In the ever-evolving landscape of global investment, many military personnel are curious about the possibility of purchasing foreign stocks, including Chinese stocks, while serving in the US Army. This article delves into the legalities and practicalities of such an investment, providing you with the information needed to make an informed decision.

Understanding the Legal Framework

The first and foremost consideration for any service member looking to invest in foreign stocks is the legal framework. According to the Department of Defense's (DOD) financial investment guidelines, military personnel are allowed to invest in securities, including stocks, as long as the investments are not in direct conflict with their duties or responsibilities.

Eligibility and Restrictions

Service members, including officers and enlisted personnel, are eligible to invest in Chinese stocks through various investment platforms and brokerage firms. However, there are specific restrictions to be aware of:

- Conflict of Interest: Investing in a stock that directly benefits a service member's military unit or mission is strictly prohibited.

- Financial Reporting: Military personnel are required to report all investments, including foreign stocks, on their annual financial disclosure forms.

- Tax Implications: Income from investments, including dividends and capital gains, is subject to income tax, just like any other income.

Investment Platforms and Brokerage Firms

Several investment platforms and brokerage firms offer access to Chinese stocks for US investors. Some popular options include:

- E*TRADE: Offers a range of international stock trading options, including Chinese stocks.

- Fidelity: Provides access to international markets, including China, through its brokerage services.

- Charles Schwab: Offers a diverse selection of international investments, including Chinese stocks.

Risk Considerations

Investing in foreign stocks, particularly in a market like China, comes with its own set of risks:

- Political and Economic Instability: The Chinese stock market can be volatile, influenced by political and economic factors unique to the country.

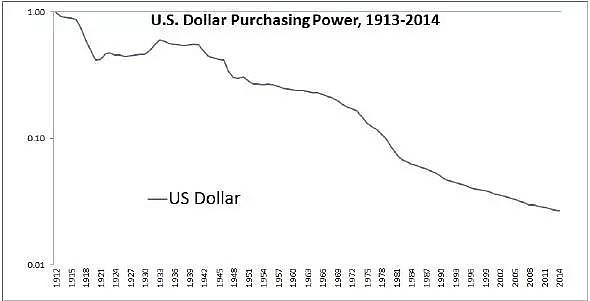

- Currency Risk: Changes in the exchange rate between the US dollar and the Chinese yuan can impact investment returns.

- Liquidity Risk: Some Chinese stocks may be less liquid, making it difficult to buy or sell shares at desired prices.

Case Study: Investing in Tencent

One notable Chinese stock that has caught the attention of investors is Tencent, a leading Chinese technology company. In 2020, Tencent's stock reached an all-time high, offering significant returns to those who had invested early. However, it's important to note that this case does not guarantee similar results for future investors.

Conclusion

While military personnel are allowed to invest in Chinese stocks, it's crucial to understand the legal framework, restrictions, and risks involved. With careful consideration and due diligence, investing in foreign stocks can be a valuable part of a diversified investment portfolio. Always consult with a financial advisor to ensure your investments align with your financial goals and risk tolerance.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....