The Year 2018: A rollercoaster ride for the US Stock Market

As we bid farewell to 2018, it's only natural to look back and reflect on the year that was, especially for those invested in the US stock market. 2018 was a tumultuous year, marked by volatility and uncertainty. This article delves into how the US stock market ended 2018, analyzing the key factors that influenced its performance.

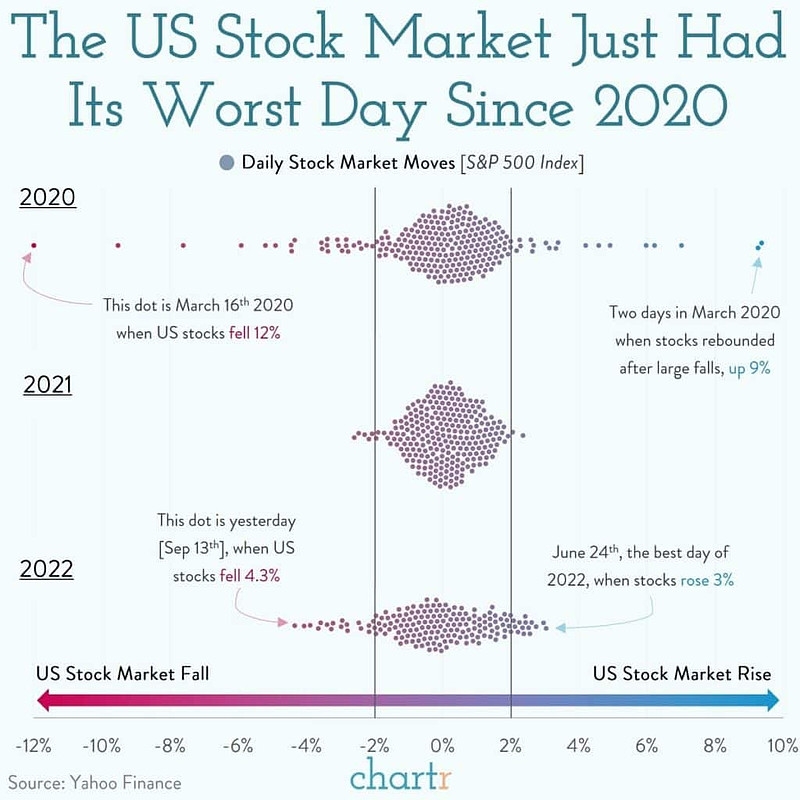

Market Volatility in 2018

The US stock market experienced a rollercoaster ride in 2018. Volatility became the norm, with the S&P 500 Index witnessing its worst December since the financial crisis of 2008. This was primarily driven by global economic uncertainty, political tensions, and interest rate hikes by the Federal Reserve.

Global Economic Uncertainty

One of the major factors contributing to the volatility in the US stock market was global economic uncertainty. The year 2018 saw tensions rise between the United States and China, leading to a trade war that impacted global markets. Additionally, concerns about the economic health of major economies, such as China and the Eurozone, added to the uncertainty.

Political Tensions

Political tensions in the United States also played a significant role in the market's performance. The ongoing budget negotiations and impeachment inquiry into the President added to the uncertainty, causing investors to become more cautious.

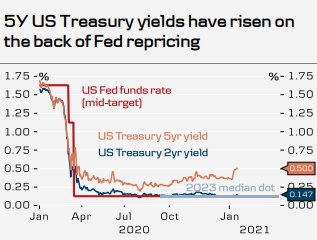

Interest Rate Hikes

The Federal Reserve's decision to hike interest rates several times in 2018 also contributed to the market's volatility. Higher interest rates can lead to increased borrowing costs for companies, which can, in turn, impact their profitability and stock prices.

Performance of Major Indices

Despite the challenges, the US stock market ended 2018 with mixed results. The S&P 500 Index closed the year down by about 6.2%, marking its first annual decline since 2008. However, the Dow Jones Industrial Average and the NASDAQ Composite ended the year slightly positive, with gains of about 0.4% and 3.9%, respectively.

Sector Performance

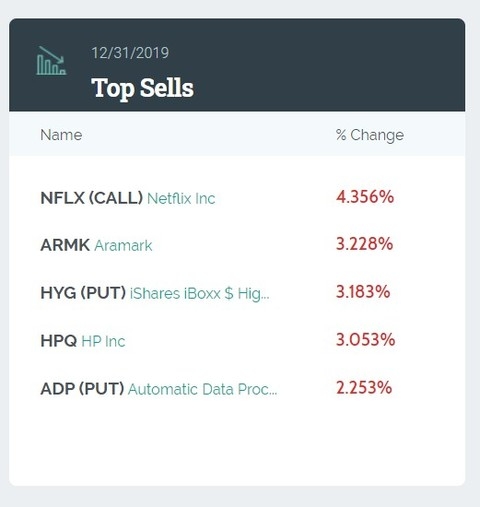

Among the major sectors, energy and real estate outperformed, while technology and consumer discretionary sectors lagged. This was largely due to the impact of the trade war and the rise in interest rates.

Impact on Investors

The volatility in the stock market in 2018 had a significant impact on investors. Risk-averse investors saw their portfolios shrink, while aggressive investors may have seen opportunities to take advantage of the market's dips.

Looking Ahead

As we move into 2019, it remains to be seen how the US stock market will perform. However, it's clear that risk management and diversification will be key to navigating the choppy waters of the stock market.

In conclusion, 2018 was a challenging year for the US stock market. Volatility, global economic uncertainty, and political tensions were the major factors that influenced its performance. While the market ended the year on a mixed note, investors will need to remain vigilant and stay focused on risk management and diversification as they navigate the unpredictable markets of 2019.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....