In today's fast-paced financial world, understanding the trends of the US stock market is crucial for investors and traders. One of the most effective tools for analyzing these trends is the stock market trend graph. This article delves into the importance of stock market trend graphs, their components, and how they can help you make informed investment decisions.

Understanding the Stock Market Trend Graph

A stock market trend graph is a visual representation of the price movement of a stock or a group of stocks over a specific period. It typically includes three types of trends: upward, downward, and sideways. These trends can be identified by observing the direction of the graph and the pattern of the price movement.

Components of a Stock Market Trend Graph

A stock market trend graph is composed of several key components:

Time Frame: The time frame represents the duration over which the data is collected. Common time frames include daily, weekly, monthly, and yearly.

Price: The price is the most critical component of the graph. It represents the value of the stock at different points in time.

Volume: The volume represents the number of shares traded during a specific period. It can provide insights into the liquidity and activity of the stock.

Moving Averages: Moving averages are lines that smooth out the price data over a specific period. They are used to identify trends and support/resistance levels.

Indicators: Indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands are used to analyze the current market conditions and predict future price movements.

Analyzing Stock Market Trends

Analyzing stock market trends using a trend graph involves several steps:

Identify the Trend: Determine whether the stock is in an upward, downward, or sideways trend. This can be done by observing the direction of the graph and the pattern of the price movement.

Identify Support and Resistance Levels: Support and resistance levels are price levels where the stock has repeatedly struggled to move above or below. These levels can be identified using moving averages and indicators.

Analyze Indicators: Use indicators to confirm the trend and predict future price movements. For example, if the RSI is above 70, it indicates that the stock is overbought, and a price pullback may occur.

Use Historical Data: Analyze historical data to identify patterns and trends. This can help you make informed decisions about future investments.

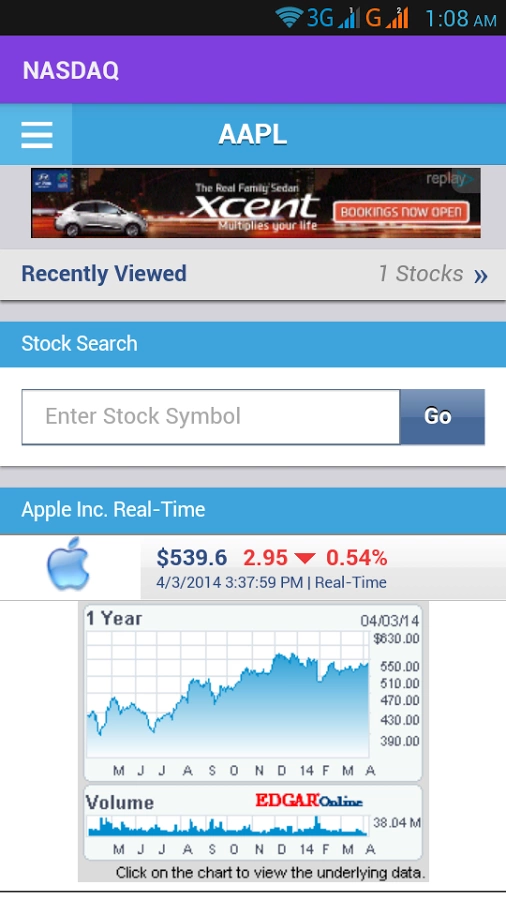

Case Study: Apple Inc. (AAPL)

Let's take a look at a case study involving Apple Inc. (AAPL). Over the past five years, AAPL has displayed a strong upward trend. By analyzing the trend graph, we can identify several key points:

Support and Resistance Levels: AAPL has consistently found support at around

130 and resistance at 150.Moving Averages: The 50-day moving average has served as a strong support level during the upward trend.

Indicators: The RSI has remained above 50, indicating that AAPL is in an uptrend.

By analyzing these components, investors can make informed decisions about when to buy or sell AAPL.

Conclusion

In conclusion, the stock market trend graph is a powerful tool for analyzing the US stock market. By understanding its components and analyzing trends, investors and traders can make informed decisions and potentially increase their chances of success. Whether you're a seasoned investor or just starting out, incorporating trend graphs into your analysis can help you navigate the complex world of the stock market.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....