In the fast-paced world of finance, staying ahead of market trends is crucial for investors. As we prepare to dive into the market outlook for tomorrow, our focus will be on analyzing the performance of US stocks. This article aims to provide a comprehensive overview, highlighting key factors that could influence the stock market's trajectory in the coming days.

Understanding the Market Dynamics

The stock market is influenced by a myriad of factors, including economic indicators, corporate earnings, geopolitical events, and technological advancements. To understand the market outlook for tomorrow, it's essential to analyze these factors and their potential impact on US stocks.

Economic Indicators

One of the primary factors affecting the stock market is economic indicators. These include unemployment rates, inflation, GDP growth, and consumer spending. Economic indicators can provide valuable insights into the overall health of the economy and, subsequently, the performance of US stocks.

For instance, if the unemployment rate decreases and consumer spending increases, it could signal a strong economic outlook. This, in turn, could lead to higher stock prices. Conversely, if economic indicators show signs of weakness, it may lead to a decline in stock prices.

Corporate Earnings

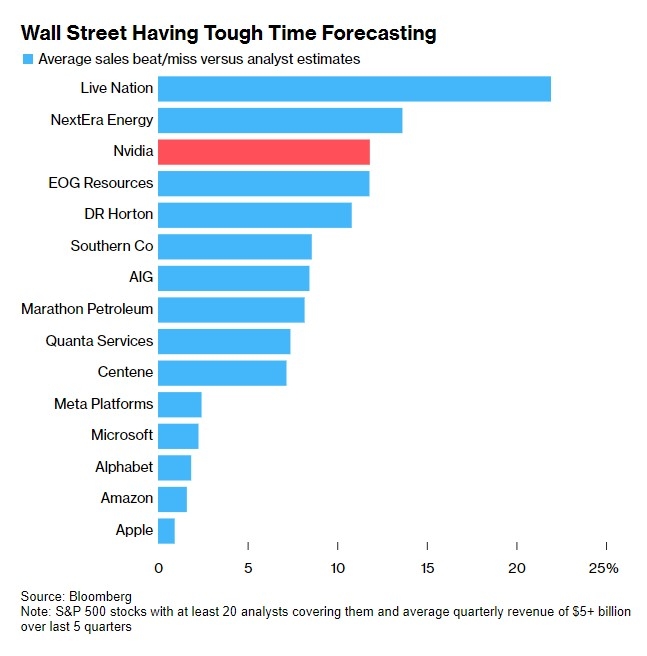

Another critical factor to consider is corporate earnings. Corporate earnings are a measure of a company's profitability and are a key driver of stock prices. When companies report strong earnings, it often leads to an increase in their stock prices. Conversely, weak earnings can result in a decline.

It's essential to keep an eye on upcoming earnings reports, as they can significantly impact the market outlook for tomorrow. Companies in sectors such as technology, healthcare, and finance often have a significant impact on the broader market.

Geopolitical Events

Geopolitical events can also have a profound impact on the stock market. Tensions between major economies, such as the US and China, can lead to uncertainty and volatility in the markets. Similarly, elections, trade disputes, and political instability can also affect the market outlook for tomorrow.

Technological Advancements

Technological advancements are another critical factor to consider. The stock market often rewards companies that are at the forefront of innovation. Companies in sectors such as artificial intelligence, biotechnology, and renewable energy are often seen as growth stocks and can significantly impact the market outlook for tomorrow.

Key US Stocks to Watch

Several US stocks are worth keeping an eye on as we analyze the market outlook for tomorrow. These include:

Apple Inc. (AAPL): As one of the world's largest companies, Apple's performance often has a significant impact on the broader market. With a strong focus on innovation and a diverse product portfolio, Apple remains a key player in the tech sector.

Amazon.com Inc. (AMZN): Amazon is a dominant force in the e-commerce and cloud computing sectors. Its continued expansion and innovation make it a critical stock to watch.

Microsoft Corporation (MSFT): Microsoft is a leading player in the technology sector, with a strong presence in software, cloud computing, and gaming. Its diverse business model and focus on innovation make it a key stock to watch.

Tesla, Inc. (TSLA): Tesla is a leader in the electric vehicle and renewable energy sectors. Its performance and growth potential make it a critical stock to watch.

Conclusion

As we prepare for the market outlook for tomorrow, it's essential to analyze various factors that can influence the performance of US stocks. By keeping an eye on economic indicators, corporate earnings, geopolitical events, and technological advancements, investors can make informed decisions and stay ahead of market trends. Additionally, keeping an eye on key US stocks can provide valuable insights into the broader market's trajectory.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....