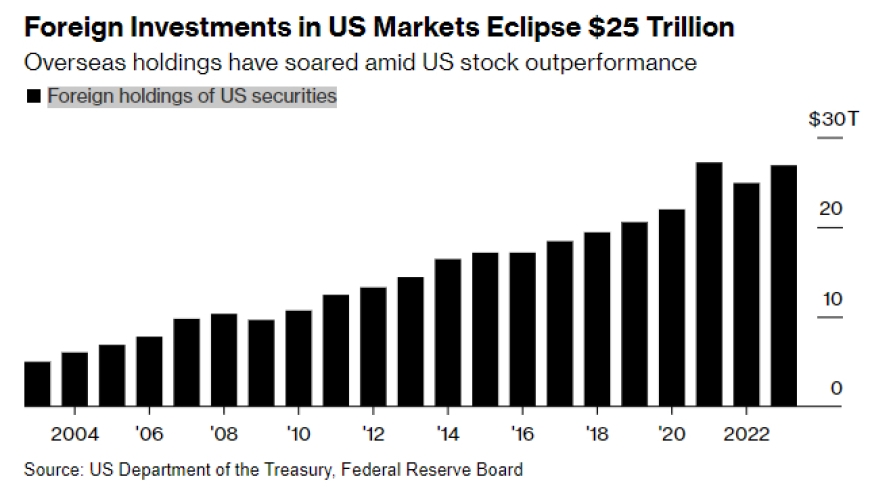

In recent years, there has been a significant increase in Chinese investors purchasing stocks in the United States. This trend has been driven by various factors, including the rise of Chinese wealth, the attractiveness of the US stock market, and the desire for diversification. This article explores the reasons behind this growing trend and examines its potential impact on the US stock market.

Rise of Chinese Wealth

The first and foremost reason for the increasing Chinese investment in US stocks is the rapid growth of Chinese wealth. Over the past few decades, China has experienced an economic boom, leading to a significant increase in the number of individuals and families with disposable income. These individuals are now looking for ways to invest their money, and the US stock market has emerged as a popular destination.

Attractiveness of the US Stock Market

The US stock market is one of the most robust and liquid markets in the world. It offers a wide range of investment opportunities, including shares of well-known companies, emerging startups, and a diverse array of sectors. Additionally, the US stock market is known for its strong regulatory framework, which provides investors with a high level of confidence and security.

Diversification

Another key factor driving Chinese investment in US stocks is the desire for diversification. The Chinese economy is heavily reliant on manufacturing and exports, which can be vulnerable to global economic fluctuations. By investing in the US stock market, Chinese investors can diversify their portfolios and reduce their exposure to domestic market risks.

Impact on the US Stock Market

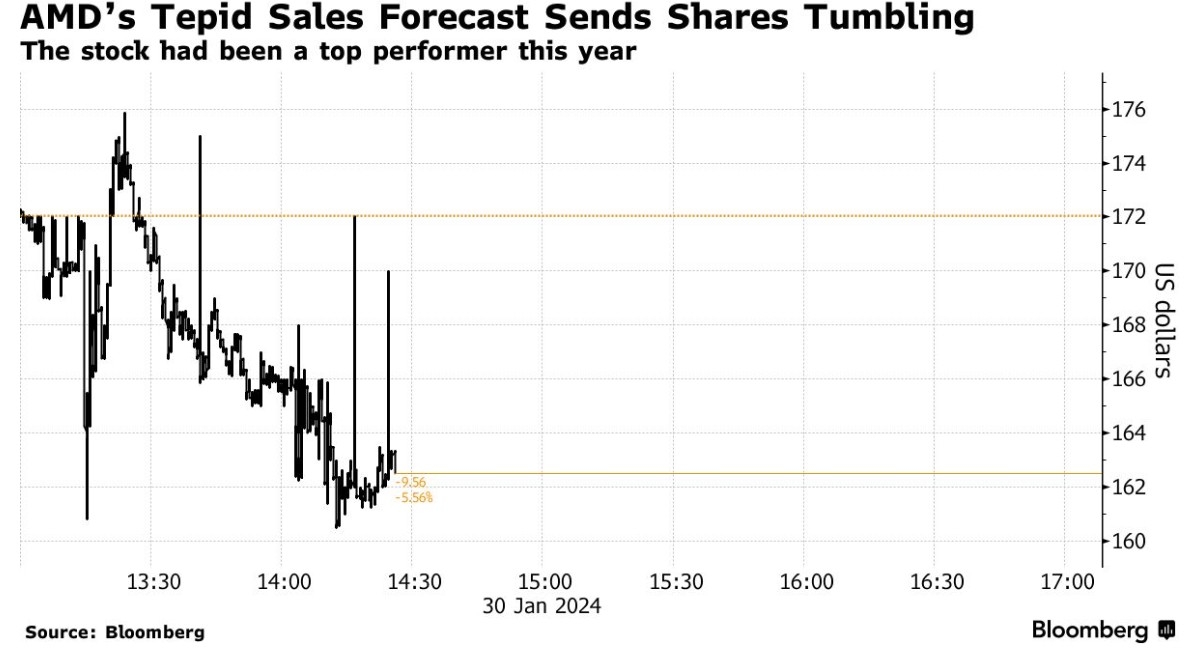

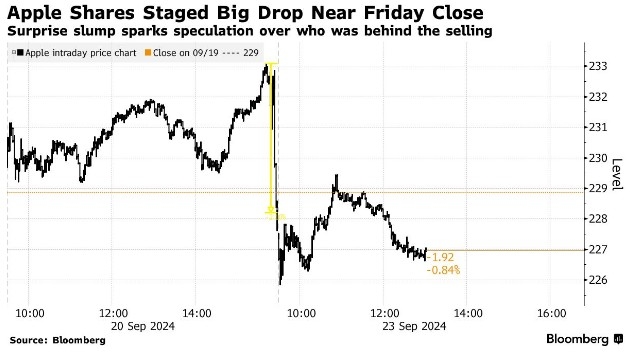

The growing Chinese investment in US stocks has had a significant impact on the market. For one, it has led to increased liquidity, as Chinese investors bring substantial capital into the market. This has, in turn, driven up stock prices and contributed to the overall growth of the market.

Case Studies

Several high-profile cases illustrate the growing Chinese investment in US stocks. For instance, in 2016, Chinese conglomerate Dalian Wanda Group acquired AMC Theatres, one of the largest cinema chains in the United States. This deal marked the largest foreign acquisition of a US company by a Chinese entity at the time.

Similarly, in 2017, Chinese tech giant Tencent Holdings Limited acquired a significant stake in popular gaming company Epic Games. This investment allowed Tencent to gain a foothold in the US gaming market and expand its global reach.

Conclusion

In conclusion, the growing trend of Chinese investors buying stocks in the US is a testament to the increasing wealth and investment appetite in China. As this trend continues, it is likely to have a significant impact on the US stock market, leading to increased liquidity and potentially driving up stock prices. For investors and companies alike, understanding this trend is crucial for making informed decisions and capitalizing on the opportunities it presents.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....