In the intricate world of finance, the Price-to-Earnings (P/E) ratio stands as a vital metric for investors seeking to gauge the value of stocks. The P/E ratio of the US stock market serves as a window into the collective sentiment and performance of the market. This article delves into the meaning, significance, and implications of the P/E ratio, providing investors with a comprehensive understanding of this crucial financial indicator.

What is the P/E Ratio?

The P/E ratio, or price-to-earnings ratio, is a valuation metric that compares the price of a stock to its per-share earnings. It is calculated by dividing the current stock price by the trailing 12-month earnings per share (EPS). This ratio helps investors determine whether a stock is overvalued or undervalued compared to its earnings.

Why is the P/E Ratio Important?

The P/E ratio is a key tool for investors to assess the overall attractiveness of the stock market. Here are a few reasons why it is important:

Market Valuation: The P/E ratio provides a quick and easy way to determine whether the market is overvalued or undervalued. A high P/E ratio suggests that the market is expensive, while a low P/E ratio indicates that the market is relatively cheap.

Comparative Analysis: Investors can use the P/E ratio to compare the valuation of one stock to another or to the overall market. This helps identify undervalued or overvalued stocks within a specific sector or industry.

Investment Strategy: The P/E ratio can inform investment strategies. For example, investors may look for stocks with a low P/E ratio for value investing opportunities, while others may prefer stocks with a high P/E ratio for growth prospects.

Analyzing the P/E Ratio of the US Stock Market

The P/E ratio of the US stock market can fluctuate widely over time, reflecting changes in market sentiment, economic conditions, and investor expectations. Here are some key points to consider when analyzing the P/E ratio of the US stock market:

Historical Context: Over the past few decades, the P/E ratio of the US stock market has ranged from around 5 to 50. Understanding the historical context can help investors assess whether the current P/E ratio is within a normal range or if it indicates an abnormal market condition.

Market Cycles: The P/E ratio often follows a cyclical pattern, rising during bull markets and falling during bear markets. By analyzing the P/E ratio in the context of market cycles, investors can gain insights into the potential future direction of the market.

Sector and Industry Comparisons: Different sectors and industries may have varying P/E ratios. For example, technology stocks often have higher P/E ratios compared to utility stocks. Comparing the P/E ratio of different sectors and industries can provide valuable insights into market trends and opportunities.

Case Study: Tech Stocks and the P/E Ratio

In recent years, technology stocks have been a significant driver of the US stock market's performance. As a case study, let's examine the P/E ratio of technology stocks and its implications for the market:

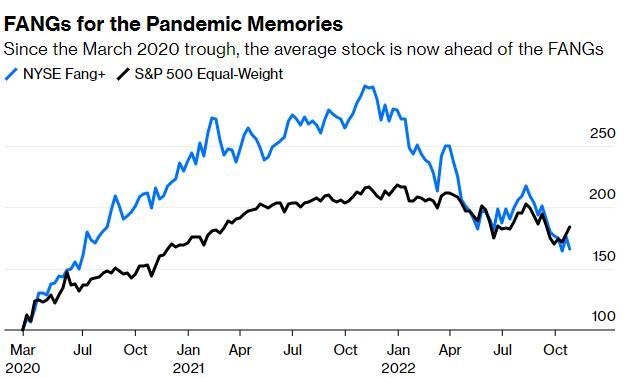

High P/E Ratio: Technology stocks, such as Apple and Microsoft, often have high P/E ratios, reflecting their growth prospects and market dominance. In 2020, the P/E ratio of the technology sector was around 30, indicating that these stocks were relatively expensive.

Market Impact: The high P/E ratio of technology stocks contributed to the overall high P/E ratio of the US stock market during this period. This suggests that the market was valuing growth prospects over current earnings.

Risk and Reward: While high P/E ratios can indicate high potential returns, they also come with increased risk. Investors need to carefully consider the risks associated with investing in high-growth, high-P/E stocks.

In conclusion, the P/E ratio of the US stock market is a crucial metric for investors seeking to understand the market's valuation and potential future direction. By analyzing the P/E ratio in the context of market cycles, sector comparisons, and historical data, investors can make informed decisions and identify attractive investment opportunities.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....