In the dynamic world of the stock market, staying informed about the latest trends and developments is crucial. One such trend that has been capturing the attention of investors is the stock price of RIO, a leading company in the energy sector. In this article, we will delve into the factors influencing the RIO US stock price and provide insights into what investors should keep an eye on.

Understanding RIO Stock

Firstly, it's essential to understand what RIO stands for. RIO Tinto is a British-Australian multinational mining and resources company, with a significant presence in the United States. The company operates in various sectors, including iron ore, copper, coal, and diamonds. Its stock, listed on the New York Stock Exchange, has been a popular choice for investors looking to gain exposure to the global commodities market.

Factors Influencing RIO US Stock Price

Several factors can influence the RIO US stock price. Here are some of the key factors to consider:

- Commodity Prices: As a mining and resources company, RIO's stock price is heavily influenced by the prices of the commodities it produces. Fluctuations in commodity prices, such as iron ore and copper, can have a significant impact on the company's revenue and profitability, thereby affecting its stock price.

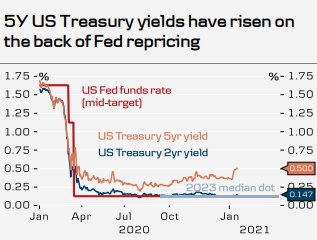

- Economic Conditions: The global economy plays a crucial role in determining commodity prices. Factors such as inflation, currency fluctuations, and geopolitical tensions can all impact the demand for commodities and, consequently, the stock price of RIO.

- Supply Chain Disruptions: Any disruptions in the supply chain, such as labor strikes or natural disasters, can affect the production and supply of commodities, leading to price volatility and, in turn, impacting RIO's stock price.

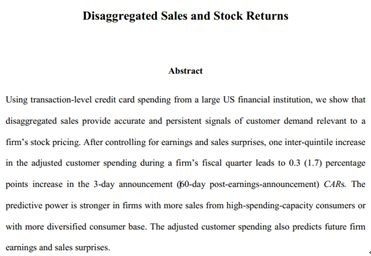

- Company Performance: The financial performance of RIO, including its revenue, earnings, and dividend payments, is a key driver of its stock price. Strong financial results can boost investor confidence and drive up the stock price, while poor performance can have the opposite effect.

Recent Trends and Analysis

In recent years, the RIO US stock price has experienced significant volatility. For instance, in 2020, the stock price surged as the global commodities market recovered from the COVID-19 pandemic. However, in 2021, the stock price faced downward pressure due to concerns about inflation and supply chain disruptions.

One notable example is the impact of the COVID-19 pandemic on RIO's stock price. In early 2020, as the pandemic began to spread, the stock price experienced a sharp decline. However, as the global economy started to recover and commodity prices stabilized, the stock price began to rebound.

Conclusion

Understanding the factors influencing the RIO US stock price is crucial for investors looking to make informed decisions. By keeping an eye on commodity prices, economic conditions, supply chain disruptions, and company performance, investors can better navigate the volatile stock market and make profitable investments.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....