The U.S. stock market, often referred to as the "American Stock Market," has been a cornerstone of global finance for centuries. As the largest and most influential stock market in the world, it plays a pivotal role in shaping the global economic landscape. In this article, we will provide a comprehensive overview of the closing U.S. stock market, covering key aspects such as its history, major indices, trading hours, and the factors that influence stock prices.

A Brief History of the U.S. Stock Market

The history of the U.S. stock market dates back to the late 18th century. The first stock exchange in America, the New York Stock and Exchange Board, was established in 1792. Over the years, the market has evolved significantly, with numerous milestones such as the creation of the Dow Jones Industrial Average in 1896 and the introduction of the electronic trading system in the 1970s.

Major Indices in the U.S. Stock Market

The U.S. stock market is home to several major indices, each representing a specific segment of the market. Some of the most prominent indices include:

- Dow Jones Industrial Average (DJIA): The DJIA, also known as "The Dow," is a price-weighted average of 30 large, publicly-owned companies. It serves as a benchmark for the overall performance of the U.S. stock market.

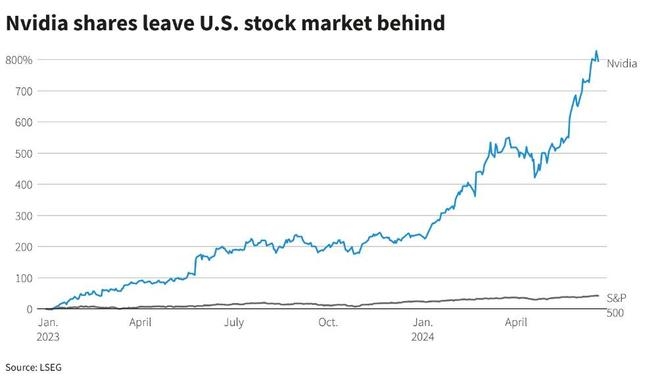

- Standard & Poor's 500 (S&P 500): The S&P 500 is a widely followed index that includes the stocks of 500 large companies from various sectors of the U.S. economy. It is considered a more comprehensive measure of the stock market's performance than the DJIA.

- Nasdaq Composite: The Nasdaq Composite is a market capitalization-weighted index that includes all listed stocks on the Nasdaq stock exchange. It is particularly popular among technology companies and is often seen as a gauge of the tech industry's performance.

Trading Hours and Closing Times

The trading hours for the U.S. stock market are typically from 9:30 a.m. to 4:00 p.m. Eastern Time. However, the market is open for pre-market trading from 4:00 a.m. to 9:30 a.m. and for after-hours trading from 4:00 p.m. to 8:00 p.m. The closing time for the market is 4:00 p.m. Eastern Time.

Factors Influencing Stock Prices

Several factors can influence stock prices in the U.S. stock market. Some of the most significant factors include:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can impact stock prices. For instance, higher GDP growth and lower unemployment rates are typically seen as positive signs for the stock market.

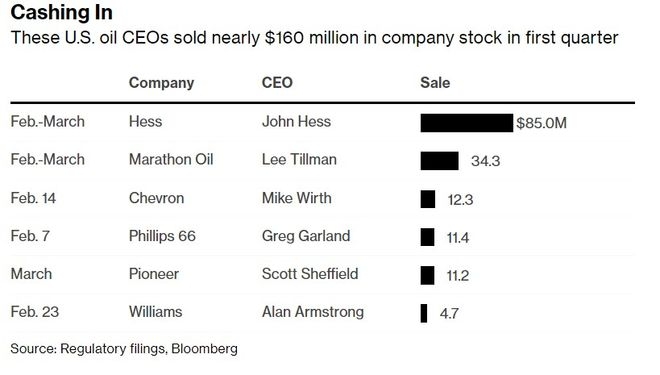

- Company Performance: The performance of individual companies can significantly affect stock prices. Strong earnings reports and positive news can drive up stock prices, while weak results or negative news can lead to declines.

- Political and Geopolitical Events: Political and geopolitical events, such as elections, trade disputes, and international conflicts, can also influence stock prices.

Case Study: The 2008 Financial Crisis

One of the most significant events in the U.S. stock market's history was the 2008 financial crisis. The crisis was triggered by the collapse of the U.S. housing market, which led to a series of bank failures and a severe economic downturn. As a result, the stock market experienced one of its worst crashes in history, with the Dow Jones Industrial Average falling by over 50% from its peak in 2007 to its trough in 2009.

Conclusion

The closing U.S. stock market is a complex and dynamic entity that plays a crucial role in the global economy. By understanding its history, major indices, trading hours, and the factors that influence stock prices, investors can better navigate the market and make informed decisions. As the market continues to evolve, staying informed and adapting to changing conditions is essential for success.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....