Introduction: The normal curve distribution is a fundamental concept in statistics that plays a crucial role in understanding the behavior of the US stock market. This article delves into the significance of the normal curve distribution in the stock market, its implications for investors, and how it can be utilized to make informed decisions. By understanding the normal curve distribution, investors can gain insights into market trends and identify potential opportunities.

Understanding the Normal Curve Distribution

The normal curve distribution, also known as the Gaussian distribution, is a bell-shaped curve that represents the probability distribution of a continuous random variable. In the context of the stock market, this distribution helps in analyzing the returns of stocks and predicting their future performance.

The normal curve distribution is characterized by its mean (μ), median, and mode, which are all equal. This distribution is symmetrical, meaning that the left and right sides of the curve are mirror images of each other. The normal curve is also defined by its standard deviation (σ), which measures the spread of data points around the mean.

Implications for the US Stock Market

The normal curve distribution has several implications for the US stock market:

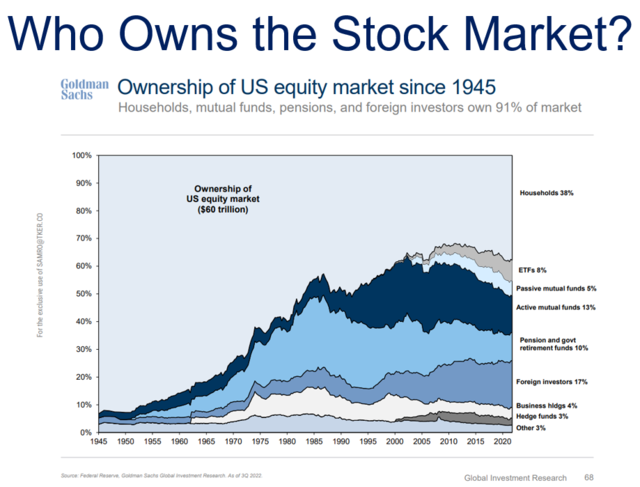

Market Returns: The normal curve distribution suggests that the returns of stocks are normally distributed. This implies that the majority of stocks will generate returns close to the average return, while a smaller number of stocks will experience unusually high or low returns.

Risk Management: The normal curve distribution helps in assessing the risk associated with investing in the stock market. By understanding the distribution of returns, investors can determine the likelihood of achieving their desired returns and make informed decisions about their investment strategies.

Market Efficiency: The normal curve distribution is often used to assess the efficiency of the stock market. If the returns of stocks follow a normal distribution, it suggests that the market is efficient and that prices reflect all available information.

Valuation: The normal curve distribution can be used to estimate the fair value of stocks. By analyzing the distribution of returns, investors can determine the expected returns and assess whether a stock is overvalued or undervalued.

Case Studies

To illustrate the application of the normal curve distribution in the stock market, let's consider two case studies:

Tech Stocks: The technology sector has experienced significant growth over the past few decades. By analyzing the returns of tech stocks, we can observe that they follow a normal curve distribution. This implies that while the majority of tech stocks will generate moderate returns, a few will experience exceptionally high returns, contributing to the overall growth of the sector.

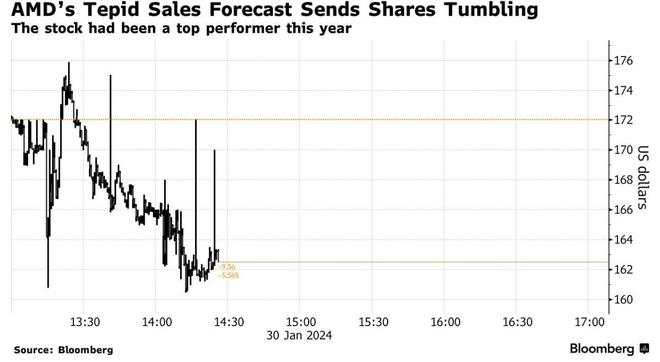

Financial Crisis of 2008: The 2008 financial crisis had a profound impact on the stock market. During this period, the normal curve distribution was disrupted, and the returns of stocks became more volatile. This highlights the importance of understanding the normal curve distribution in predicting market trends and managing risks during periods of crisis.

Conclusion:

The normal curve distribution is a vital tool for understanding the behavior of the US stock market. By analyzing the distribution of returns, investors can gain insights into market trends, assess risks, and make informed decisions. Understanding the normal curve distribution is essential for anyone looking to navigate the complexities of the stock market and achieve long-term success.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....