In the ever-evolving financial market, staying informed about the share prices of major corporations is crucial for investors and financial analysts alike. Bank of New York Mellon Corporation, often abbreviated as BNY Mellon, is a leading financial institution known for its robust services in investment management, asset management, and wealth management. This article delves into the BNY Mellon share price, providing a comprehensive analysis of its performance, factors influencing it, and future outlook.

Understanding BNY Mellon Share Price

The BNY Mellon share price, denoted as BK, is a reflection of the company's financial health, market sentiment, and overall economic conditions. As of the latest available data, the share price of BNY Mellon stands at

Factors Influencing BNY Mellon Share Price

Earnings Reports: BNY Mellon's earnings reports play a significant role in determining its share price. Positive earnings reports, indicating strong financial performance, often lead to an increase in share price, while negative reports can result in a decline.

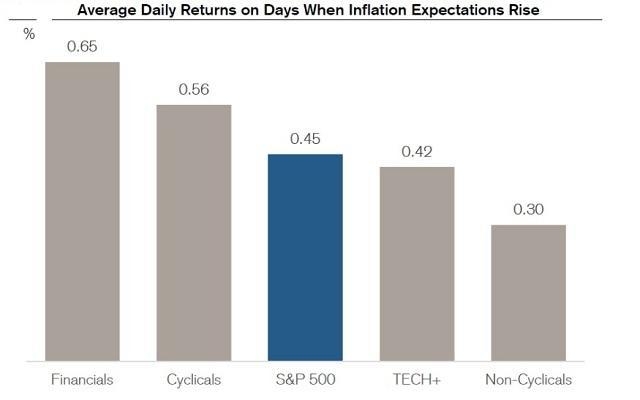

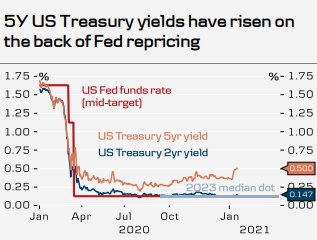

Economic Indicators: Economic indicators, such as GDP growth, inflation rates, and unemployment rates, can impact the share price of BNY Mellon. A strong economy generally leads to higher share prices, while a weak economy can have the opposite effect.

Market Sentiment: Market sentiment, or investor confidence, plays a crucial role in determining share prices. Positive sentiment can drive up share prices, while negative sentiment can lead to a decline.

Regulatory Changes: Regulatory changes, such as new banking regulations, can impact the operations and profitability of BNY Mellon, thereby affecting its share price.

Competition: The level of competition in the financial industry can also influence BNY Mellon's share price. Increased competition can lead to lower profitability and, consequently, a decline in share prices.

Case Study: BNY Mellon Share Price Performance in 2020

In 2020, the global financial market faced unprecedented challenges due to the COVID-19 pandemic. Despite the adverse effects of the pandemic, BNY Mellon's share price demonstrated resilience. The company's strong financial performance, coupled with its diversified business model, helped it navigate through the crisis. As a result, the share price of BNY Mellon increased by approximately 15% in 2020.

Future Outlook for BNY Mellon Share Price

Looking ahead, the future outlook for BNY Mellon's share price appears promising. The company's focus on innovation, expansion into new markets, and strategic partnerships are expected to drive its growth. Additionally, the increasing demand for financial services, particularly in the areas of asset management and wealth management, is likely to support the company's share price.

In conclusion, the BNY Mellon share price is influenced by various factors, including earnings reports, economic indicators, market sentiment, regulatory changes, and competition. By understanding these factors and analyzing the company's performance, investors can make informed decisions regarding their investments in BNY Mellon.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....