In the ever-evolving world of finance, investors are always seeking the best ways to grow their wealth. One of the most popular investment avenues is through mutual funds, which pool money from many investors to invest in a diversified portfolio of stocks. This article delves into the synergy between mutual funds and US stocks, highlighting how they can complement each other in an investor's portfolio.

What are Mutual Funds?

Mutual funds are investment vehicles that allow individuals to invest in a collection of stocks, bonds, or other securities managed by a professional fund manager. These funds are designed to offer diversification, which means spreading investments across different asset classes to reduce risk. By pooling resources, mutual funds can access a broader range of investments than individual investors might be able to on their own.

The Role of US Stocks in Mutual Funds

US stocks play a crucial role in mutual funds. They offer the potential for significant growth, which is a key component of many mutual fund strategies. U.S. stocks are often seen as a benchmark for the global market and are home to many of the world's largest and most successful companies. Mutual funds that invest in US stocks can provide investors with exposure to these companies, regardless of the size of their individual investment.

Diversification: The Key to Success

One of the main advantages of investing in mutual funds is the diversification they offer. Diversification is the process of spreading investments across various assets to minimize risk. By including US stocks in a mutual fund, investors gain exposure to a wide range of sectors, industries, and geographic locations. This can help to stabilize returns and mitigate the impact of market downturns.

Risk and Return Balance

Investing in mutual funds that include US stocks allows investors to balance risk and return. While US stocks have the potential for high returns, they also come with higher risk. Mutual funds that invest in a mix of stocks and bonds can help to offset this risk by adding stability to the portfolio.

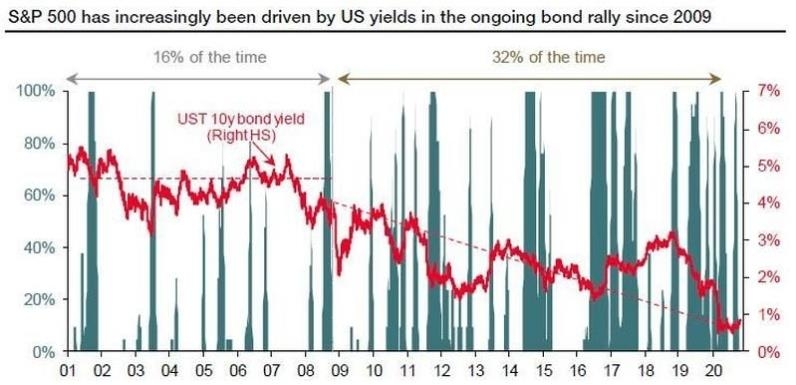

Case Study: The S&P 500 Index Fund

A classic example of a mutual fund that includes US stocks is the S&P 500 Index Fund. This fund tracks the performance of the S&P 500, which is a stock market index that includes the 500 largest companies listed on stock exchanges in the United States. Over the years, the S&P 500 has been a strong performer, offering investors significant growth potential.

Conclusion

In conclusion, mutual funds and US stocks have a symbiotic relationship that can be highly beneficial for investors. Mutual funds provide the opportunity to invest in a diversified portfolio of US stocks, which can offer growth potential while also mitigating risk. Whether you are a seasoned investor or just starting out, understanding how mutual funds and US stocks work together can help you build a robust and diversified investment portfolio.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....