In the ever-evolving world of finance, the NASDAQ Composite Index has become a cornerstone of the U.S. stock market. Understanding the historical performance of the NASDAQ can provide valuable insights into the market's behavior and potential future trends. This article delves into the historical data of the NASDAQ, highlighting key milestones and offering a glimpse into what the future might hold.

The NASDAQ Composite Index: A Brief Overview

The NASDAQ Composite Index is a broad-based index that measures the performance of all domestic and international common stocks listed on the NASDAQ stock exchange. It includes a diverse range of companies across various sectors, making it a vital gauge of the overall market's health.

Historical Milestones of the NASDAQ

The NASDAQ was established in 1971, making it one of the oldest stock exchanges in the United States. Over the years, it has witnessed several significant milestones:

- 1980s: The Birth of Tech Stocks - The 1980s marked the emergence of technology companies, which began to dominate the NASDAQ. Companies like Apple, Microsoft, and Intel became household names, and the NASDAQ saw a surge in tech stocks.

- 1990s: The Dot-Com Bubble - The 1990s saw the rise of the dot-com bubble, with internet and technology stocks skyrocketing. However, the bubble burst in 2000, leading to a significant decline in the NASDAQ.

- 2000s: Recovery and Growth - The NASDAQ recovered from the dot-com bubble and experienced steady growth throughout the 2000s, driven by companies like Google and Amazon.

- 2010s: Record Highs and Volatility - The NASDAQ reached record highs during the 2010s, but it also experienced significant volatility, particularly during the 2020 COVID-19 pandemic.

Key Insights from the NASDAQ Historical Data

Analyzing the historical data of the NASDAQ provides several valuable insights:

- Tech Stocks Dominate - The NASDAQ has always been synonymous with technology stocks. Understanding the performance of these companies can provide a glimpse into the future of the tech industry.

- Market Volatility - The NASDAQ has experienced periods of high volatility, particularly during economic downturns and technological disruptions. Investors should be prepared for potential market fluctuations.

- Long-Term Growth - Despite short-term volatility, the NASDAQ has shown long-term growth, making it an attractive investment option for long-term investors.

Case Studies: Tech Giants on the NASDAQ

Several iconic tech companies have made significant contributions to the NASDAQ's growth:

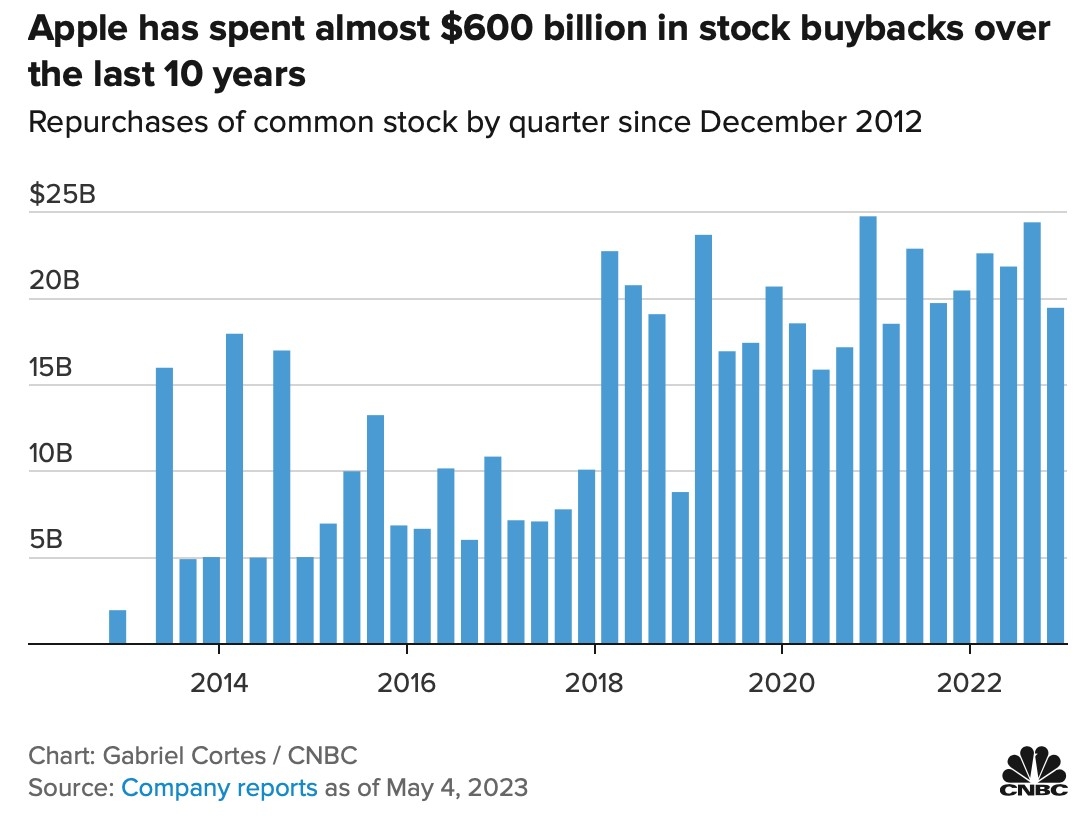

- Apple (AAPL) - Since its listing on the NASDAQ in 1980, Apple has become one of the most valuable companies in the world. Its stock has experienced significant growth, making it a favorite among investors.

- Microsoft (MSFT) - Another tech giant, Microsoft, has seen its stock soar since its listing on the NASDAQ in 1986. The company's diversification into various sectors has contributed to its long-term success.

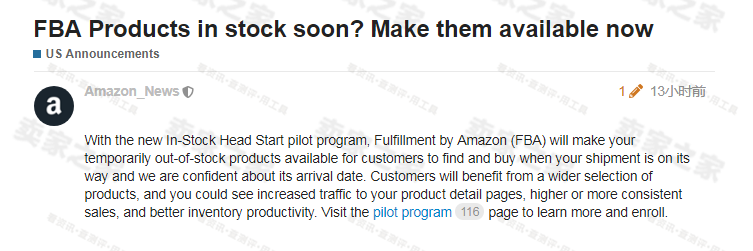

- Amazon (AMZN) - Amazon's listing on the NASDAQ in 1997 marked the beginning of its meteoric rise. The company has become a dominant player in the e-commerce and cloud computing sectors.

Conclusion

The NASDAQ Composite Index has been a vital indicator of the U.S. stock market's performance over the years. By analyzing its historical data, investors can gain valuable insights into the market's behavior and potential future trends. As technology continues to evolve, the NASDAQ is likely to remain a key player in the global stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....