The nastitic US stock market has long been a beacon of economic prowess and investment opportunity for investors around the world. With its dynamic nature and diverse range of assets, it offers a platform for individuals and institutions to grow their wealth. In this article, we delve into the intricacies of the US stock market, exploring its history, key components, and strategies for successful investing.

A Brief History of the US Stock Market

The US stock market has a rich history that dates back to the early 18th century. The first stock exchange, the New York Stock & Exchange (NYSE), was established in 1792. Over the years, the market has evolved, with the advent of electronic trading and the inclusion of numerous exchanges and marketplaces.

Key Components of the US Stock Market

The US stock market is composed of several key components, including:

- Stock Exchanges: The NYSE, NASDAQ, and AMEX are the three major stock exchanges in the United States. Each has its unique characteristics and listings.

- Stocks: Stocks represent ownership in a company. Investors can buy and sell stocks through stock exchanges, with prices fluctuating based on supply and demand.

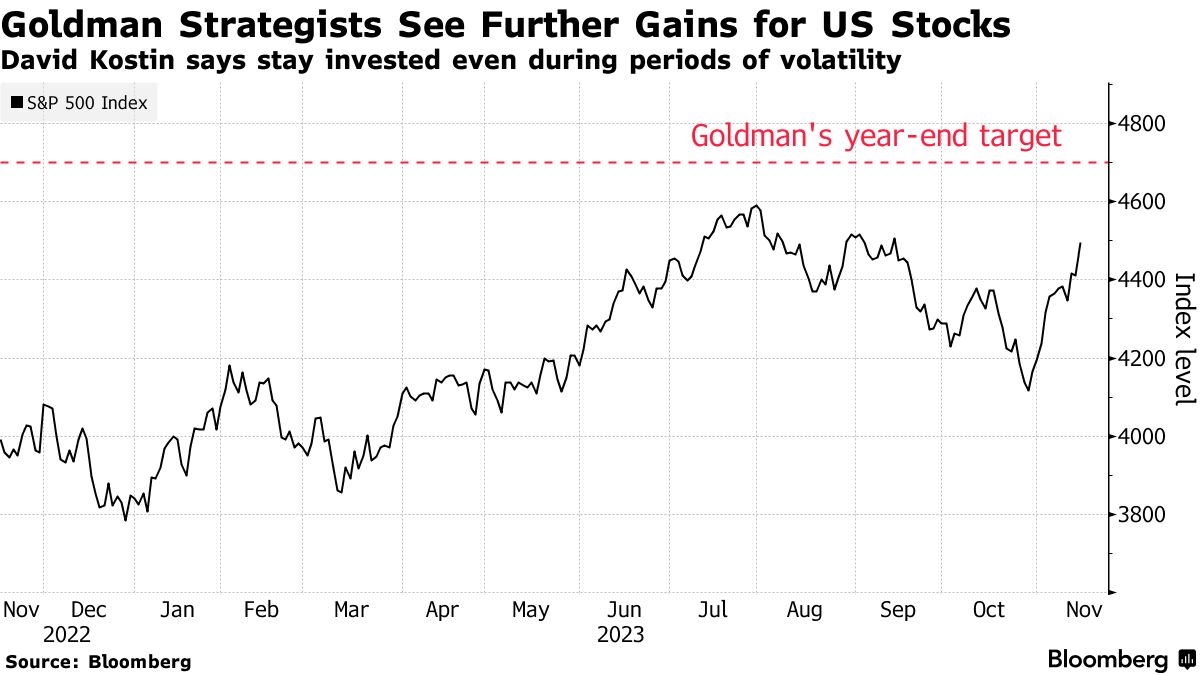

- Market Indices: Market indices, such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite, provide a snapshot of the overall performance of the stock market.

- Mutual Funds and ETFs: Mutual funds and ETFs are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other assets.

Investing Strategies in the Nastitic US Stock Market

Investing in the US stock market requires a well-thought-out strategy. Here are some key strategies to consider:

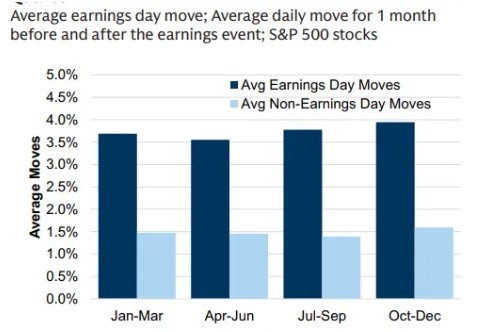

- Diversification: Diversifying your portfolio can help reduce risk. By investing in a variety of stocks, industries, and asset classes, you can minimize the impact of market downturns.

- Long-Term Investing: Investing for the long term can help mitigate short-term market volatility. By holding onto investments for several years, you can ride out market fluctuations and benefit from the potential growth of your investments.

- Research and Due Diligence: Conduct thorough research and due diligence before investing in any stock. Analyze financial statements, industry trends, and other relevant factors to make informed decisions.

- Risk Management: Understand your risk tolerance and invest accordingly. Avoid investing in stocks that are too risky for your comfort level.

Case Studies: Successful Investments in the Nastitic US Stock Market

Several companies have experienced significant growth in the US stock market, offering valuable lessons for investors. Here are a few notable examples:

- Apple Inc. (AAPL): Since its initial public offering (IPO) in 1980, Apple has become one of the most valuable companies in the world. Investors who bought Apple stock in the early 1980s have seen their investments grow exponentially.

- Amazon.com Inc. (AMZN): Launched in 1994, Amazon has become a dominant player in the e-commerce industry. Investors who purchased Amazon stock in the late 1990s have seen substantial returns.

- Tesla, Inc. (TSLA): Tesla, founded in 2003, has become a leader in the electric vehicle market. Investors who bought Tesla stock in the early 2010s have seen their investments soar.

Conclusion

The nastitic US stock market offers a wealth of opportunities for investors looking to grow their wealth. By understanding the market's components, adopting sound investment strategies, and conducting thorough research, investors can navigate the complexities of the stock market and achieve their financial goals.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....