Are you looking to invest in the mining sector but unsure where to start? Nickel mining stocks in the US could be a great opportunity for you. With the growing demand for nickel in various industries, this article will provide an in-depth analysis of the US nickel mining stocks market, including key players, market trends, and potential risks.

Understanding Nickel Mining Stocks

Nickel is a versatile metal used in various applications, including stainless steel production, batteries, and aerospace industries. As a result, the demand for nickel has been steadily increasing over the years. Investing in nickel mining stocks can be a lucrative opportunity, but it's essential to understand the market dynamics and the companies involved.

Key Players in the US Nickel Mining Industry

The US nickel mining industry is dominated by a few key players. Here are some of the most prominent companies:

- BHP Billiton Ltd. (BHP): As one of the world's largest mining companies, BHP Billiton operates several nickel mines in Australia and New Caledonia, with limited operations in the US.

- Rio Tinto Group (RIO): Another global mining giant, Rio Tinto has significant nickel mining operations in Australia and New Caledonia, with a smaller presence in the US.

- Freeport-McMoRan Inc. (FCX): Freeport-McMoRan is a major player in the US nickel mining industry, with its Grasberg mine in Indonesia being the world's largest copper and gold mine, which also produces significant amounts of nickel.

- Vale S.A. (VALE): Although primarily known for iron ore, Vale also has significant nickel mining operations in New Caledonia.

Market Trends

The US nickel mining industry has been witnessing several trends:

- Increasing Demand: The growing demand for nickel in various industries, particularly in electric vehicles (EVs), is expected to drive the demand for nickel mining stocks.

- Technological Advancements: The industry is investing in advanced technologies to improve efficiency and reduce costs.

- Government Regulations: Environmental regulations and mining permits can impact the operations of nickel mining companies.

Potential Risks

Investing in nickel mining stocks comes with its own set of risks:

- Market Volatility: The mining industry is subject to market volatility, which can impact the performance of nickel mining stocks.

- Regulatory Risks: Changes in government regulations can affect the operations of mining companies.

- Geopolitical Risks: Geopolitical tensions and conflicts in nickel-producing countries can impact the supply of nickel and, subsequently, the stock prices.

Case Study: Freeport-McMoRan Inc.

Let's take a closer look at Freeport-McMoRan Inc., a significant player in the US nickel mining industry. Freeport-McMoRan's Grasberg mine has been a major source of nickel for the company. However, the company has faced challenges, including labor strikes and environmental concerns, which have impacted its operations.

Despite these challenges, Freeport-McMoRan has managed to maintain its position as a key player in the nickel mining industry. This case study highlights the importance of understanding the risks and challenges associated with investing in the mining sector.

Conclusion

Investing in nickel mining stocks in the US can be a lucrative opportunity, but it's essential to conduct thorough research and understand the market dynamics. By considering key players, market trends, and potential risks, you can make informed decisions and maximize your investment returns.

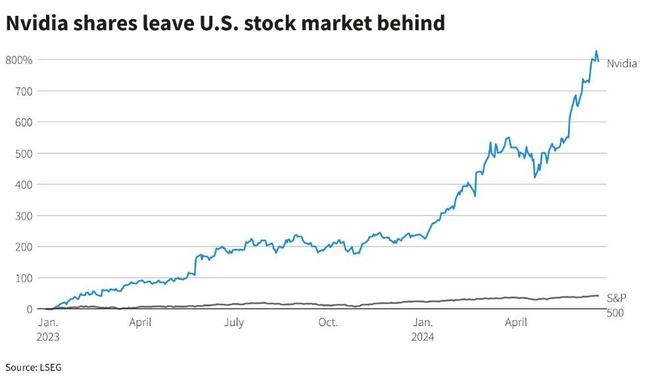

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....