Are you a foreign investor looking to diversify your portfolio by investing in U.S. stocks? You're not alone. The U.S. stock market is one of the largest and most influential in the world, offering a wide range of investment opportunities. However, investing in a foreign market can be daunting. In this article, we'll guide you through the process of investing in U.S. stocks as a foreigner, so you can make informed decisions and start building your wealth.

Understanding the Basics

Before diving into the investment process, it's crucial to understand the basics of U.S. stocks. A stock represents a share of ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company's profits, which are distributed as dividends. The value of a stock can fluctuate based on various factors, including the company's performance, the overall market conditions, and economic indicators.

Opening a U.S. Brokerage Account

The first step in investing in U.S. stocks is to open a brokerage account. This account will serve as your gateway to the U.S. stock market. Here's how to do it:

- Choose a Brokerage Firm: Research and compare brokerage firms that offer services to foreign investors. Look for firms that have a good reputation, low fees, and a user-friendly platform.

- Provide Identification: You'll need to provide identification, such as a passport and proof of address, to verify your identity.

- Fill Out the Application: Complete the application process, which may include answering questions about your investment goals and risk tolerance.

- Fund Your Account: Deposit funds into your account to start trading.

Understanding U.S. Stock Market Terms

To make informed investment decisions, it's essential to familiarize yourself with key terms and concepts:

- Exchange-Traded Funds (ETFs): ETFs are a type of investment fund that trades on an exchange like a stock. They track a basket of assets, such as stocks, bonds, or commodities.

- Dividends: Dividends are payments made by a company to its shareholders, usually in the form of cash or additional shares.

- Market Capitalization: Market capitalization is the total value of a company's outstanding shares, calculated by multiplying the share price by the number of shares outstanding.

Researching and Analyzing Stocks

Once your brokerage account is set up, it's time to research and analyze stocks. Here are some tips:

- Analyze Financial Statements: Examine a company's financial statements, including the balance sheet, income statement, and cash flow statement, to assess its financial health.

- Read News and Reports: Stay informed about the company's industry, competitors, and any news that could impact its stock price.

- Use Stock Screeners: Many brokerage platforms offer stock screeners that help you find stocks based on specific criteria, such as market capitalization, industry, or performance.

Diversifying Your Portfolio

Diversification is crucial for managing risk. By investing in a variety of stocks, you can reduce the impact of a single stock's poor performance on your portfolio. Consider investing in:

- Different Industries: Invest in companies from various industries to reduce the risk associated with industry-specific downturns.

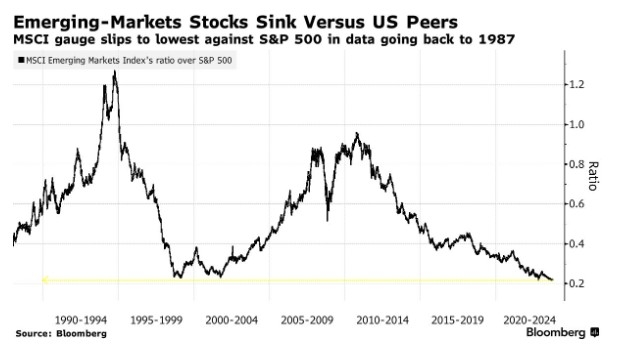

- Geographical Diversification: Invest in companies from different countries to benefit from the global economic landscape.

Case Study: Investing in Apple as a Foreigner

Let's say you're interested in investing in Apple Inc. (AAPL), one of the most popular companies in the tech industry. Here's how you would go about it:

- Research Apple: Analyze Apple's financial statements, news, and reports to understand its performance and future prospects.

- Open a Brokerage Account: Use a brokerage firm that offers access to U.S. stocks, such as Charles Schwab or TD Ameritrade.

- Buy Apple Stock: Once your account is funded, you can buy Apple stock through your brokerage platform.

Investing in U.S. stocks as a foreigner can be a rewarding experience if you approach it with thorough research and a well-diversified portfolio. By understanding the basics, opening a brokerage account, and staying informed about the market, you can start building wealth in the world's largest stock market.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....