In recent years, there has been a growing buzz about China's increasing investment in the United States. Specifically, many investors and analysts are questioning whether China is buying up US stocks at an alarming rate. This article aims to delve into this topic, exploring the reasons behind China's interest in US stocks, the potential impact on the US market, and the broader implications of this trend.

The Rise of China's Investment in US Stocks

China has been actively investing in the US stock market for quite some time now. According to data from the US Treasury Department, Chinese investors held a total of $1.2 trillion in US stocks and bonds as of 2021. This figure has been on the rise, making China one of the largest foreign investors in the US market.

Reasons Behind China's Investment

There are several reasons why China is investing in US stocks:

- Diversification: China's economy has been growing rapidly, but it is also facing challenges such as aging demographics and environmental concerns. By investing in the US stock market, China can diversify its portfolio and reduce its exposure to domestic risks.

- Innovation: The US is home to some of the world's most innovative companies, particularly in technology and healthcare. China is keen to tap into these industries and gain access to cutting-edge technologies.

- Currency Reserves: China holds a significant amount of foreign currency reserves, and investing in US stocks is one way to deploy these reserves and generate returns.

Impact on the US Market

The influx of Chinese investment has had a notable impact on the US stock market:

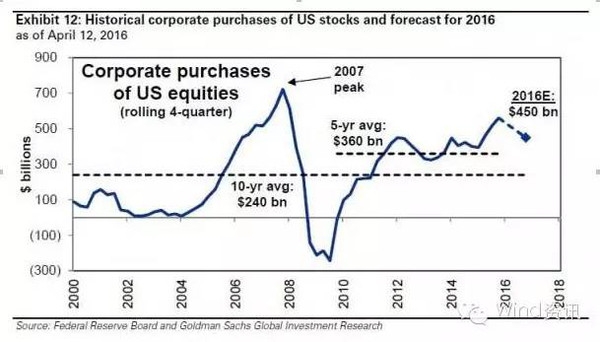

- Higher Stock Prices: Increased demand for US stocks from Chinese investors has driven up stock prices, benefiting American companies and investors.

- Economic Growth: The flow of capital from China has contributed to economic growth in the US, creating jobs and fostering innovation.

- Competition: Some analysts argue that China's investment could lead to increased competition for US companies, as Chinese companies may seek to acquire US assets and gain a foothold in the global market.

Case Studies

One notable case study is the acquisition of Wanda Group by a Chinese conglomerate, Dalian Wanda Group. In 2016, Dalian Wanda purchased a majority stake in Wanda, one of China's largest entertainment companies. This deal marked the largest overseas acquisition by a Chinese company at the time and highlighted China's growing interest in the US market.

Another example is Tencent's investment in US-based gaming company, Epic Games. In 2012, Tencent acquired a 30% stake in Epic Games, becoming one of the company's largest shareholders. This investment allowed Tencent to gain access to Epic Games' popular game titles, such as Fortnite, and expand its presence in the global gaming market.

Conclusion

In conclusion, it is evident that China is indeed buying up US stocks at a significant rate. This trend is driven by a variety of factors, including diversification, access to innovation, and the need to deploy its vast foreign currency reserves. While this investment has had a positive impact on the US market, it also presents challenges and opportunities for American companies and investors. As China continues to grow as an economic powerhouse, its investment in the US stock market is likely to remain a key area of focus for both countries.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....