In the rapidly evolving world of technology, robotics has emerged as a key sector with immense potential. As we step into 2025, the robotics industry is expected to witness significant growth, driven by advancements in AI, automation, and IoT. This article highlights the best US robotics stocks that investors should consider adding to their portfolios in the upcoming year.

1. iRobot Corporation (IRBT)

iRobot Corporation is a leading provider of home robots, including the popular Roomba vacuum cleaner. The company has a strong presence in the robotics market and is continuously innovating to bring new products to market. With a focus on home automation and smart living, iRobot is well-positioned to benefit from the growing demand for robotic solutions.

2. Boston Dynamics

Boston Dynamics is a renowned robotics company known for its impressive humanoid robots and quadruped robots. The company's technology is widely used in various industries, including manufacturing, logistics, and defense. With its recent acquisition by SoftBank, Boston Dynamics is expected to accelerate its growth and expand its market reach.

3. NVIDIA Corporation (NVDA)

NVIDIA is a global leader in AI and computer graphics technology. The company's GPUs are widely used in robotics for tasks such as computer vision, machine learning, and simulation. With its cutting-edge technology, NVIDIA is well-positioned to benefit from the increasing demand for robotics in various industries.

4. Universal Robots

Universal Robots is a Danish company that specializes in the development of collaborative robots (cobots). These robots are designed to work alongside humans in a safe and efficient manner. Universal Robots has gained significant traction in the manufacturing industry and is expected to continue its growth trajectory in the coming years.

5. Clearpath Robotics

Clearpath Robotics is a Canadian company that focuses on the development of autonomous mobile robots for research, education, and commercial applications. The company's products are used in various industries, including agriculture, mining, and logistics. With its innovative technology and strong market presence, Clearpath Robotics is a promising investment opportunity.

6. ABB Ltd. (ABB)

ABB is a global leader in power and automation technologies. The company offers a wide range of robotics solutions for various industries, including manufacturing, logistics, and healthcare. With its extensive product portfolio and global reach, ABB is well-positioned to capitalize on the growing demand for robotics in the coming years.

7. Rethink Robotics

Rethink Robotics is a US-based company that specializes in the development of intelligent robots for manufacturing and logistics applications. The company's robots are designed to work alongside humans, improving efficiency and productivity. With its innovative technology and strong market presence, Rethink Robotics is a promising investment opportunity.

8. Fetch Robotics

Fetch Robotics is a US-based company that focuses on the development of autonomous mobile robots for logistics and material handling applications. The company's robots are designed to improve efficiency and reduce costs in warehouses and distribution centers. With its innovative technology and growing market presence, Fetch Robotics is a promising investment opportunity.

9. AutoMate Robotics

AutoMate Robotics is a US-based company that specializes in the development of autonomous mobile robots for industrial applications. The company's robots are designed to improve efficiency and safety in manufacturing and logistics environments. With its strong market presence and innovative technology, AutoMate Robotics is a promising investment opportunity.

As the robotics industry continues to grow, these companies are well-positioned to benefit from the increasing demand for robotic solutions. Investors looking to capitalize on this trend should consider adding these top US robotics stocks to their portfolios in 2025.

vanguard total stock market et

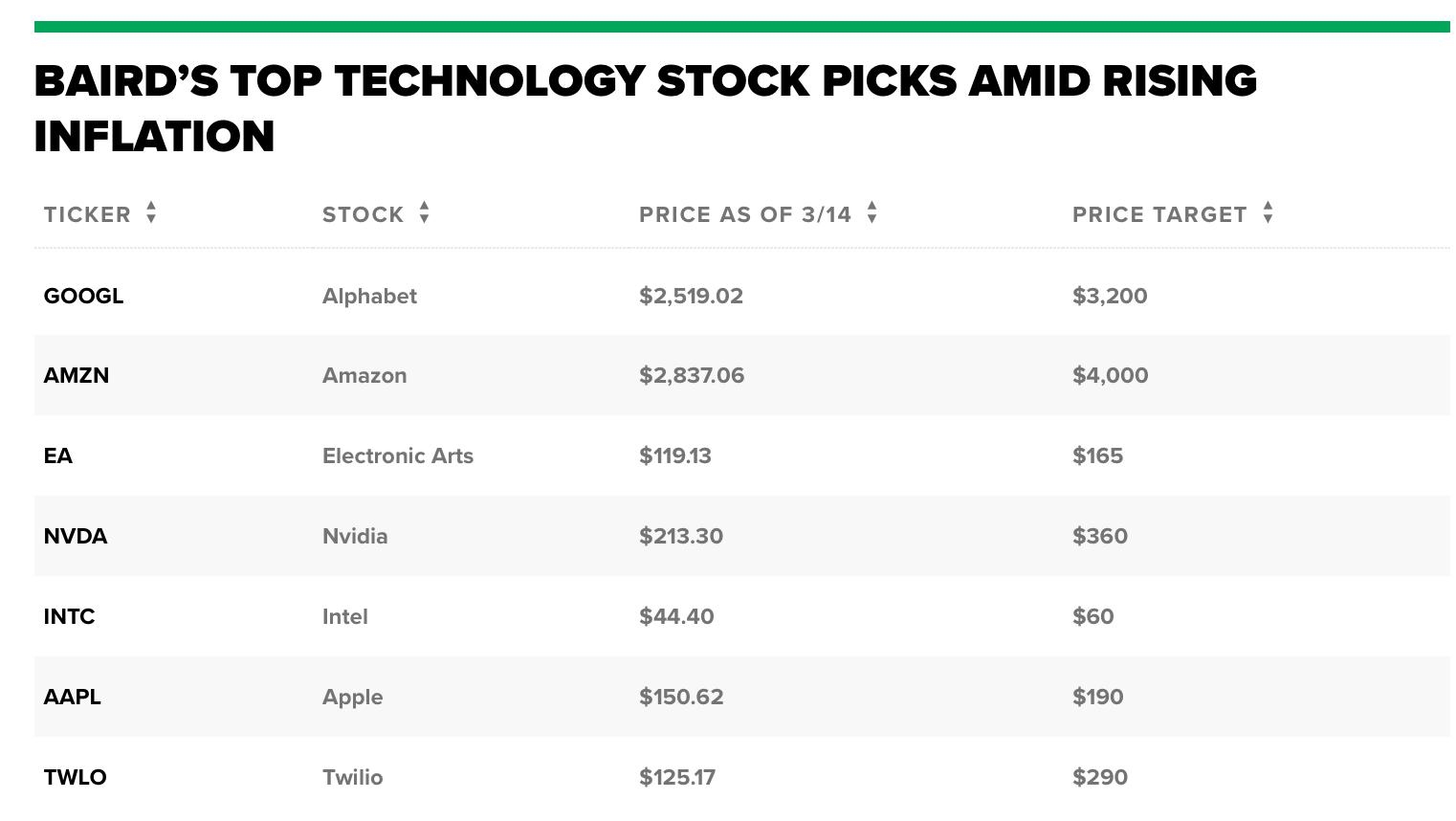

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....