The last recession in the US stock market, often referred to as the Great Recession, was a period of significant economic downturn that began in December 2007 and lasted until June 2009. This recession had a profound impact on the global economy, and understanding its causes, effects, and lessons learned is crucial for investors and policymakers alike. In this article, we will delve into the factors that led to the recession, its impact on the stock market, and the lessons we can take away from this pivotal period.

Causes of the Last Recession

The Great Recession was primarily caused by a combination of factors, including the bursting of the housing bubble, excessive risk-taking by financial institutions, and a lack of regulation. The housing bubble, which had been inflating for years, finally burst in 2007, leading to a sharp decline in home prices and a wave of mortgage defaults. This, in turn, caused a ripple effect throughout the financial system, leading to the collapse of several major financial institutions and a credit crunch.

Impact on the Stock Market

The stock market was one of the hardest-hit sectors during the Great Recession. The S&P 500, a widely followed index of large US companies, plummeted by nearly 50% from its peak in October 2007 to its trough in March 2009. This was the largest decline in the index's history, and it was a reflection of the broader economic turmoil at the time.

Several key events during the recession contributed to the stock market's volatility. These included the bankruptcy of Lehman Brothers in September 2008, the federal government's bailout of the automotive industry, and the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010.

Lessons Learned

The last recession in the US stock market has provided several important lessons for investors and policymakers. One of the most significant lessons is the importance of risk management. Investors need to be aware of the risks associated with their investments and be prepared to handle market downturns.

Another important lesson is the need for strong regulation of financial institutions. The Great Recession highlighted the dangers of excessive risk-taking and the need for better oversight of the financial system.

Case Studies

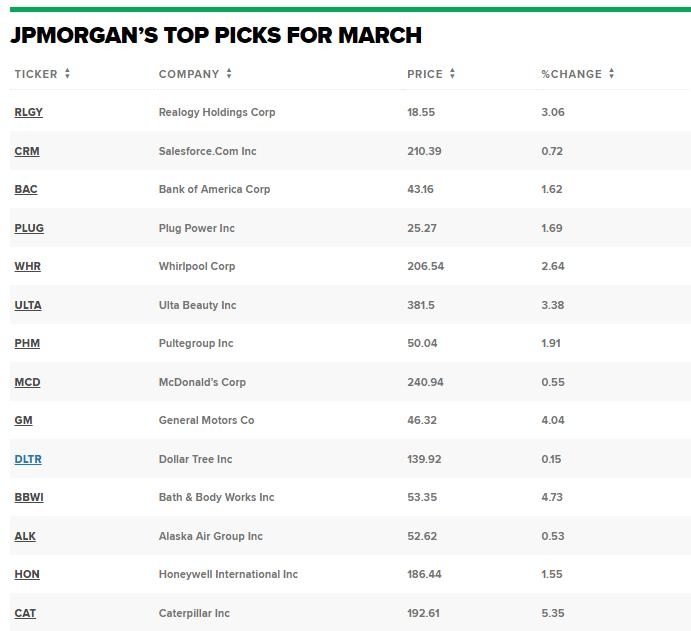

To illustrate the impact of the last recession on the stock market, let's look at two case studies: General Motors (GM) and Bank of America (BAC).

General Motors: GM, one of the largest automakers in the world, filed for bankruptcy protection in June 2009. The company received a $49.5 billion bailout from the federal government, which helped it survive the recession. Since then, GM has made a remarkable comeback, and its stock price has soared by over 1,000% since the trough of the recession.

Bank of America: BAC, one of the largest banks in the US, was also heavily affected by the recession. The bank received a $45 billion bailout from the government and faced numerous legal issues related to its mortgage practices. Despite these challenges, BAC has managed to recover and is now one of the most profitable banks in the country.

In conclusion, the last recession in the US stock market was a period of significant economic turmoil that had a profound impact on the global economy. Understanding the causes, effects, and lessons learned from this recession is crucial for investors and policymakers alike. By recognizing the importance of risk management and strong regulation, we can better prepare for future economic challenges.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....