Are you interested in investing in US stocks but unsure about the best way to do so from the UK? If so, a UK Individual Savings Account (ISA) could be the perfect solution. This guide will explore how you can buy US stocks in a UK ISA, the benefits of doing so, and what you need to consider before making your investment.

Understanding a UK ISA

A UK ISA is a tax-efficient savings account designed to help you invest your money without paying income tax or capital gains tax on the returns. There are two types of ISAs: the cash ISA and the stocks and shares ISA. The latter is what you'll need to invest in US stocks.

Benefits of Investing in US Stocks via a UK ISA

Tax Efficiency: As mentioned, the main benefit of a UK ISA is the tax-efficient nature of the investment. You won't pay income tax or capital gains tax on your returns, making it a more profitable option compared to investing directly.

Access to a Broader Market: Investing in a UK ISA allows you to invest in a wider range of assets, including US stocks. This diversification can help mitigate risk and potentially increase your returns.

Potential for Higher Returns: The US stock market has historically offered higher returns than the UK market. By investing in US stocks via a UK ISA, you can potentially benefit from these higher returns while enjoying tax-efficient savings.

How to Buy US Stocks in a UK ISA

Choose a UK ISA Provider: Research and compare different UK ISA providers to find one that offers the services and fees that suit your needs. Popular providers include Hargreaves Lansdown, Fidelity, and Interactive Brokers.

Open a UK ISA Account: Once you've chosen a provider, open a UK ISA account. This process typically involves filling out an application form and providing identification and proof of address.

Fund Your ISA Account: Transfer funds from your bank account to your new UK ISA account. Ensure that the funds are eligible for ISA investments to maintain tax efficiency.

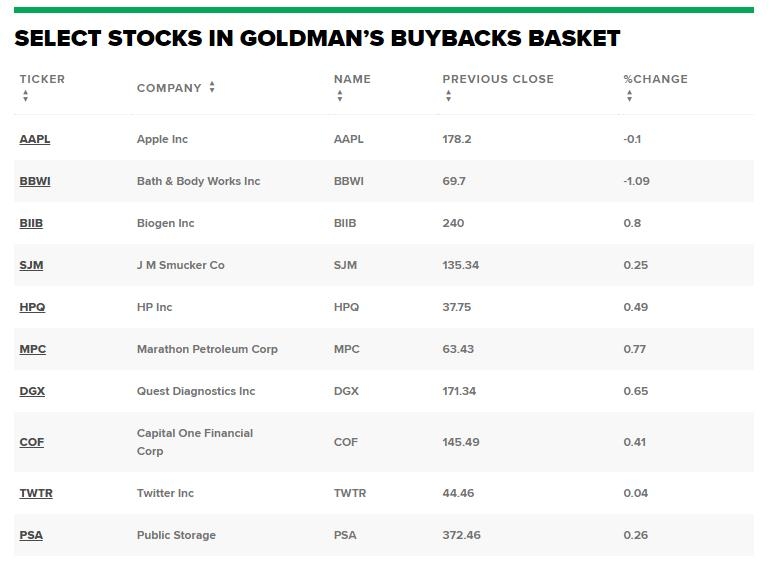

Select US Stocks to Invest In: Research US stocks that you're interested in, keeping in mind factors such as market trends, company performance, and risk. Some popular US stocks to consider include Apple, Amazon, and Microsoft.

Place Your Investment: Once you've chosen your US stocks, place your investment through your UK ISA provider. They will handle the transaction on your behalf and ensure that your investment is tax-efficient.

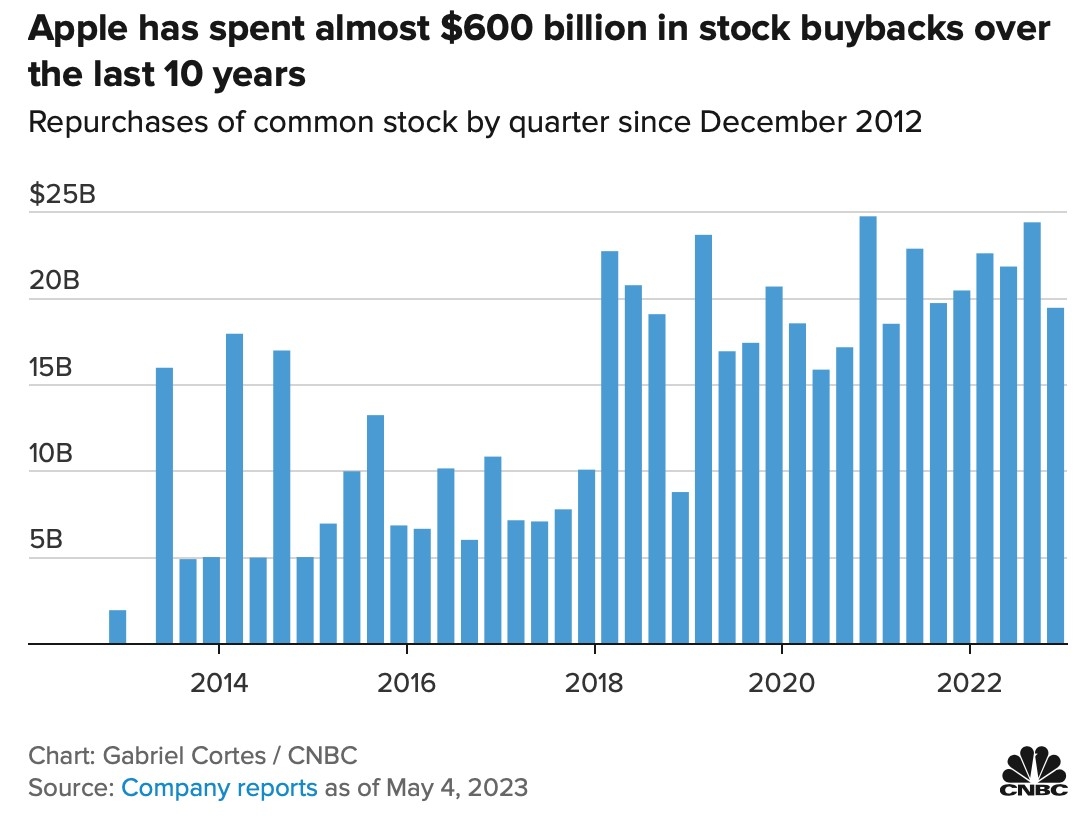

Case Study: Investing in Apple via a UK ISA

Imagine you want to invest £10,000 in Apple Inc. (AAPL) via a UK ISA. By purchasing shares directly in the US, you would be subject to capital gains tax on any returns. However, by investing in Apple via a UK ISA, you can potentially earn tax-free returns on your investment.

Considerations When Investing in US Stocks via a UK ISA

Currency Risk: The value of the pound and the US dollar can fluctuate, which may impact your investment returns. Be prepared for potential currency movements and consider diversifying your currency exposure.

Research and Due Diligence: Thoroughly research US stocks before investing, as you would with any investment. Pay attention to factors such as financial performance, market trends, and regulatory news.

Fees and Costs: Be aware of any fees and costs associated with investing in US stocks via a UK ISA, including transaction fees, account fees, and currency conversion fees.

Investing in US stocks via a UK ISA can be a tax-efficient and potentially profitable option. By following these steps and considering the associated factors, you can make informed decisions about your investments and take advantage of the benefits that a UK ISA offers.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....