Introduction

The US stock market has long been a beacon of economic activity and investment opportunities. As investors and market enthusiasts alike ponder the current state of the market, the question on everyone's mind is: "Is the US stock market booming?" In this article, we delve into the factors contributing to the market's current trajectory and analyze whether it's a time for celebration or caution.

Historical Context

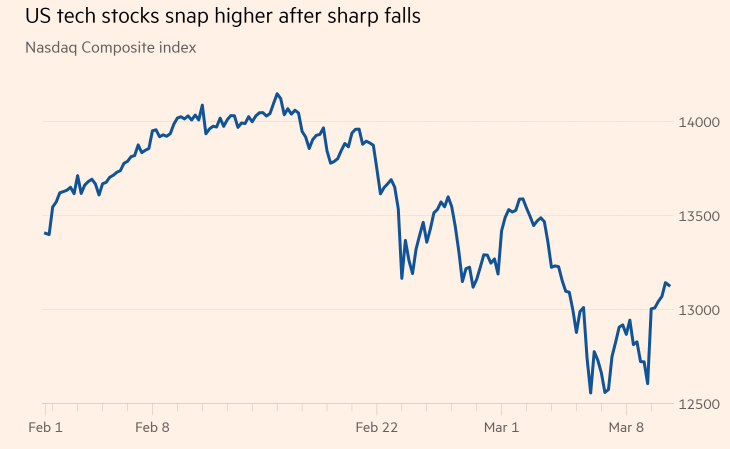

To understand the current state of the US stock market, it's essential to look back at its historical performance. Over the past few decades, the market has experienced periods of both growth and decline. However, the overall trend has been upward, with the S&P 500 index, a widely followed benchmark, posting significant gains.

Current Market Trends

Several factors have contributed to the current boom in the US stock market:

Economic Growth: The US economy has been on a steady upward trajectory, with low unemployment rates and strong GDP growth. This has bolstered investor confidence and driven stock prices higher.

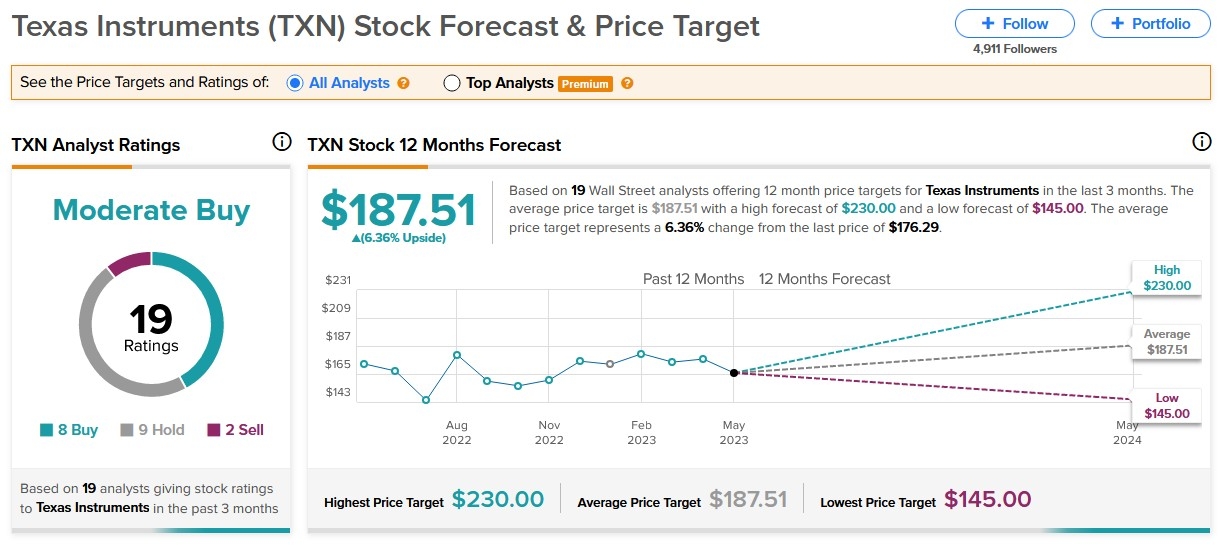

Corporate Profits: Companies have been reporting robust earnings, with many achieving record-breaking profits. This has translated into higher stock prices and increased investor optimism.

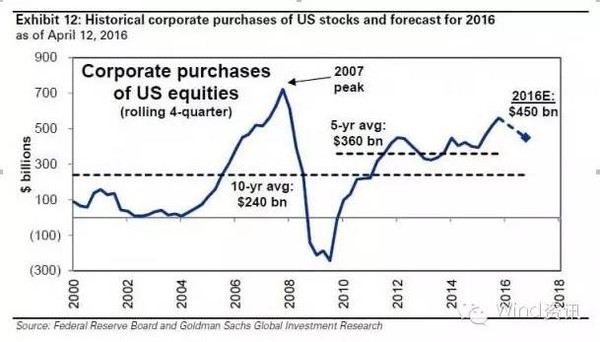

Low Interest Rates: The Federal Reserve has maintained low interest rates to stimulate economic growth. This has made borrowing cheaper for companies and individuals, leading to increased investment and spending.

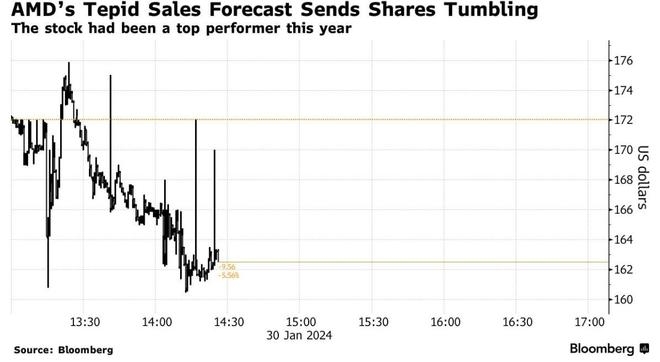

Technology and Innovation: The technology sector has been a significant driver of the market's growth. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, contributing to the overall market's rise.

Global Economic Conditions: The US stock market has been influenced by global economic conditions, with many investors looking to the US for stability and growth.

Case Studies

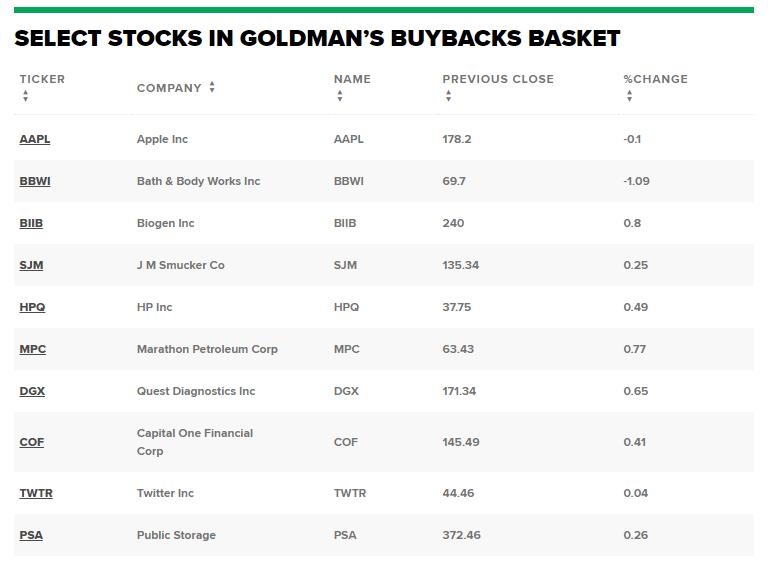

To illustrate the market's performance, let's look at a few notable examples:

Apple Inc.: Apple's stock has seen significant growth over the past few years, driven by its innovative products and strong market demand. The company's market capitalization has surpassed $2 trillion, making it the most valuable company in the world.

Tesla Inc.: Tesla has become a symbol of the electric vehicle revolution, with its stock prices skyrocketing as the company expands its production capabilities and market share.

Amazon.com Inc.: Amazon has been a leader in the e-commerce industry, with its stock prices reflecting its market dominance and potential for future growth.

Conclusion

While the US stock market has been experiencing a boom, it's essential to remain cautious. Market conditions can change rapidly, and investors should be prepared for potential downturns. However, with strong economic growth, robust corporate profits, and innovative technology driving the market, the current trend appears to be positive. As always, it's crucial to do thorough research and consult with a financial advisor before making investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....