The US stock market has always been a topic of interest for investors around the globe. Lately, there has been a significant buzz about the "expensive gap" in the US stock market. This article delves into what this gap is, its implications, and the factors contributing to its occurrence.

Understanding the Expensive Gap

The "expensive gap" refers to a situation where the US stock market is overvalued relative to its historical averages. This means that the prices of stocks are higher than what they should be based on traditional valuation metrics such as price-to-earnings (P/E) ratios or price-to-book (P/B) ratios.

Why Is the US Stock Market Overvalued?

There are several factors contributing to the overvaluation of the US stock market:

- Low Interest Rates: The Federal Reserve has maintained low interest rates for an extended period. This has led to investors seeking higher yields in the stock market, pushing stock prices higher.

- Economic Recovery: The US economy has been recovering from the COVID-19 pandemic, leading to strong corporate earnings and, consequently, higher stock prices.

- Institutional Investors: Institutional investors, such as mutual funds and pension funds, have been increasing their exposure to the stock market, driving up demand and prices.

Implications of the Expensive Gap

The expensive gap in the US stock market has several implications:

- Increased Risk of a Market Correction: When a stock market is overvalued, there is a higher risk of a market correction, where stock prices fall sharply.

- Reduced Returns: Investors who buy stocks at overvalued prices may see lower returns compared to those who bought stocks at more reasonable valuations.

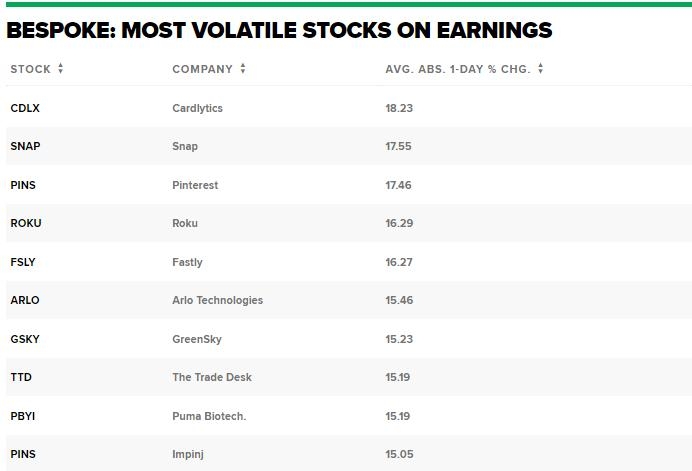

- Market Volatility: The expensive gap can lead to increased market volatility, as investors react to changes in the economic outlook or corporate earnings.

Case Studies

Several case studies illustrate the impact of the expensive gap in the US stock market:

- The Tech Bubble of 2000: The tech bubble of the late 1990s and early 2000s was a classic example of an expensive gap. Many tech stocks were overvalued, leading to a sharp market correction when the bubble burst.

- The Dot-Com Bubble: The dot-com bubble of the late 1990s also resulted from an expensive gap. Many tech stocks were overvalued, leading to a significant market correction when the bubble burst.

Conclusion

The expensive gap in the US stock market is a concerning situation for investors. It highlights the risks of overvaluation and the potential for a market correction. Investors should be cautious and consider diversifying their portfolios to mitigate these risks.

- Key Takeaways:

- The US stock market is currently overvalued relative to its historical averages.

- Several factors, including low interest rates and economic recovery, contribute to this overvaluation.

- The expensive gap poses risks of a market correction and reduced returns.

- Investors should be cautious and consider diversifying their portfolios.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....