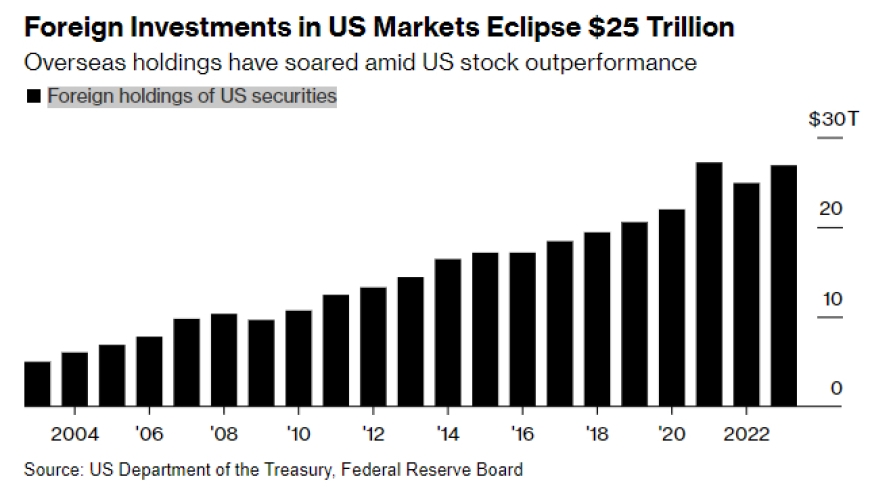

Are you a foreign investor looking to venture into the US stock market? The American stock market is known for its diversity and potential for high returns. But how can you buy US stocks from overseas? In this article, we'll guide you through the process, providing you with the information you need to invest in US stocks successfully.

Understanding the Basics

Before you start buying US stocks, it's crucial to understand the basics. The US stock market is composed of several exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list a wide range of companies, from small startups to large multinational corporations.

Open a Brokerage Account

The first step in buying US stocks is to open a brokerage account. This account will serve as your gateway to the US stock market. There are several types of brokerage accounts to choose from, such as traditional brokerage accounts, Roth IRAs, and ETFs.

When choosing a brokerage, consider factors such as fees, customer service, and the range of investment options. Some popular brokerage firms for foreign investors include TD Ameritrade, Charles Schwab, and E*TRADE.

Understand the Tax Implications

As a foreign investor, you need to be aware of the tax implications of buying US stocks. The United States has a tax treaty with many countries, which can help reduce your tax liability. However, you'll still need to file an annual tax return and pay any taxes due.

It's advisable to consult with a tax professional to understand the specific tax rules that apply to your situation.

Research and Analyze Stocks

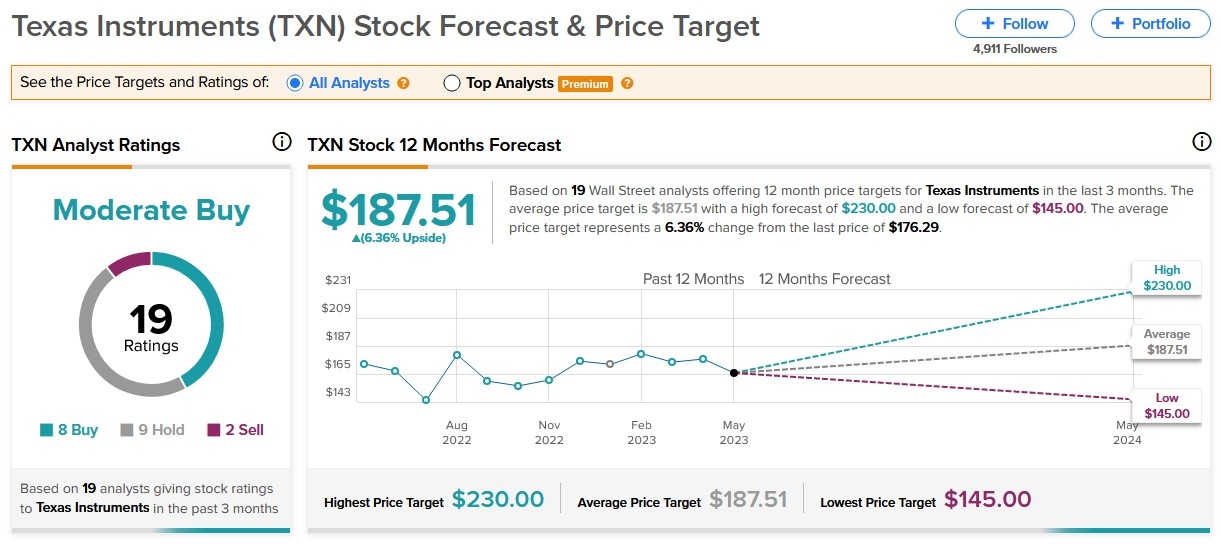

Once you have your brokerage account set up, it's time to start researching and analyzing stocks. This is a critical step in the process, as it helps you make informed investment decisions. Use financial websites, investment apps, and other resources to gather information about companies you're interested in.

Key factors to consider include:

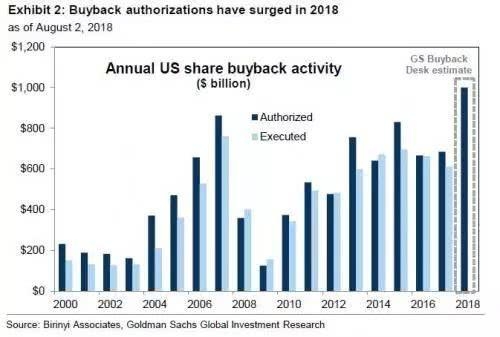

- Financial Health: Look at a company's financial statements, including its income statement, balance sheet, and cash flow statement.

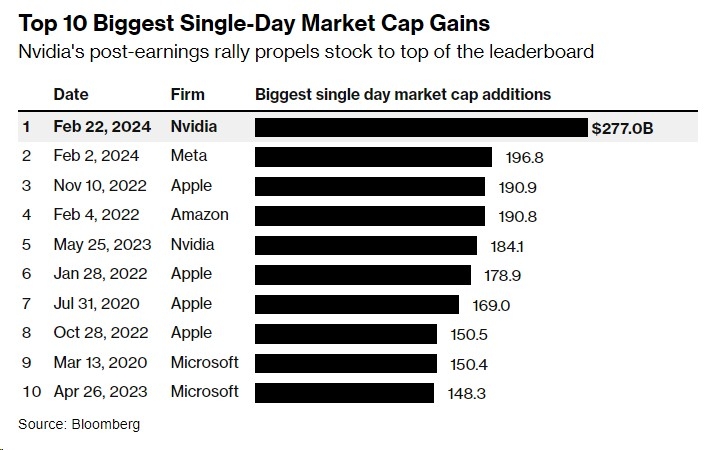

- Market Performance: Analyze a company's stock performance over time.

- Industry Trends: Understand the industry trends and how they might impact the company's future growth.

Make Your Investments

Once you've done your research and chosen a company to invest in, you can place an order through your brokerage account. You'll need to specify the number of shares you want to buy and the price at which you're willing to purchase them.

Types of Orders:

- Market Order: Buy or sell a stock at the current market price.

- Limit Order: Buy or sell a stock at a specific price or better.

Monitor Your Investments

After making your investments, it's essential to monitor your portfolio regularly. Keep an eye on your investments' performance and stay informed about any news or developments that might affect the companies you've invested in.

Remember, investing in the stock market involves risk, and it's crucial to diversify your investments to manage risk effectively.

Conclusion

Buying US stocks as a foreigner is a process that requires careful planning and research. By understanding the basics, opening a brokerage account, and conducting thorough research, you can make informed investment decisions. While there are risks involved, the potential rewards of investing in the US stock market are significant.

Remember, investing is a long-term endeavor, and patience and discipline are key to successful investing.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....