In the rapidly evolving cannabis industry, Tilray Inc. (NASDAQ: TLRY) has emerged as a prominent player. This article delves into the current Tilray US stock price, providing insights into its market performance and potential future trends. By analyzing key factors such as industry dynamics, company performance, and market sentiment, we aim to offer a comprehensive overview of Tilray's stock price trajectory.

Understanding Tilray's Stock Price

The Tilray US stock price has experienced significant volatility over the years, reflecting both the company's growth potential and the challenges faced by the cannabis industry. Launched in 2013, Tilray quickly became one of the first legal cannabis companies to export medical cannabis to Europe. This move showcased the company's commitment to expanding its global reach and diversifying its product offerings.

Industry Dynamics and Market Sentiment

The cannabis industry has witnessed a surge in interest from investors and consumers alike. This growth can be attributed to several factors, including changing regulations, increased public acceptance, and the potential for significant revenue streams. However, the industry also faces several challenges, such as regulatory uncertainty, market saturation, and intense competition.

The Tilray US stock price has been influenced by these industry dynamics, with the company's stock price often reflecting market sentiment. For instance, during periods of positive regulatory news or market expansion, Tilray's stock price tends to rise. Conversely, negative news or market setbacks can lead to a decline in the stock price.

Analyzing Tilray's Performance

To gain a better understanding of Tilray's stock price, it is crucial to analyze the company's financial performance. Tilray has reported impressive revenue growth over the years, driven by its expanding product portfolio and global market presence. However, the company has also faced challenges, such as high operating expenses and a significant debt burden.

Case Study: Tilray's Expansion into Germany

A notable example of Tilray's growth strategy is its expansion into the German market. In 2019, Tilray became the first foreign company to be granted a license to sell medical cannabis in Germany. This move marked a significant milestone for the company and showcased its commitment to international expansion.

The launch of Tilray's products in Germany was well-received by healthcare providers and patients, leading to increased sales and market share. This success story highlights Tilray's ability to adapt to different markets and capitalize on global opportunities.

Conclusion

In conclusion, the Tilray US stock price has been influenced by a combination of industry dynamics, company performance, and market sentiment. While the company has faced challenges, its commitment to growth and diversification has positioned it as a key player in the cannabis industry. As the market continues to evolve, it will be interesting to observe how Tilray's stock price responds to new opportunities and challenges.

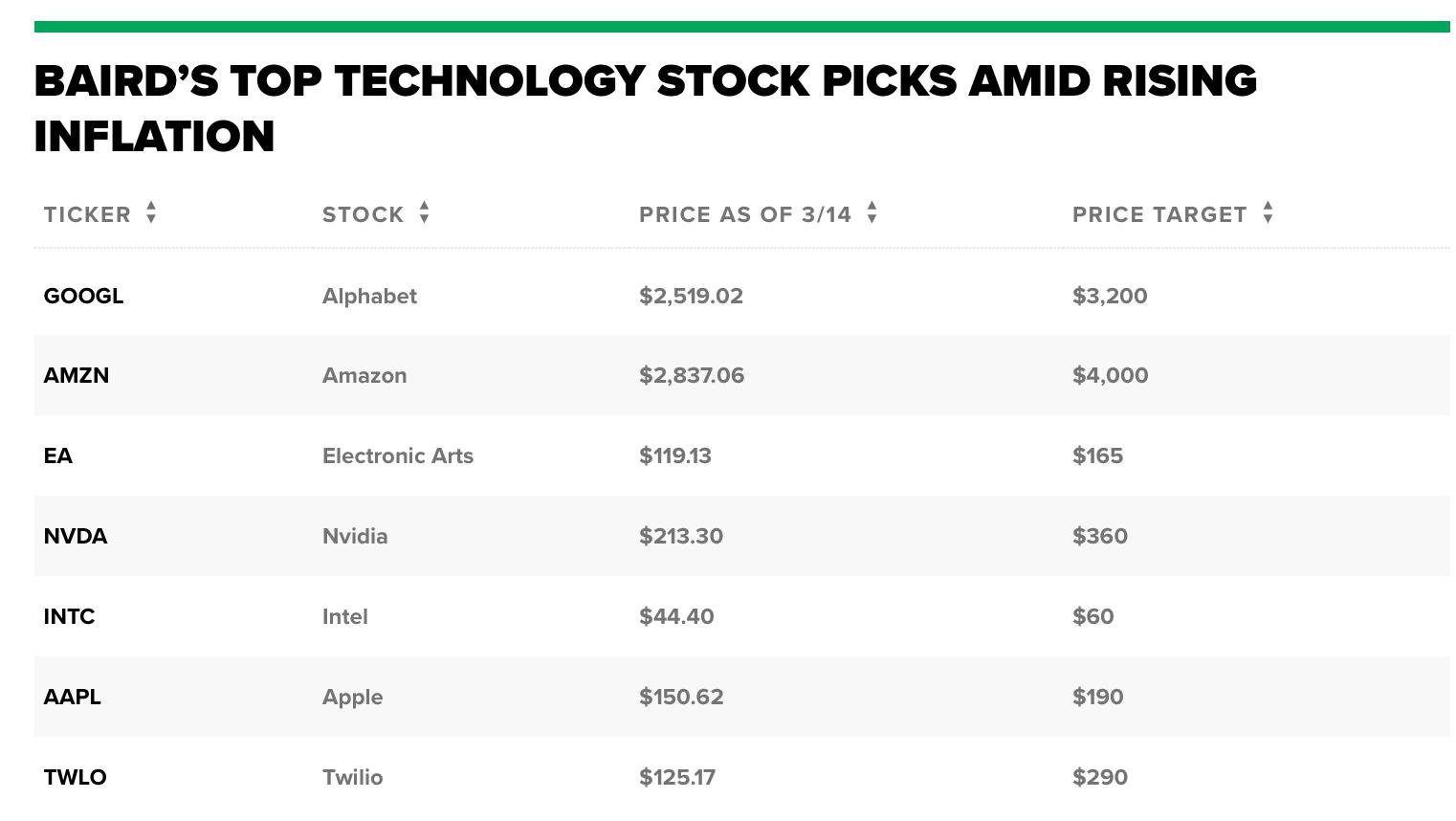

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....