In the ever-evolving landscape of global finance, investors are often faced with the daunting task of choosing between the international market and the US stock market. Both offer unique opportunities and challenges, and understanding their differences can significantly impact investment decisions. This article will delve into a comprehensive comparison of the international market versus the US stock market, highlighting key factors such as market size, liquidity, and volatility.

Market Size

One of the most significant differences between the international market and the US stock market is their size. The US stock market is the largest and most liquid in the world, with a market capitalization of over $30 trillion. This vast size provides investors with access to a wide array of companies across various industries, from tech giants like Apple and Google to energy companies like ExxonMobil.

In contrast, the international market encompasses the stock exchanges of other countries, such as Europe, Asia, and South America. While these markets may not be as large as the US, they offer exposure to different economies and industries. For example, the Chinese stock market is known for its heavy reliance on technology and consumer goods companies, while the Indian market is characterized by its strong banking and IT sectors.

Liquidity

Liquidity is another crucial factor to consider when comparing the international market and the US stock market. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. The US stock market is renowned for its high liquidity, making it easy for investors to enter and exit positions without incurring substantial transaction costs.

On the other hand, the international market may have varying levels of liquidity, depending on the country and the specific stock. While some international markets, like those in Europe, offer high liquidity, others, such as those in emerging economies, may have lower liquidity, making it more challenging to execute trades at desired prices.

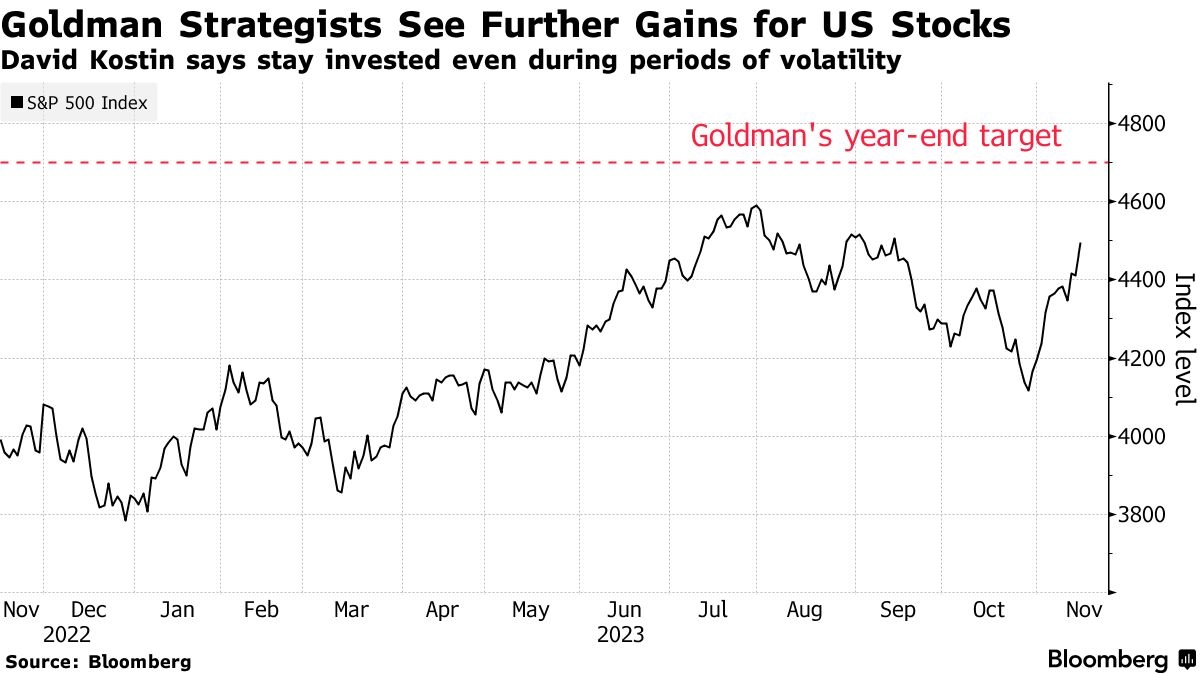

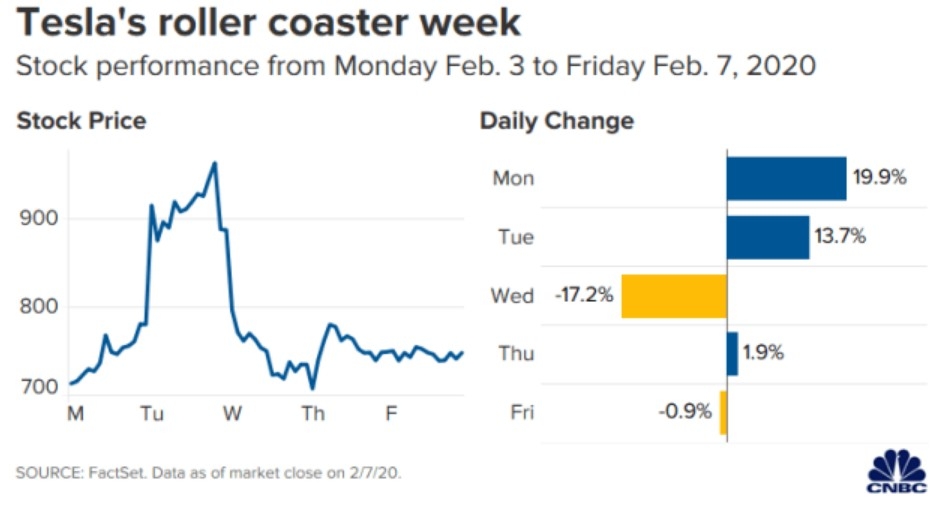

Volatility

Volatility is a measure of how much a stock or market moves over a specific period. The US stock market is known for its relatively low volatility compared to the international market. This can be attributed to the mature and well-regulated nature of the US market, which often provides a stable investment environment.

In contrast, the international market may experience higher volatility due to various factors, such as political instability, economic fluctuations, and currency fluctuations. This volatility can present both opportunities and risks for investors, depending on their risk tolerance and investment strategy.

Case Studies

To illustrate the differences between the international market and the US stock market, let's consider two case studies:

Apple Inc. (AAPL): As a leading technology company, Apple is listed on the NASDAQ exchange in the US. Its stock is highly liquid and has a relatively low volatility, making it an attractive investment for many investors.

Tencent Holdings Ltd. (TCEHY): Tencent, a major Chinese technology company, is listed on the Hong Kong Stock Exchange. While it offers exposure to the fast-growing Chinese tech sector, its stock may experience higher volatility due to the country's regulatory environment and economic fluctuations.

In conclusion, the decision between the international market and the US stock market depends on various factors, including market size, liquidity, and volatility. While the US stock market offers stability and liquidity, the international market provides exposure to diverse economies and industries. Investors should carefully consider these factors and align their investment strategy with their risk tolerance and investment goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....