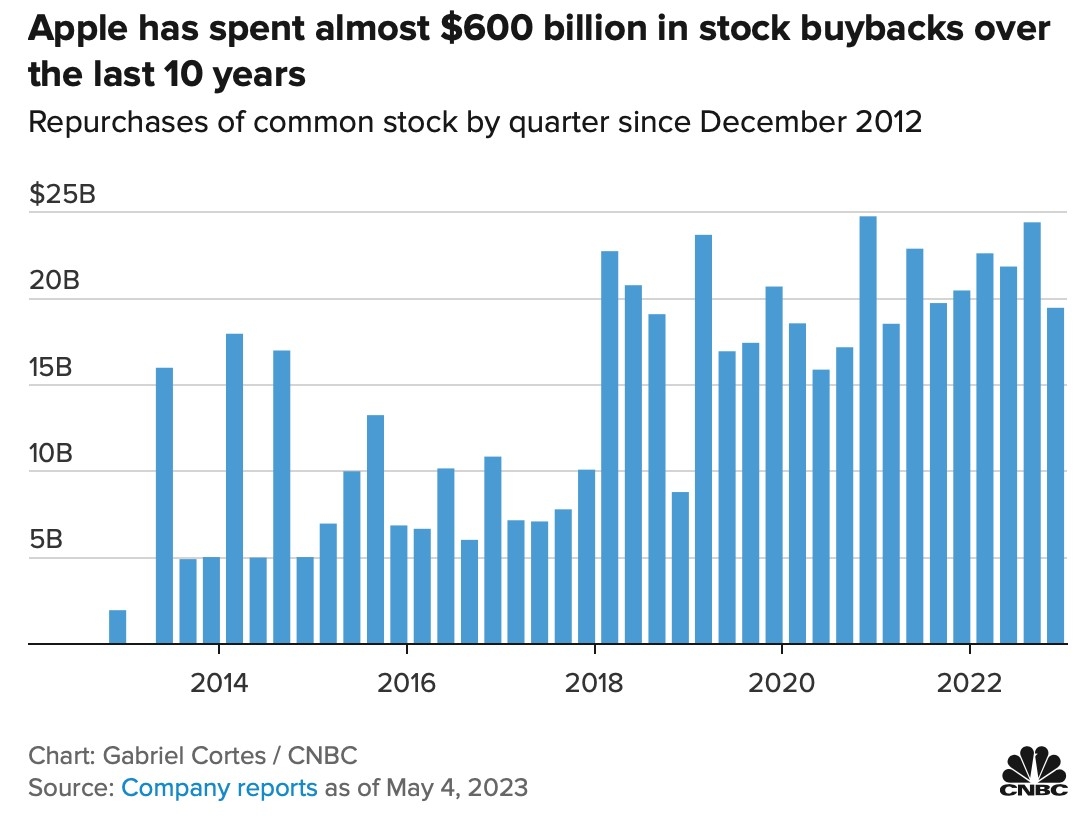

Apple Inc. (AAPL): As the world's largest technology company, Apple has consistently demonstrated strong momentum. With a market capitalization of over $2 trillion, Apple's stock has surged in recent weeks, driven by strong demand for its iPhones, iPads, and MacBooks.

Amazon.com Inc. (AMZN): The e-commerce giant has also been a major force in the stock market, with its shares experiencing a surge due to robust earnings and expanding business operations. Amazon's continued investment in cloud computing, artificial intelligence, and other innovative technologies has further fueled its growth trajectory.

Microsoft Corporation (MSFT): As a leader in the software industry, Microsoft has consistently delivered strong performance. With its recent acquisition of Nuance Communications and significant investments in gaming, Microsoft's stock has seen significant gains in the past week.

Google's Parent Company Alphabet Inc. (GOOGL): The search engine giant has also been a major mover in the market, with its stock experiencing a surge on the back of robust advertising revenue and growing cloud computing business.

Meta Platforms Inc. (META): Once known as Facebook, Meta has been a notable performer in the stock market, with its shares gaining momentum on the back of its continued investment in virtual reality and augmented reality technologies.

Factors Influencing Momentum:

Several factors contribute to the momentum of these stocks. Here are some key factors to consider:

- Earnings Reports: Strong earnings reports can significantly impact stock prices, leading to increased momentum. Companies that exceed market expectations often see their stocks surge.

- Market Trends: Investors often flock to certain sectors based on market trends. For example, technology and cloud computing have been major trends in recent years, leading to strong performance in those sectors.

- Innovation: Companies that invest in innovation and technology often see their stocks rise, as they position themselves for future growth.

Case Studies:

Tesla Inc. (TSLA): Once a niche player in the electric vehicle market, Tesla has become a major force in the industry. With strong sales and innovative technology, Tesla's stock has seen significant gains in recent years.

NVIDIA Corporation (NVDA): The graphics processing unit (GPU) manufacturer has experienced explosive growth due to its leading position in the AI and gaming markets. NVIDIA's stock has surged on the back of strong demand for its products.

Intuit Inc. (INTU): The financial software company has seen strong performance, driven by its leading position in the accounting and tax software market. Intuit's recent acquisition of Credit Karma further expands its market presence and potential for growth.

Conclusion:

Investing in momentum stocks can be a powerful way to capitalize on market trends. By focusing on large-cap stocks with strong performance and potential for growth, investors can position themselves for success in the dynamic world of stock trading. Keep an eye on these top-performing momentum stocks as they continue to drive the market forward.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....