In 2025, the United States stock market is once again facing the specter of a valuation bubble. This article delves into the current state of the market, analyzing key indicators and historical parallels to provide a comprehensive overview of the potential risks and opportunities ahead.

Market Valuation Metrics

To assess whether the US stock market is in a bubble, we must first examine its valuation metrics. The most commonly used metrics include the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and the Shiller P/E ratio.

As of 2025, the S&P 500 index has a P/E ratio of around 30, which is significantly higher than its long-term average of 15-18. The P/B ratio is also elevated, hovering around 3.5, well above the historical average of 1.5-2.0. The Shiller P/E ratio, which averages the P/E ratio over the past 10 years, is currently around 32, indicating that the market is overvalued relative to its historical average.

Historical Parallels

History has shown that when valuation metrics are significantly above their long-term averages, it often precedes a market correction. For instance, in the late 1990s, the tech bubble reached a P/E ratio of over 100, which was followed by a dramatic collapse. Similarly, the dot-com bubble of the early 2000s and the housing bubble leading up to the 2008 financial crisis were both characterized by elevated valuation metrics.

Potential Risks

Several factors could contribute to a market correction. One of the primary risks is inflation. As the economy continues to recover from the COVID-19 pandemic, inflation has started to rise, which could lead to higher interest rates. Higher interest rates can negatively impact stock prices, especially for companies with high levels of debt.

Another risk is corporate earnings growth. While earnings have been strong in recent quarters, there is concern that this growth may not be sustainable. As the economy normalizes, companies may face increased competition and higher input costs, which could lead to lower profit margins.

Opportunities

Despite the risks, there are still opportunities in the stock market. Companies with strong fundamentals, such as those in the technology, healthcare, and consumer discretionary sectors, may continue to perform well. Additionally, dividend-paying stocks could be attractive as investors seek income in a low-interest-rate environment.

Case Studies

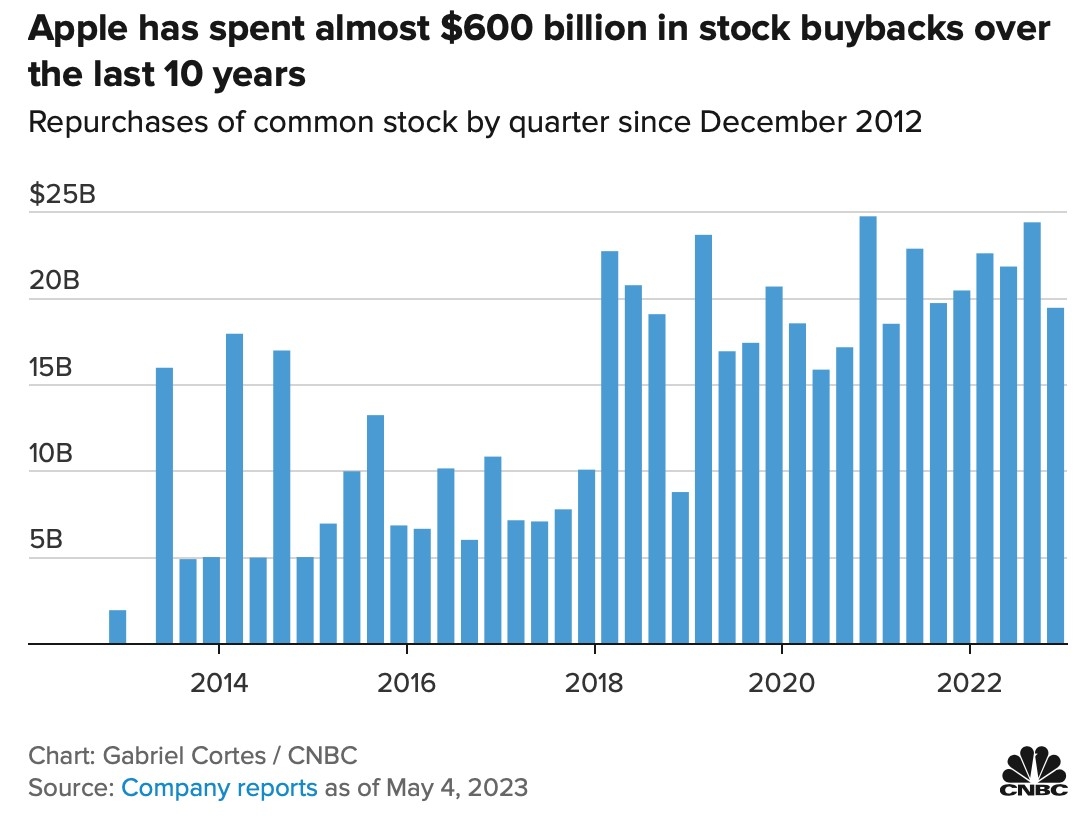

One example of a stock that has been performing well despite the elevated valuation is Apple Inc. (AAPL). The company has a strong track record of innovation and a loyal customer base, which has helped it maintain strong earnings growth. As a result, the stock has continued to rise, despite the market's overall overvaluation.

Another example is Tesla, Inc. (TSLA). The electric vehicle (EV) manufacturer has seen significant growth in its market share, driven by increasing consumer demand for sustainable transportation options. Despite its high valuation, the company's long-term prospects remain promising.

Conclusion

The current US stock market is facing the risk of a valuation bubble. While there are potential risks, there are also opportunities for investors with a long-term perspective. By carefully analyzing market metrics, historical parallels, and individual company fundamentals, investors can make informed decisions about their investments in 2025 and beyond.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....