In today's volatile and unpredictable financial markets, investors are constantly seeking opportunities that align with their values and long-term goals. One such opportunity is to invest in U.S. ESG stocks. ESG stands for Environmental, Social, and Governance, and these stocks represent companies that prioritize sustainability and ethical practices. This article delves into the world of U.S. ESG stocks, highlighting their benefits and providing insights into how they can be a smart investment for the future.

Understanding ESG Stocks

ESG stocks are those that score well on environmental, social, and governance criteria. These criteria are used to evaluate the impact of a company's operations on the environment, its treatment of employees and customers, and its governance practices. Companies that excel in these areas are more likely to be sustainable and resilient in the long run.

Environmental Benefits

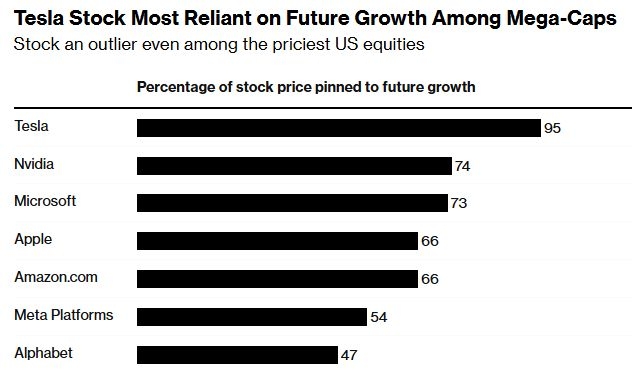

One of the primary reasons to invest in ESG stocks is their positive impact on the environment. These companies are committed to reducing their carbon footprint, conserving natural resources, and developing sustainable products and services. For example, renewable energy companies like Tesla and NVIDIA are leading the charge in reducing greenhouse gas emissions and promoting clean energy solutions.

Social Responsibility

ESG stocks also prioritize social responsibility. These companies are committed to treating their employees fairly, providing equal opportunities, and contributing to the communities in which they operate. For instance, Nike has been recognized for its efforts to promote diversity and inclusion, while Apple has received accolades for its commitment to human rights and labor practices.

Governance Practices

Good governance is another key aspect of ESG stocks. These companies are transparent, accountable, and have strong corporate governance practices in place. This includes having diverse boards of directors, independent auditors, and ethical business practices. Microsoft is often cited as a prime example of a company with robust governance practices.

Benefits of Investing in ESG Stocks

Investing in ESG stocks offers several benefits, including:

- Long-term performance: Studies have shown that companies with strong ESG practices tend to outperform their peers over the long term.

- Risk mitigation: ESG stocks are less likely to be affected by environmental regulations, social unrest, and governance issues.

- Alignment with values: Investors who prioritize sustainability and ethical practices can feel good about their investments.

Case Studies

To illustrate the potential of ESG stocks, let's consider a few case studies:

- Tesla: As a leader in the electric vehicle (EV) market, Tesla has seen significant growth in its stock price over the past few years. Its commitment to sustainability and innovation has made it a favorite among ESG investors.

- Nike: Despite facing criticism in the past, Nike has made significant strides in improving its social and environmental practices. Its commitment to sustainability and diversity has helped it maintain its position as a market leader.

- Microsoft: With a strong focus on governance and ethical practices, Microsoft has become a favorite among ESG investors. Its commitment to privacy, security, and accessibility has helped it build a loyal customer base.

Conclusion

Investing in U.S. ESG stocks can be a smart move for investors who want to align their investments with their values and achieve long-term growth. By prioritizing environmental, social, and governance factors, these companies are well-positioned to thrive in the future. As more investors recognize the benefits of ESG investing, we can expect to see continued growth in this sector.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....