In times of crisis, the question of whether the United States can shut down the stock market often arises. This article delves into the complexities surrounding this topic, examining the historical context, legal framework, and potential implications of such a decision.

Historical Context

The stock market has been a cornerstone of the American economy since the 19th century. Throughout its history, the market has faced numerous challenges, including financial crises and natural disasters. However, the government has never completely shut down the stock market.

One notable example is the 1929 stock market crash, which led to the Great Depression. Despite the economic turmoil, the stock market remained open, albeit with significant volatility. This decision allowed investors to sell their stocks and potentially mitigate their losses.

Legal Framework

The authority to shut down the stock market lies with the U.S. Securities and Exchange Commission (SEC). The SEC is responsible for regulating the securities industry, including the stock market. In the event of a crisis, the SEC can take various measures, such as halting trading or imposing trading restrictions.

However, the SEC has limited power to shut down the entire market. According to the Exchange Act of 1934, the SEC can impose trading halts on individual stocks or entire exchanges, but it cannot shut down the entire market.

Potential Implications

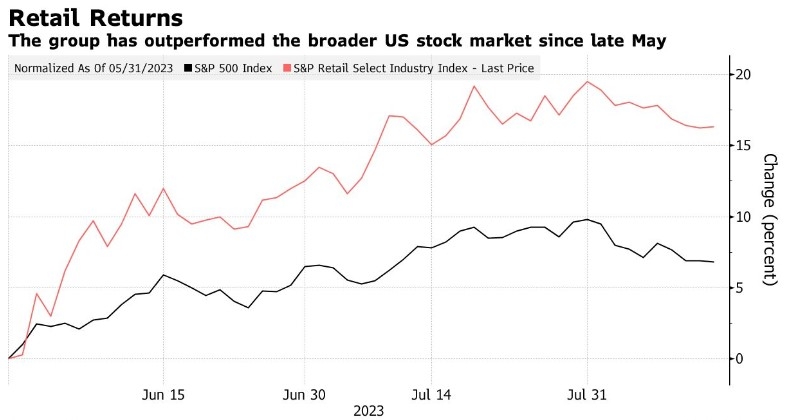

Shutting down the stock market could have several unintended consequences. For instance, it could lead to a loss of investor confidence, causing further panic and volatility in the markets. Additionally, it could disrupt the flow of capital, making it difficult for businesses to raise funds and invest in growth.

Moreover, a complete shutdown could have a ripple effect on the broader economy. Many businesses rely on the stock market for investment, and a halt in trading could lead to a slowdown in economic activity.

Case Studies

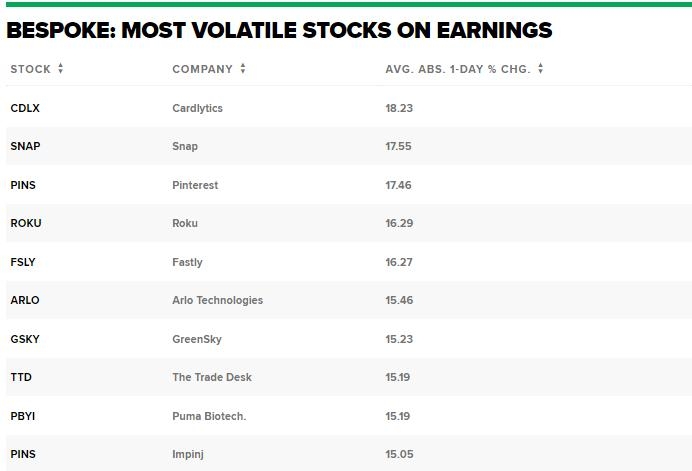

One recent example of the SEC's power to halt trading is the 2010 "Flash Crash." In May 2010, the stock market experienced a sudden and dramatic drop in prices. The SEC imposed a temporary halt in trading on the S&P 500 index, which helped stabilize the market.

Another example is the SEC's decision to halt trading on GameStop (GME) and other stocks in January 2021. This action was prompted by a massive surge in trading volume and volatility, which raised concerns about market manipulation.

Conclusion

While the U.S. government has the authority to shut down the stock market, it is a complex decision with significant implications. The SEC's power to impose trading halts on individual stocks or exchanges is a more practical and targeted approach. In times of crisis, the focus should be on restoring stability and confidence in the market, rather than resorting to a complete shutdown.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....