Investing in the United States stock market can be an exciting and potentially lucrative venture. However, selecting the right stocks can be a challenging task. With thousands of companies to choose from, how do you know which ones are worth your investment? This comprehensive guide will walk you through the essential steps to help you pick US stocks like a pro.

Understanding the Market

Before diving into stock picking, it's crucial to have a clear understanding of the US stock market. The two primary exchanges where you can trade stocks are the New York Stock Exchange (NYSE) and the Nasdaq. Each exchange has its unique characteristics, but both offer a wide range of companies across various industries.

Research and Analysis

The key to successful stock picking is thorough research and analysis. Here are some essential factors to consider:

1. Company fundamentals: Look for companies with strong financials, including high revenue growth, low debt levels, and good profitability. Evaluate their earnings reports, balance sheets, and cash flow statements to gauge their financial health.

2. Industry trends: Research the industry in which the company operates. Is it a growing industry with a strong outlook, or is it facing challenges and potential decline? Pay attention to market demand, technological advancements, and regulatory changes that may impact the industry.

3. Management team: A company's success often hinges on the leadership of its management team. Look for experienced and capable leaders with a proven track record of success.

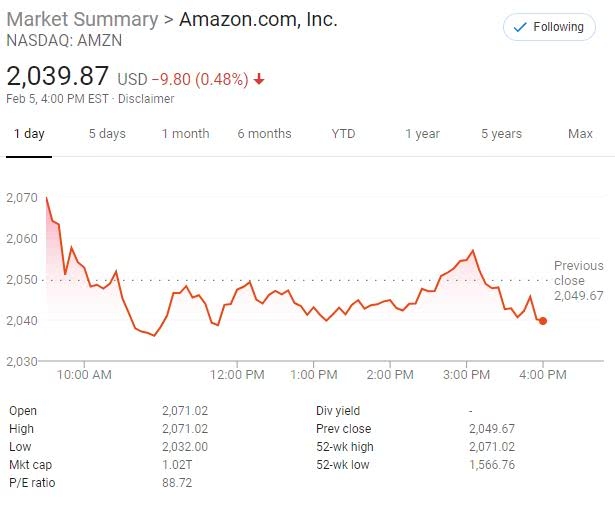

4. Valuation: Assess the company's valuation by comparing it to its peers and the overall market. Use metrics like price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) to determine if the stock is overvalued, undervalued, or fairly priced.

5. Dividends: Consider companies that offer dividends, as they can provide a consistent income stream and may indicate financial stability.

Technical Analysis

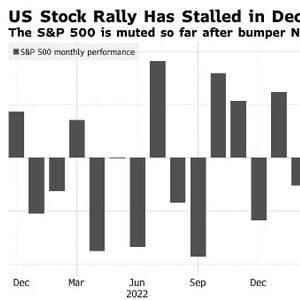

In addition to fundamental analysis, many investors use technical analysis to predict stock price movements based on historical data and patterns. This involves analyzing stock charts, trends, and indicators to identify potential buy and sell signals.

Diversification

To minimize risk, it's essential to diversify your stock portfolio. Invest in companies from various industries and geographic locations to spread out your risk. This approach can help mitigate the impact of market downturns and specific industry challenges.

Case Study: Apple Inc.

Let's take a look at a real-world example of a successful stock pick. Apple Inc. (AAPL) has been a top-performing stock over the years. Here's how some of the factors discussed earlier applied to Apple:

- Company fundamentals: Apple has consistently reported strong revenue growth, low debt levels, and impressive profitability.

- Industry trends: The technology industry has seen significant growth, with a strong demand for smartphones, tablets, and other consumer electronics.

- Management team: Apple's CEO, Tim Cook, has been instrumental in the company's continued success.

- Valuation: While Apple has been valued at various points, it has generally been considered fairly priced relative to its peers and the market.

- Dividends: Apple offers a dividend, making it an attractive investment for income seekers.

In conclusion, picking US stocks requires a thorough understanding of the market, careful research, and analysis. By considering company fundamentals, industry trends, management teams, valuation, dividends, and diversification, you can make informed investment decisions. Remember to stay patient and disciplined, as successful investing often requires a long-term perspective.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....