In recent years, there has been a growing concern about the role of the US government in manipulating the stock market. Critics argue that the government's interventions, both direct and indirect, have a significant impact on the stock market's performance. This article delves into the various aspects of this debate, examining the evidence, the implications, and the potential consequences of such interventions.

Understanding the Concerns

The primary concern is that the US government, through its various agencies and policies, may be manipulating the stock market to benefit certain groups or individuals. This manipulation can take several forms, including:

- Quantitative Easing (QE): The Federal Reserve's policy of buying government securities to stimulate the economy has been a point of contention. Critics argue that QE artificially inflates stock prices, leading to a bubble that could burst at any time.

- Corporate Tax Cuts: The Tax Cuts and Jobs Act of 2017 significantly reduced corporate tax rates. While this was intended to boost economic growth, some believe it may have disproportionately benefited large corporations, leading to increased stock prices.

- Regulatory Changes: The Trump administration has rolled back several regulations on Wall Street, which some argue have created a more favorable environment for stock market manipulation.

Evidence of Government Influence

There is some evidence to support the claim that the US government manipulates the stock market. For example:

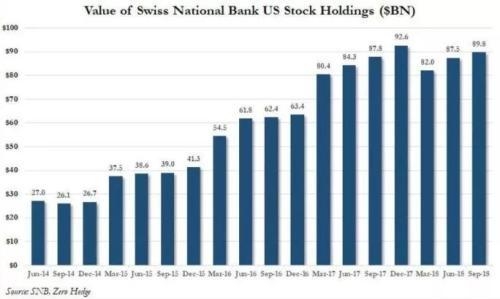

- Stock Market Performance: Since the financial crisis of 2008, the stock market has experienced a significant rally. Critics argue that this rally is largely due to government interventions, rather than organic economic growth.

- Corporate Profits: Corporate profits have also surged since the financial crisis, which some believe is a result of government policies that have benefited large corporations.

- Market Volatility: The stock market has become increasingly volatile, with periods of extreme volatility followed by rapid recoveries. Some argue that this volatility is a sign of manipulation.

Case Studies

Several case studies illustrate the potential for government manipulation of the stock market:

- Goldman Sachs: In 2008, Goldman Sachs was accused of manipulating the market by selling credit default swaps (CDS) on mortgage-backed securities. While the charges were dropped, the incident raised questions about the role of financial institutions in manipulating the market.

- Facebook: In 2018, Facebook's stock price plummeted after the company revealed that it had lost user data to a third-party. Some analysts suggested that the government's response to the incident may have influenced the stock's recovery.

The Implications

The potential for government manipulation of the stock market has several implications:

- Market Integrity: Manipulating the stock market undermines market integrity and can lead to investor distrust.

- Economic Stability: Artificially inflating stock prices can lead to economic instability, as seen during the dot-com bubble and the financial crisis of 2008.

- Income Inequality: The benefits of government interventions often disproportionately benefit the wealthy, exacerbating income inequality.

Conclusion

While there is no definitive proof that the US government manipulates the stock market, the concerns raised by critics are worth considering. As the government continues to play a significant role in the economy, it is essential to scrutinize its policies and interventions to ensure market integrity and economic stability.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....