The stock market is a dynamic and complex entity that reflects the economic health of a country. On November 25th, the US stock market experienced a series of events that are worth examining. This article aims to provide a comprehensive review of the US stock market on that day, including key developments, market trends, and potential implications for investors.

Market Overview on 25 November

On November 25th, the US stock market opened with a slight upward trend, driven by positive economic data and corporate earnings reports. The major indices, including the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, all saw gains in the early hours of trading.

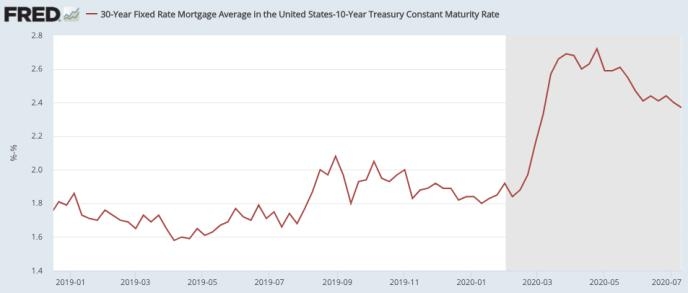

However, as the day progressed, the market faced several challenges. The Federal Reserve's decision to raise interest rates, concerns about the global economic outlook, and geopolitical tensions contributed to a decline in investor confidence. As a result, the major indices reversed their gains and ended the day with mixed results.

Key Developments

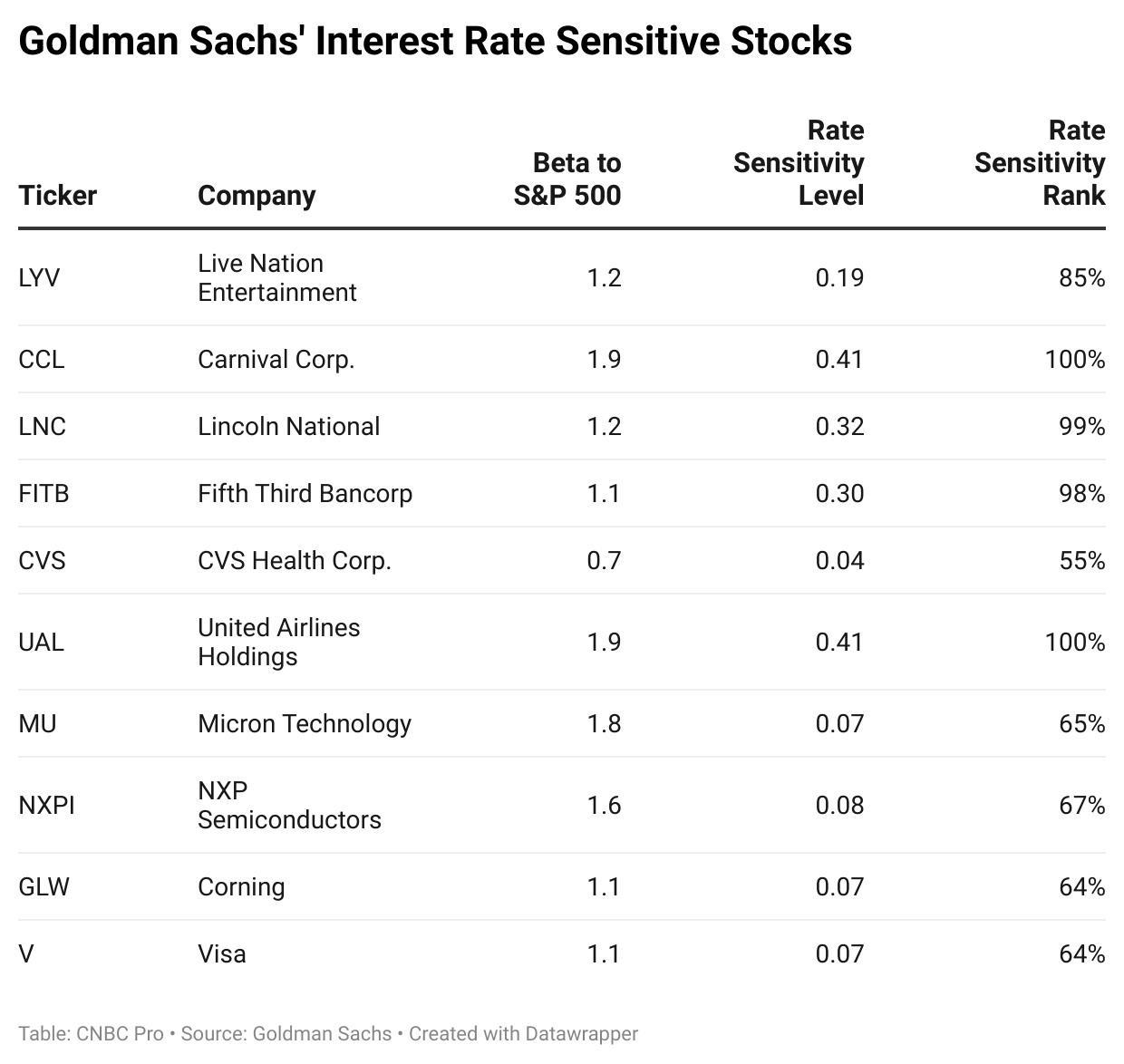

Federal Reserve Interest Rate Hike: The Federal Reserve announced a 0.25% increase in interest rates, bringing the federal funds rate to a range of 2.25% to 2.5%. This decision was in line with market expectations and aimed to control inflation.

Corporate Earnings Reports: Several major companies released their earnings reports for the third quarter. While many companies reported strong earnings, some faced challenges due to rising input costs and supply chain disruptions.

Global Economic Outlook: Concerns about the global economic outlook, particularly in Europe and China, weighed on investor sentiment. The ongoing trade tensions and slowing economic growth in these regions raised concerns about the potential impact on the US economy.

Geopolitical Tensions: Geopolitical tensions, including the conflict in the Middle East and tensions between the US and Iran, added to the uncertainty in the market.

Market Trends

The US stock market on November 25th showcased several key trends:

Sector Rotation: Investors shifted their focus from growth sectors, such as technology and consumer discretionary, to value sectors, such as financials and energy.

Small-Cap Stocks: Small-cap stocks outperformed large-cap stocks, reflecting a preference for companies with higher growth potential.

Dividend Stocks: Dividend-paying stocks gained popularity, as investors sought income in a volatile market.

Case Studies

To illustrate the impact of these developments, let's consider two case studies:

Apple Inc.: Apple Inc. reported strong earnings for the third quarter, driven by robust demand for its iPhone and services. However, the company warned about potential challenges in the global economy, leading to a slight decline in its stock price.

Walmart Inc.: Walmart Inc. reported solid earnings, driven by strong sales in its e-commerce division. However, the company expressed concerns about rising input costs, which could impact its profitability in the coming quarters.

Conclusion

The US stock market on November 25th showcased the complexities and uncertainties of the global economy. While the market experienced a volatile day, investors should remain focused on long-term fundamentals and consider diversifying their portfolios to mitigate risks.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....