With the recent US-China trade deal, investors are looking for the best stocks to buy. This landmark agreement holds significant potential for the global market, particularly for companies with ties to the Chinese economy. In this article, we will explore some of the top stocks to consider after the US-China trade deal.

Tech Stocks Leading the Charge

One of the most promising sectors in the wake of the US-China trade deal is technology. Companies like Apple (AAPL), Intel (INTC), and Qualcomm (QCOM) are likely to benefit from increased demand for their products in China. These companies have a strong presence in the Chinese market, and the trade deal could lead to a surge in sales.

Consumer Goods: A Boon for Brands

The consumer goods industry is also expected to see a positive impact from the trade deal. Companies like Nike (NKE), Coca-Cola (KO), and Mars Inc. have significant operations in China and could see a boost in sales as trade barriers are reduced. These brands have a strong consumer base in China and are well-positioned to capitalize on the improved trade relations.

Automotive Industry: A New Era

The automotive industry is another sector that stands to benefit from the trade deal. Companies like General Motors (GM), Ford (F), and Tesla (TSLA) have a substantial presence in China and could see increased sales as tariffs are lowered. Additionally, the deal is expected to promote investments in electric vehicles (EVs), which could benefit companies like NIO (NIO) and Li Auto (LI).

Financial Services: The New Frontier

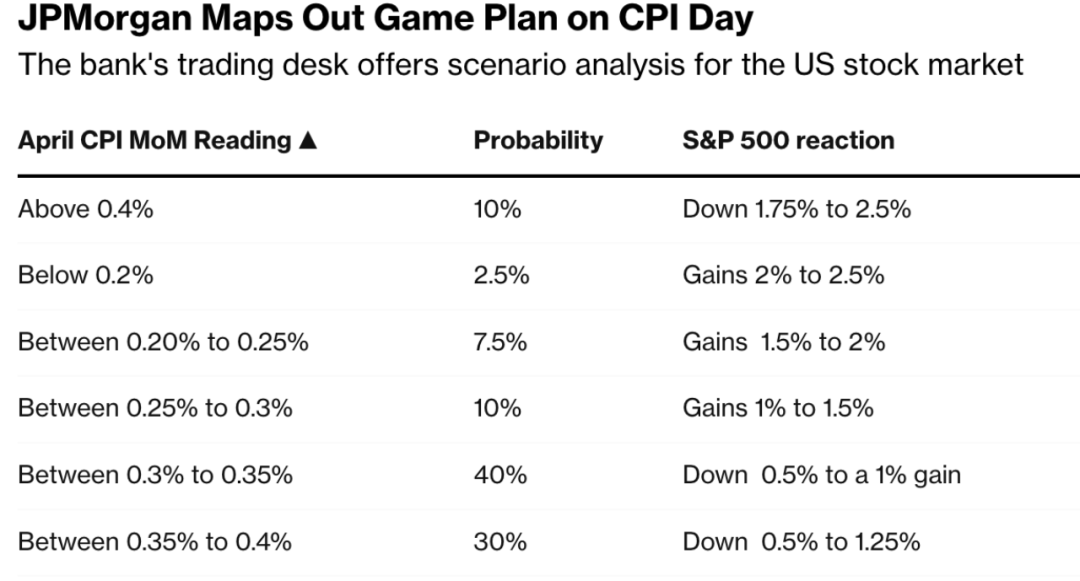

Financial services companies are also poised to benefit from the trade deal. Firms like Goldman Sachs (GS), Morgan Stanley (MS), and JPMorgan Chase (JPM) could see increased investment activity as the trade relationship improves. The deal could also lead to more cross-border mergers and acquisitions, providing opportunities for financial firms to expand their reach.

Case Study: Caterpillar (CAT)

Caterpillar, the world’s leading manufacturer of construction and mining equipment, has a significant presence in China. The company has been affected by trade tensions in the past, but the recent trade deal could be a game-changer. With reduced tariffs and improved trade relations, Caterpillar could see a surge in sales, particularly in the construction and mining sectors in China.

Conclusion

The US-China trade deal presents a unique opportunity for investors to capitalize on emerging trends in various sectors. From technology to consumer goods, automotive to financial services, there are numerous stocks to consider. However, it is essential to conduct thorough research and stay informed about market dynamics to make informed investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....