Introduction

Investing in the U.S. stock market has always been an attractive option for international investors. But with the global market's interconnectedness, many are wondering if they can trade U.S. stocks. The answer is a resounding yes. In this article, we'll explore how foreign investors can trade U.S. stocks and the benefits of doing so.

Eligibility and Requirements

To trade U.S. stocks, foreign investors must meet certain eligibility and requirement criteria. Here's what you need to know:

- Residency Status: Foreign investors must be residents or citizens of a country with a reciprocal arrangement with the U.S. government. This means that if your country allows U.S. citizens to invest in your stock market, you can trade U.S. stocks.

- Investment Account: Foreign investors need to open an investment account with a U.S. brokerage firm. This account will allow you to buy and sell U.S. stocks.

- Financial Statements: Some brokerage firms may require foreign investors to provide financial statements to assess their risk level.

- Knowledge and Understanding: It's crucial to have a good understanding of the U.S. stock market and trading procedures before investing.

Benefits of Trading U.S. Stocks

There are several advantages to trading U.S. stocks as a foreign investor:

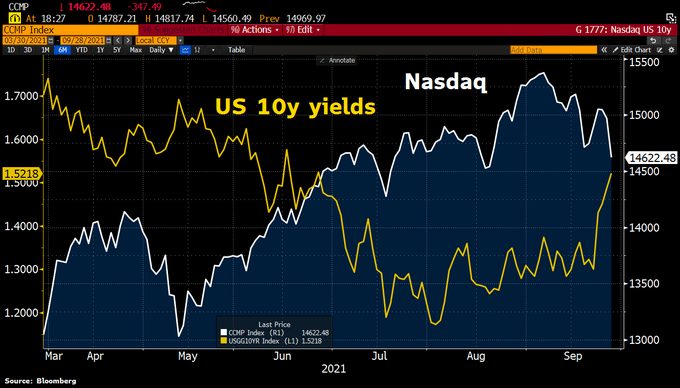

- Diversification: The U.S. stock market offers a wide range of investment opportunities, allowing you to diversify your portfolio.

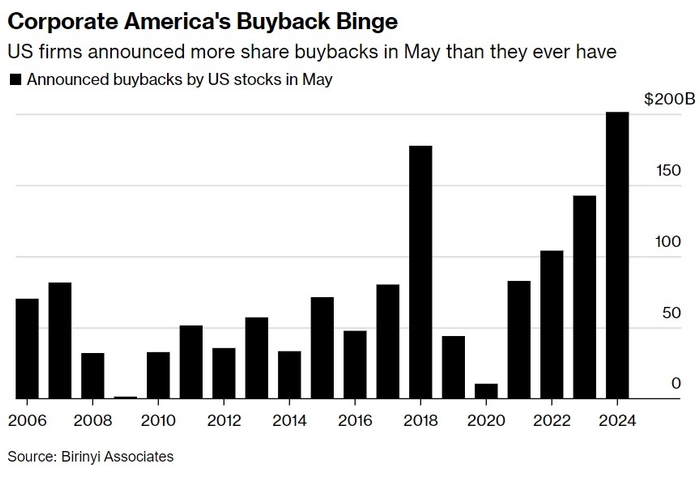

- Potential for High Returns: U.S. companies have a history of strong performance, and investing in them can lead to significant returns.

- Access to Technology and Innovation: The U.S. is a global leader in technology and innovation, and investing in U.S. stocks can provide exposure to cutting-edge industries.

- Regulatory Protections: The U.S. stock market is regulated by the Securities and Exchange Commission (SEC), which provides investors with legal protections.

How to Trade U.S. Stocks

Here's a step-by-step guide to trading U.S. stocks as a foreign investor:

- Choose a Brokerage Firm: Research and select a reputable U.S. brokerage firm that caters to international clients.

- Open an Investment Account: Complete the necessary paperwork and open an investment account with the brokerage firm.

- Fund Your Account: Transfer funds from your foreign bank account to your U.S. investment account.

- Research and Analyze Stocks: Conduct thorough research and analysis on U.S. stocks you're interested in.

- Place Orders: Place buy or sell orders through your brokerage firm's platform.

- Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company news.

Case Studies

Let's look at a couple of case studies to understand how foreign investors have successfully traded U.S. stocks:

- Japanese Investor: A Japanese investor decided to invest in U.S. tech stocks, such as Apple and Google, in 2016. Over the next five years, their investment grew by 40%, showcasing the potential for high returns.

- British Investor: A British investor opened a U.S. investment account in 2017 and invested in energy stocks, such as ExxonMobil. Due to the increase in oil prices, their investment grew by 30% within two years.

Conclusion

Trading U.S. stocks can be a lucrative investment opportunity for foreign investors. By meeting the necessary requirements and following proper procedures, you can gain access to the world's largest stock market and potentially enjoy significant returns. Remember to conduct thorough research and seek professional advice if needed.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....