Are you an Indian investor looking to expand your portfolio and gain exposure to the world's largest stock market? Investing in US stocks can be a great way to diversify your investments and potentially earn higher returns. In this article, we'll explore the steps and considerations for investing in US stocks from India.

Understanding the US Stock Market

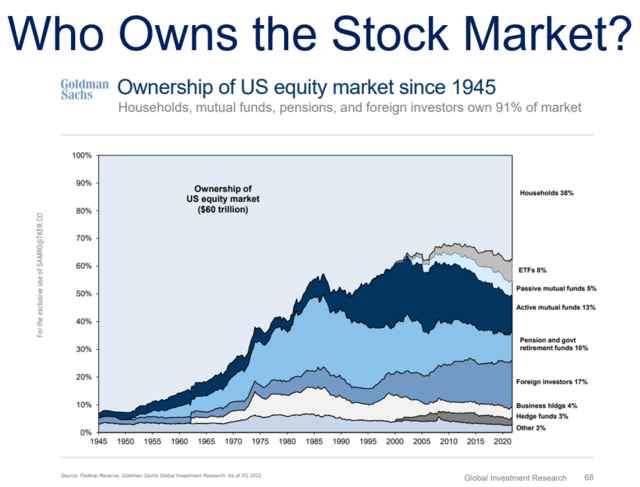

The US stock market is known for its liquidity, efficiency, and wide range of investment opportunities. It includes major indices like the S&P 500, NASDAQ, and Dow Jones, which represent some of the largest and most successful companies in the world.

Steps to Invest in US Stocks from India

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to US stocks. Some popular options for Indian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Choose a Brokerage Account: When selecting a brokerage account, consider factors like fees, minimum deposit requirements, and customer service. Many brokers offer free trading for a certain period, which can be beneficial for new investors.

Complete the Account Opening Process: You'll need to provide some personal information, including your name, address, and tax identification number. Some brokers may also require proof of identity and address.

Fund Your Account: Once your account is open, you'll need to fund it with Indian rupees. You can do this through wire transfer, bank draft, or credit/debit card. Some brokers offer currency conversion services, which can be convenient.

Research and Analyze Stocks: Before investing, it's crucial to research and analyze the stocks you're interested in. Look at factors like the company's financial health, market position, and growth prospects. You can use various online tools and resources to gather this information.

Place Your Order: Once you've identified a stock you want to invest in, you can place your order through your brokerage account. You can choose to buy shares at the current market price or set a limit order to buy at a specific price.

Monitor Your Investments: After investing, it's important to monitor your investments regularly. Keep track of the stock's performance and stay informed about any news or developments that may affect its value.

Considerations for Indian Investors

Currency Fluctuations: Since you'll be investing in US dollars, currency fluctuations can impact your returns. It's important to consider the exchange rate when investing in US stocks.

Tax Implications: Indian investors need to be aware of the tax implications of investing in US stocks. You may need to pay taxes on any capital gains you earn from US stocks. It's advisable to consult a tax professional for guidance.

Regulatory Compliance: Ensure that you comply with all regulatory requirements for investing in US stocks from India. This includes understanding the rules and regulations of the US Securities and Exchange Commission (SEC).

Case Study: Investing in Apple Inc.

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple Inc., one of the largest companies in the world. After thorough research, the investor determines that Apple is a solid investment with strong growth prospects.

The investor opens a brokerage account with a US-based broker, funds the account, and places an order to buy shares of Apple. Over time, the investor monitors the stock's performance and adjusts their investment strategy as needed.

By investing in Apple Inc., the Indian investor gains exposure to the technology sector and potentially earns higher returns compared to domestic investments.

Conclusion

Investing in US stocks from India can be a rewarding opportunity for Indian investors. By following the steps outlined in this article and considering the key factors, you can successfully invest in US stocks and diversify your portfolio. Remember to do thorough research and consult with a financial advisor or tax professional for personalized advice.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....