Are you a Canadian investor looking to expand your portfolio into the U.S. stock market? Trading U.S. stocks from Canada can be a strategic move, offering access to a vast array of companies and potentially higher returns. However, navigating this process requires a solid understanding of the regulations, tools, and strategies involved. In this article, we'll delve into the essential aspects of Canadian trading in U.S. stocks, including the necessary steps, fees, and benefits.

Opening an Account with a U.S. Brokerage

The first step for Canadian investors interested in trading U.S. stocks is to open an account with a U.S.-based brokerage firm. Many reputable brokerage platforms offer services tailored to international investors, including access to a wide range of U.S. stocks. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding U.S. Stock Market Hours

It's crucial to be aware of the trading hours for U.S. stocks. The primary exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, operate from 9:30 a.m. to 4:00 p.m. Eastern Time. This means that Canadian investors need to plan their trading activities accordingly, considering the time difference between Canada and the U.S.

Understanding the Costs Involved

When trading U.S. stocks, Canadian investors should be mindful of the various costs associated with the process. These include brokerage fees, currency exchange rates, and potential tax implications. Many brokers offer transparent fee structures, so it's essential to review these thoroughly before opening an account.

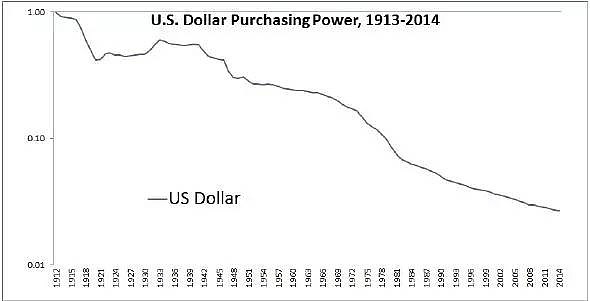

Currency Conversion and Exchange Rates

One of the challenges Canadian investors face when trading U.S. stocks is dealing with currency conversion. When buying U.S. stocks, your Canadian dollars will be converted to U.S. dollars. The exchange rate at the time of conversion can significantly impact the cost of your investment. It's important to monitor exchange rates and consider the potential impact on your investment returns.

Tax Considerations

Canadian investors trading U.S. stocks must also consider the tax implications. The Canada Revenue Agency (CRA) requires Canadian residents to report any income earned from foreign investments, including U.S. stocks. This includes capital gains tax on any profits realized from selling U.S. stocks. It's advisable to consult with a tax professional to ensure compliance with Canadian tax laws.

Using Stop-Loss and Take-Profit Orders

To manage risk and protect their investments, Canadian investors trading U.S. stocks should consider using stop-loss and take-profit orders. These orders allow investors to set specific prices at which they want to buy or sell a stock, helping to mitigate potential losses and lock in gains.

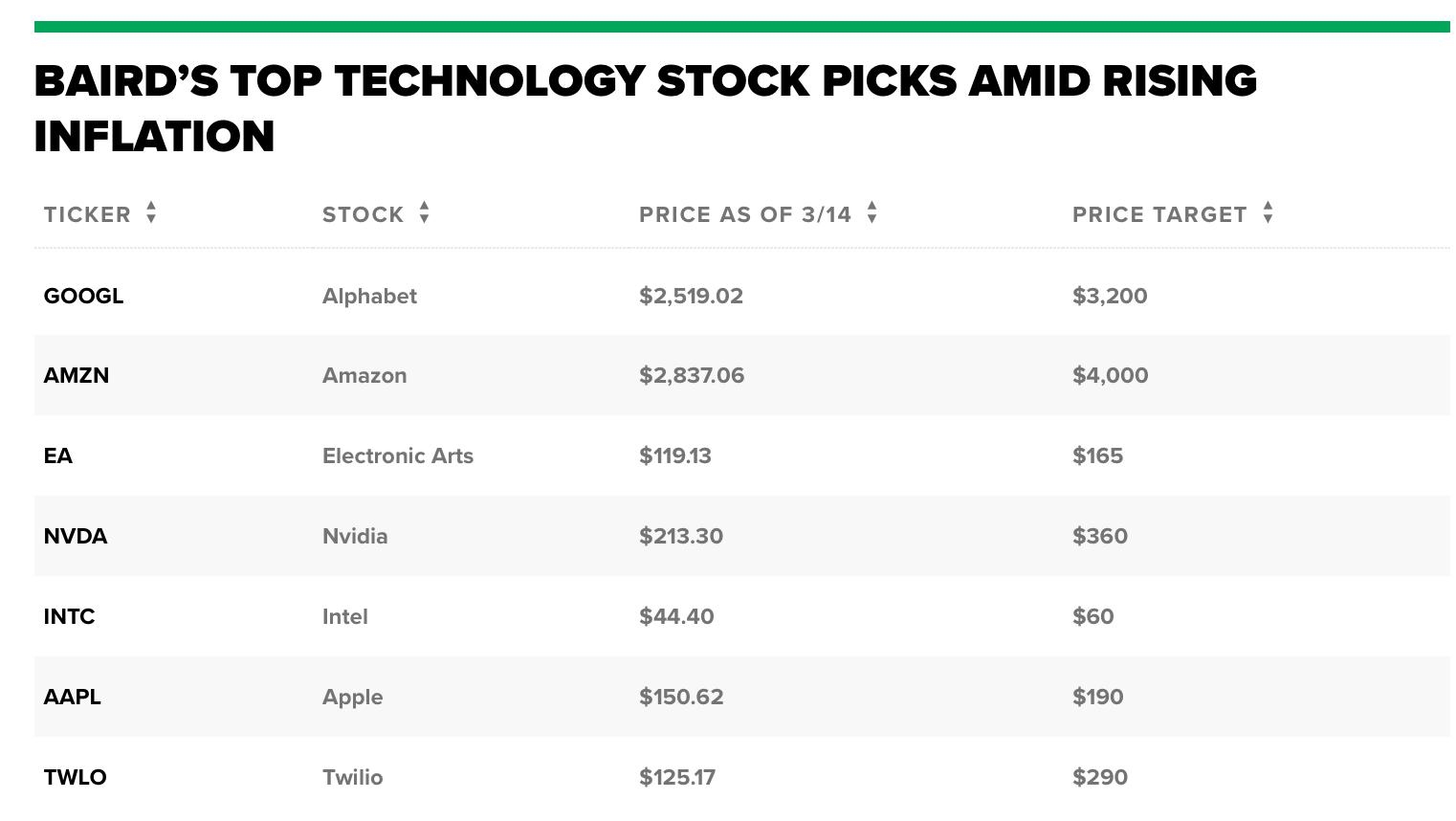

Case Study: Investing in a Tech Giant

Let's consider a hypothetical scenario. A Canadian investor decides to invest in a well-known U.S. tech giant. By opening an account with a U.S. brokerage, they purchase 100 shares of the company at

Over the next year, the stock price increases to

Conclusion

Trading U.S. stocks from Canada can be a lucrative opportunity for investors looking to diversify their portfolios. By understanding the process, costs, and risks involved, Canadian investors can make informed decisions and potentially benefit from the U.S. stock market's strengths. Remember to consider the tax implications and seek professional advice where necessary to ensure compliance with Canadian tax laws.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....