The recent US-China trade deal has sparked a wave of optimism across global markets, and India is no exception. The agreement, which aims to ease tensions between the two economic powerhouses, is expected to have a positive impact on Indian stocks. This article delves into the potential benefits and opportunities that Indian investors can expect from this landmark trade deal.

Boost to Trade and Investment

One of the primary advantages of the US-China trade deal is the potential for increased trade and investment between the two nations. India, being a significant player in the global market, stands to benefit from this boost in economic activity. As trade barriers are reduced and tariffs lowered, Indian companies can expect to see a surge in exports to the US and China.

Emerging Opportunities in Technology and Manufacturing

India's technology and manufacturing sectors are poised to gain significantly from the US-China trade deal. With the US and China focusing on promoting high-tech industries and manufacturing, Indian companies specializing in these areas can tap into new markets and partnerships. For instance, Infosys, one of India's leading IT services companies, has already announced plans to expand its operations in the US and China.

Increased Foreign Direct Investment (FDI)

The trade deal is also expected to attract more foreign direct investment into India. As the US and China look to diversify their supply chains, Indian companies can become attractive investment targets. This influx of FDI could lead to job creation, technological advancements, and overall economic growth.

Impact on Key Sectors

Several key sectors in India are likely to benefit from the trade deal. Here are a few examples:

- Automotive Industry: With the US and China looking to reduce their reliance on Chinese suppliers, Indian automakers like Maruti Suzuki and Tata Motors can expect increased demand for their products.

- Pharmaceuticals: India is one of the world's largest pharmaceutical producers. The trade deal is expected to boost exports of generic drugs to the US and China, benefiting companies like Sun Pharmaceutical Industries and Dr. Reddy's Laboratories.

- Textiles and Apparel: The textiles and apparel sector is another area where Indian companies can benefit. As the US and China look to diversify their supply chains, Indian manufacturers like Arvind Limited and Aditya Birla Group can expect increased orders.

Case Study: Wipro

One Indian company that has already reaped the benefits of the US-China trade deal is Wipro Ltd.. The company has announced plans to invest $1 billion in the US over the next five years, as part of its strategy to expand its operations in the technology sector. This investment is expected to create thousands of jobs in the US and further strengthen Wipro's position as a global leader in IT services.

Conclusion

The US-China trade deal presents a significant opportunity for Indian stocks. With increased trade, investment, and collaboration, Indian companies can tap into new markets and partnerships, leading to economic growth and job creation. As the deal takes effect, Indian investors should keep a close eye on key sectors and companies that are likely to benefit the most from this landmark agreement.

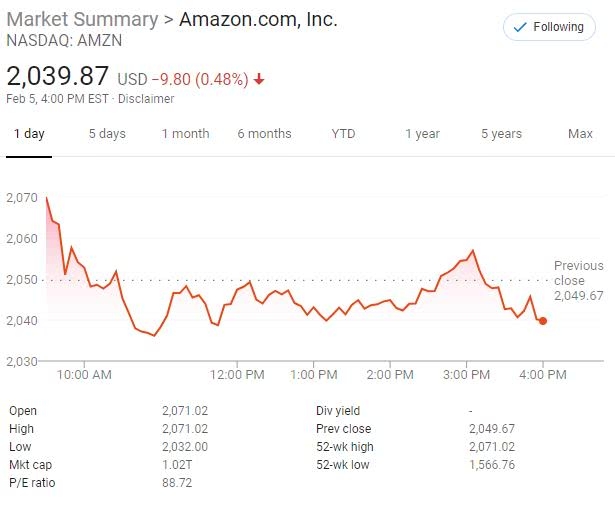

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....