In today's interconnected global economy, investing in US stocks has become increasingly accessible to international investors. Whether you're a seasoned investor or a beginner looking to diversify your portfolio, understanding how to buy US stocks can open up a world of investment opportunities. This article will provide a comprehensive guide on how foreigners can buy US stocks, including the necessary steps, regulations, and tips for success.

Understanding the Basics

1. Types of Stocks

Before diving into the details of purchasing US stocks, it's essential to understand the different types available. Common types of stocks include common shares, preferred shares, and ADRs (American Depositary Receipts).

- Common Shares: These represent ownership in a company and offer voting rights.

- Preferred Shares: These provide a fixed dividend but usually do not offer voting rights.

- ADRs: These are shares of foreign companies traded on US exchanges, making it easier for foreign investors to invest in them.

2. Stock Exchanges

US stocks are primarily traded on two major exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. Each exchange has its unique features, and investors should research which is best suited for their investment goals.

The Steps to Buying US Stocks

1. Open a Brokerage Account

Foreign investors must open a brokerage account to purchase US stocks. Several reputable brokers offer accounts tailored to international investors, including Charles Schwab, TD Ameritrade, and E*TRADE.

2. Verify Your Identity

To comply with anti-money laundering and know-your-customer regulations, you'll need to provide identification and proof of residence. This process may require additional documentation, depending on your country of residence.

3. Fund Your Account

Once your account is verified, you can fund it using various methods, such as wire transfers, credit cards, or bank drafts.

4. Research and Select Stocks

Before purchasing stocks, conduct thorough research to identify companies that align with your investment goals and risk tolerance. Utilize online research tools, financial news, and analyst reports to gather insights.

5. Place Your Order

Once you've selected a stock, you can place your order through your brokerage account. Choose between market orders (executed at the best available price) and limit orders (executed at a specified price or better).

6. Monitor Your Investment

After purchasing stocks, monitor their performance and stay informed about the company's news and market trends. Consider diversifying your portfolio to mitigate risk and potentially increase returns.

Regulations and Taxes

1. Regulations

Foreigners purchasing US stocks must comply with various regulations, including the Foreign Account Tax Compliance Act (FATCA). Ensure you understand the requirements and consult a tax professional if necessary.

2. Taxes

Foreign investors in US stocks are subject to capital gains tax on profits. Taxation varies depending on your country of residence and the length of your investment. It's crucial to consult with a tax advisor to understand your obligations.

Case Studies

1. Investing in Tech Stocks

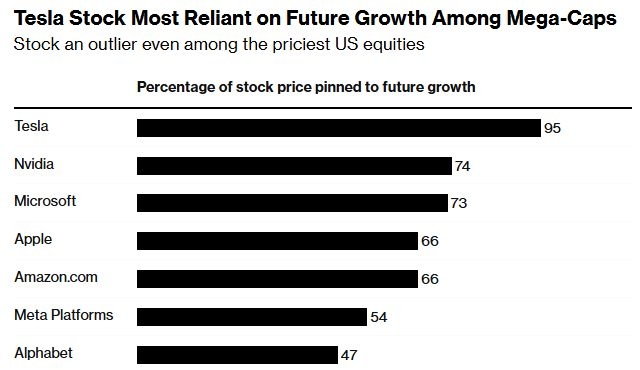

Many foreign investors have successfully invested in US tech stocks, such as Apple and Microsoft. These companies offer high growth potential and have a strong global presence.

2. Diversifying with REITs

Real Estate Investment Trusts (REITs) provide an excellent way to invest in the US real estate market. Companies like Public Storage and Prologis offer exposure to the real estate sector with lower risk compared to direct property investments.

Conclusion

Investing in US stocks can be a lucrative opportunity for foreign investors. By understanding the process, complying with regulations, and conducting thorough research, you can make informed investment decisions. Remember to diversify your portfolio and seek professional advice when necessary. With the right approach, you can unlock the potential of the US stock market and achieve your financial goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....