In the ever-evolving world of finance, understanding the intricacies of stock charges is crucial for investors. HSBC, one of the world's leading banks, offers a range of services to its clients, including stock trading. However, it's essential to delve into the details of HSBC US stock charges to make informed decisions. This article will provide a comprehensive overview of HSBC's stock charges, helping you navigate the complexities of stock trading with this esteemed financial institution.

Understanding HSBC US Stock Charges

HSBC's stock charges are designed to cover various aspects of stock trading, including transaction fees, clearing fees, and exchange fees. Here's a breakdown of the key charges you can expect:

Transaction Fees: These fees are typically charged per trade and vary depending on the type of stock you're trading. For example, trading U.S. stocks may incur a different fee compared to international stocks.

Clearing Fees: Clearing fees are associated with the process of settling a trade. HSBC charges a clearing fee for each trade, which is usually a fixed amount.

Exchange Fees: Exchange fees are charged when you trade on certain exchanges. HSBC may charge additional fees for trading on specific exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Factors Influencing HSBC US Stock Charges

Several factors can influence the total cost of trading stocks with HSBC. Here are some key considerations:

Stock Type: As mentioned earlier, the type of stock you're trading can affect the fees. For instance, trading U.S. stocks may be cheaper compared to international stocks.

Trading Frequency: If you're a frequent trader, HSBC offers different pricing structures to accommodate your needs. It's important to understand these structures to ensure you're getting the best deal.

Market Conditions: Market volatility can impact the fees you pay. During periods of high market activity, HSBC may adjust its fees accordingly.

Comparing HSBC US Stock Charges with Other Brokers

When choosing a stockbroker, it's crucial to compare the fees and services offered. Here's a comparison of HSBC's stock charges with other popular brokers:

Fidelity: Fidelity offers competitive transaction fees and a range of investment options. However, their clearing fees may be higher compared to HSBC.

Charles Schwab: Charles Schwab is known for its low transaction fees and extensive research tools. However, their clearing fees may be higher than HSBC's.

E*TRADE: E*TRADE offers a user-friendly platform and competitive fees. However, their clearing fees may be higher compared to HSBC.

Case Study: Trading U.S. Stocks with HSBC

Let's consider a hypothetical scenario where an investor wants to trade U.S. stocks with HSBC. The investor plans to trade 10 shares of a well-known U.S. company.

Transaction Fee: Let's assume the transaction fee for U.S. stocks is

7 per trade. Therefore, the total transaction fee for this trade would be 70.Clearing Fee: The clearing fee for this trade would be $5, as per HSBC's standard rate.

Total Cost: The total cost of this trade would be $75, which includes the transaction fee and clearing fee.

By understanding the charges and factors influencing HSBC US stock charges, investors can make informed decisions and optimize their trading strategies. Remember to compare fees with other brokers and consider your trading frequency to find the best fit for your investment needs.

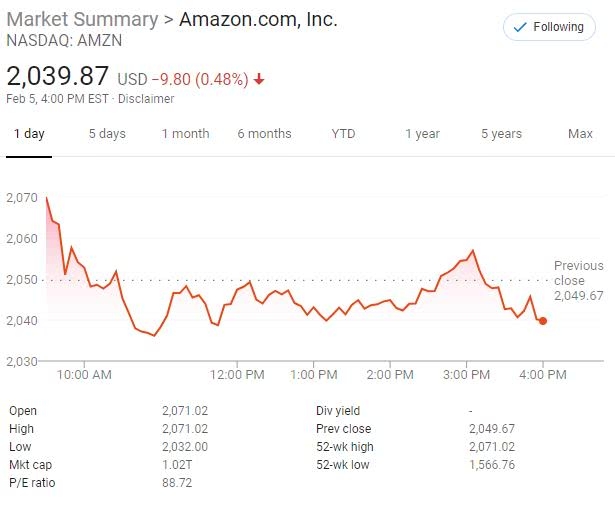

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....