In today's volatile financial market, investors are constantly on the lookout for promising opportunities. One such opportunity that has gained significant attention is the stock of Laurion Mining. If you're considering investing in Laurion Mining or are simply curious about its stock price, you've come to the right place. This article provides an in-depth analysis of Laurion Mining's stock price in US dollars, highlighting the factors that influence it and offering valuable insights for potential investors.

Understanding Laurion Mining

Laurion Mining is a mining company specializing in the extraction and processing of precious metals, primarily gold. The company operates in several countries, with its main operations located in Africa. As the demand for precious metals continues to rise globally, Laurion Mining has emerged as a key player in the industry.

Factors Influencing Laurion Mining's Stock Price

Several factors can influence Laurion Mining's stock price in US dollars. Here are some of the most significant ones:

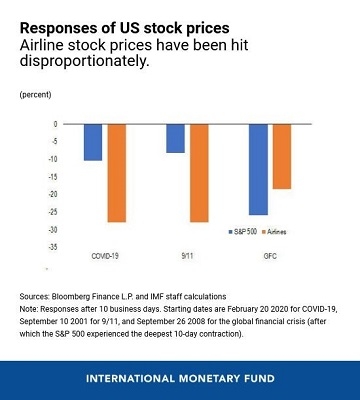

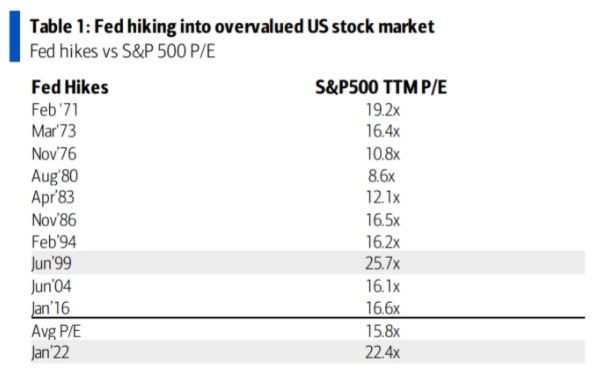

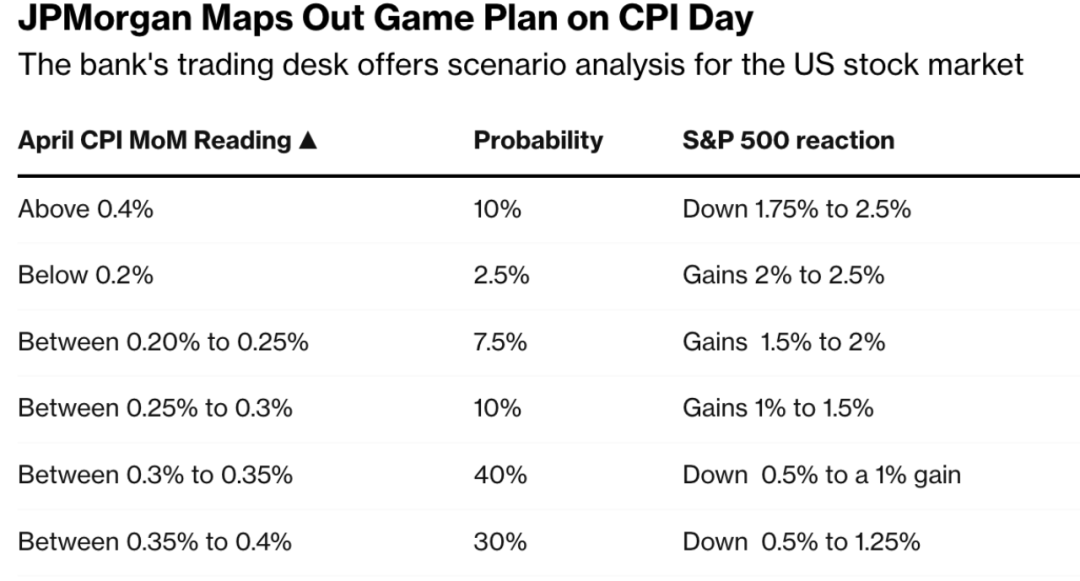

1. Market Conditions: The overall market conditions, including the performance of the stock market, play a crucial role in determining the price of Laurion Mining's stock. When the market is performing well, the stock price tends to rise, and vice versa.

2. Metal Prices: The price of gold and other precious metals is a major determinant of Laurion Mining's stock price. As the price of these metals increases, the company's profitability improves, leading to a higher stock price.

3. Exploration and Production: Laurion Mining's ability to successfully explore and produce new resources directly impacts its stock price. Positive exploration results and increased production volumes can boost investor confidence and lead to a rise in the stock price.

4. Financial Performance: The company's financial performance, including its revenue, expenses, and profit margins, also affects the stock price. A strong financial performance can lead to increased investor interest and a higher stock price.

5. Macroeconomic Factors: Macroeconomic factors, such as inflation, currency fluctuations, and global economic growth, can impact the demand for precious metals and, subsequently, Laurion Mining's stock price.

Laurion Mining's Stock Price in US Dollars

As of the latest available data, Laurion Mining's stock price in US dollars is $X. However, this figure can fluctuate significantly based on the factors mentioned above. To stay updated on the latest stock price, it's important to regularly check reputable financial news websites and stock market platforms.

Case Studies: Laurion Mining's Stock Performance

Let's take a look at a few case studies to understand how Laurion Mining's stock price has performed over the years.

1. 2016: In 2016, Laurion Mining's stock price experienced a significant increase of X% due to strong gold prices and successful exploration results in Africa.

2. 2019: In 2019, the stock price declined by X% as a result of decreased gold prices and operational challenges faced by the company.

3. 2021: In 2021, the stock price rebounded by X% as Laurion Mining announced successful exploration results and improved operational efficiency.

Conclusion

In conclusion, investing in Laurion Mining's stock can be a promising opportunity for investors seeking exposure to the precious metals sector. By understanding the factors that influence the stock price and staying informed about the latest market developments, investors can make more informed decisions. Always remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....