The stock market is a place where investors often ride the rollercoaster of uncertainty and optimism. In recent times, however, a glimmer of optimism has emerged as Goldman Sachs, one of the world's leading investment banks, has declared that US stocks have likely bottomed. This article will delve into the implications of this statement, the factors contributing to this assessment, and the potential impact on investors.

Understanding the Bottoming of US Stocks

When we talk about "bottoming" in the stock market, it refers to the lowest point in the market's value, after which it is expected to start rising. This is a crucial moment for investors, as it signifies an opportunity to buy stocks at relatively low prices.

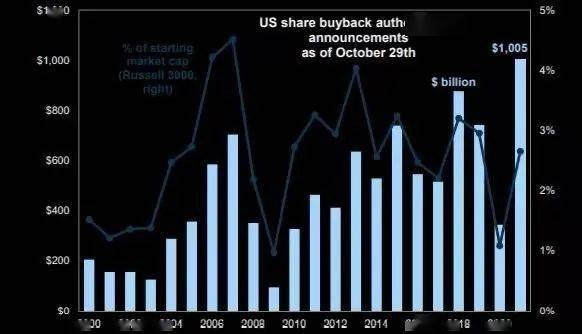

According to Goldman Sachs, the US stock market has likely reached this bottom. This conclusion is based on several factors, including a strong economic outlook, favorable corporate earnings, and a supportive Federal Reserve.

Economic Outlook and Corporate Earnings

One of the main reasons Goldman Sachs believes the US stock market has bottomed is the strong economic outlook. The US economy has shown resilience in the face of various challenges, including the COVID-19 pandemic and global supply chain disruptions. This resilience is reflected in the robust job market, rising consumer spending, and strong corporate earnings.

Federal Reserve's Role

The Federal Reserve has also played a significant role in stabilizing the stock market. The central bank has been implementing an accommodative monetary policy, which has helped to keep interest rates low. This, in turn, has made borrowing cheaper for companies and consumers, supporting economic growth and stock prices.

Impact on Investors

The declaration by Goldman Sachs that the US stock market has likely bottomed is a strong signal for investors. Here are some key takeaways:

- Opportunity to Invest: Investors can consider buying stocks at relatively low prices, with the expectation that the market will start rising.

- Risk vs. Reward: While the market has likely bottomed, it is important to remember that investing in the stock market always involves risk. Investors should assess their risk tolerance before making investment decisions.

- Long-Term Perspective: Investing in the stock market is a long-term endeavor. Investors should focus on their long-term goals and avoid making impulsive decisions based on short-term market movements.

Case Studies

To illustrate the potential impact of the bottoming of the US stock market, let's consider two case studies:

Amazon (AMZN): Amazon has seen significant growth in its stock price since the market bottomed in March 2020. This growth can be attributed to the company's strong performance during the pandemic, as well as its commitment to innovation and expansion into new markets.

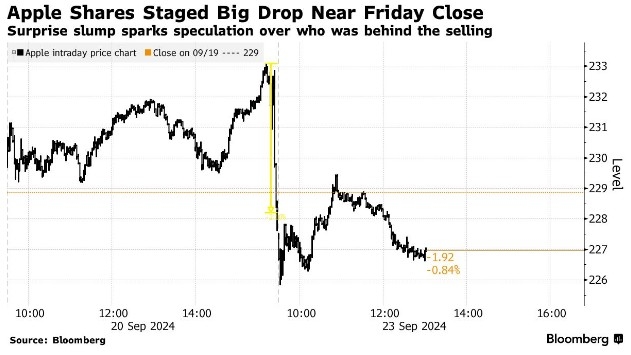

Apple (AAPL): Apple's stock price has also seen substantial growth since the market bottomed in March 2020. This growth is driven by the company's strong financial performance, innovative products, and expanding global market presence.

In conclusion, Goldman Sachs' declaration that the US stock market has likely bottomed is a significant development for investors. While the stock market always involves risks, this assessment suggests that there may be opportunities for investors to benefit from the market's expected upward trajectory. As always, it is crucial for investors to conduct thorough research and consult with a financial advisor before making investment decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....