In the ever-evolving world of finance, staying up-to-date with the latest US stock prices is crucial for investors and traders alike. Whether you're a seasoned pro or just starting out, understanding the current market trends and the prices of various stocks can help you make informed decisions. In this article, we'll explore the latest US stock prices and provide insights into what they mean for investors.

Understanding the Stock Market

Before diving into the latest US stock prices, it's essential to have a basic understanding of the stock market. The stock market is a platform where companies can raise capital by selling ownership stakes in their business, known as stocks. Investors can then buy and sell these stocks, allowing them to profit from price increases or dividends.

The stock market is influenced by various factors, including economic indicators, corporate earnings, political events, and technological advancements. Keeping an eye on the latest US stock prices can help you gauge the market's overall health and identify potential opportunities.

Key Factors Influencing Stock Prices

Several factors can influence the latest US stock prices. Here are some of the most significant ones:

Economic Indicators: Economic indicators such as unemployment rates, inflation, and GDP growth can impact stock prices. For instance, if the unemployment rate falls, it may indicate a strong economy, leading to higher stock prices.

Corporate Earnings: The financial performance of companies plays a crucial role in determining stock prices. Positive earnings reports can drive stock prices higher, while negative reports can lead to declines.

Political Events: Political events, such as elections or policy changes, can also impact stock prices. For example, a new administration may introduce policies that could benefit certain industries, leading to increased stock prices in those sectors.

Technological Advancements: Technological advancements can drive stock prices higher, particularly for companies in the tech sector. Innovations can lead to increased revenue and market share, making these stocks more attractive to investors.

Market Sentiment: The overall mood of the market, known as market sentiment, can also influence stock prices. When investors are optimistic, stock prices tend to rise, while pessimism can lead to declines.

Latest US Stock Prices: Key Takeaways

As of the latest available data, here are some key takeaways regarding the latest US stock prices:

- The S&P 500 index is a widely followed benchmark for the overall performance of the stock market. As of this writing, the S&P 500 is trading at around 4,800 points.

- The NASDAQ Composite index, which includes many tech companies, is currently trading at around 15,000 points.

- The Dow Jones Industrial Average, which represents the performance of 30 large companies, is trading at around 35,000 points.

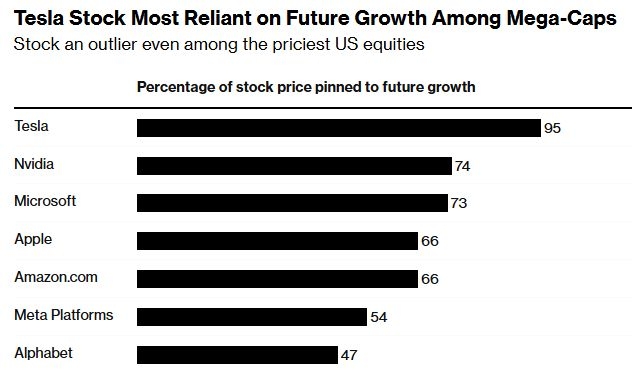

Case Study: Tesla, Inc.

To illustrate how the latest US stock prices can affect individual companies, let's look at Tesla, Inc. (TSLA). As one of the leading electric vehicle manufacturers, Tesla has seen its stock prices soar over the past few years. The company's innovative technology and commitment to sustainability have made it a favorite among investors.

In February 2021, Tesla's stock price reached an all-time high of $875 per share. Since then, the stock has experienced significant volatility, but it remains one of the most popular and highly traded stocks on the market.

By keeping an eye on the latest US stock prices, investors can gain valuable insights into the overall market and identify potential opportunities. Whether you're looking to buy, sell, or hold, understanding the factors that influence stock prices is essential for making informed decisions.

Remember, the stock market is dynamic and subject to constant change. Stay informed, stay vigilant, and make your investment decisions with confidence.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....