In the ever-evolving landscape of the financial world, staying ahead of market trends and making informed investment decisions is crucial. One such trend that has been capturing the attention of investors is the performance of the US stock market, particularly when it comes to companies like Bank of America (BOFA). This article delves into the current state of the US stock market and provides an in-depth analysis of Hartnett's perspective on BOFA, offering valuable insights for investors looking to navigate the market effectively.

Understanding Hartnett's Perspective on the US Stock Market

David Hartnett, the Chief Investment Strategist at Bank of America Merrill Lynch, has been a prominent voice in the financial world. His insights on the US stock market, especially regarding companies like BOFA, have been closely watched by investors. According to Hartnett, the US stock market is currently in a phase of recovery, driven by several key factors.

Key Factors Driving the US Stock Market

- Economic Recovery: The US economy has been gradually recovering from the impact of the COVID-19 pandemic. This has led to an increase in consumer spending and business activity, boosting the stock market.

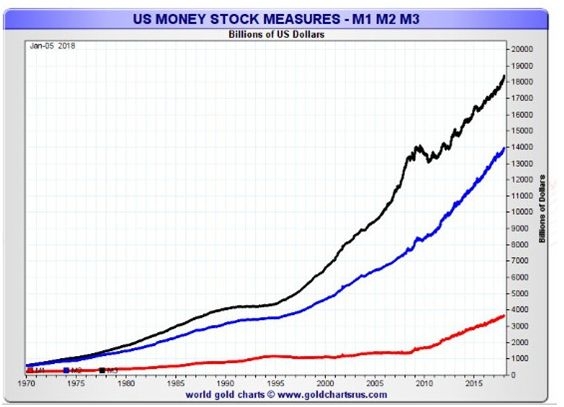

- Monetary Policy: The Federal Reserve has been implementing expansionary monetary policies to stimulate economic growth. This has resulted in lower interest rates, making borrowing cheaper and encouraging businesses and consumers to spend.

- Corporate Earnings: Many companies, including BOFA, have reported strong earnings in recent quarters, driving investor confidence.

BOFA: A Bright Spot in the US Stock Market

Among the various companies in the US stock market, Bank of America (BOFA) has emerged as a bright spot. According to Hartnett, BOFA has been performing well, driven by several factors:

- Strong Earnings: BOFA has reported strong earnings in recent quarters, driven by increased revenue and improved profitability.

- Digital Transformation: BOFA has been investing heavily in digital transformation, which has helped the bank to reduce costs and improve efficiency.

- Strong Management: BOFA's management team has been praised for their strategic vision and execution.

Case Studies: BOFA's Performance

To illustrate BOFA's performance, let's take a look at some key metrics:

- Revenue: BOFA's revenue has increased significantly over the past few years, driven by growth in various business segments, including consumer banking, global markets, and wealth management.

- Profitability: BOFA's profitability has also been impressive, with net income growing consistently.

- Market Capitalization: BOFA's market capitalization has reached new highs, reflecting investor confidence in the company's future prospects.

Conclusion

In conclusion, the US stock market, particularly companies like Bank of America (BOFA), has been performing well, driven by factors such as economic recovery, expansionary monetary policy, and strong corporate earnings. According to Hartnett's analysis, BOFA stands out as a bright spot in the market, thanks to its strong performance, digital transformation, and effective management. As investors continue to navigate the market, keeping an eye on companies like BOFA can be a valuable strategy.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....