The financial landscape is abuzz with anticipation as US stock futures indicate a lower opening ahead of the 2024 market year. As investors brace for the upcoming trading sessions, it is crucial to understand the factors contributing to this trend and how it might impact the broader market. This article delves into the reasons behind the lower stock futures and explores potential implications for investors.

Reasons for Lower Stock Futures

Several key factors are contributing to the downward trend in US stock futures:

- Economic Concerns: The Federal Reserve's aggressive interest rate hikes to combat inflation have led to economic uncertainty. The possibility of a recession and the subsequent impact on corporate earnings have investors wary.

- Geopolitical Tensions: Ongoing geopolitical conflicts, particularly in Europe and Asia, have raised concerns about global economic stability. These tensions have created uncertainty and contributed to the lower stock futures.

- Corporate Earnings: Many companies have reported lower-than-expected earnings, leading investors to question the health of the US economy and the stock market's future prospects.

Impact on the Broader Market

The lower stock futures ahead of the 2024 market open have several potential implications for the broader market:

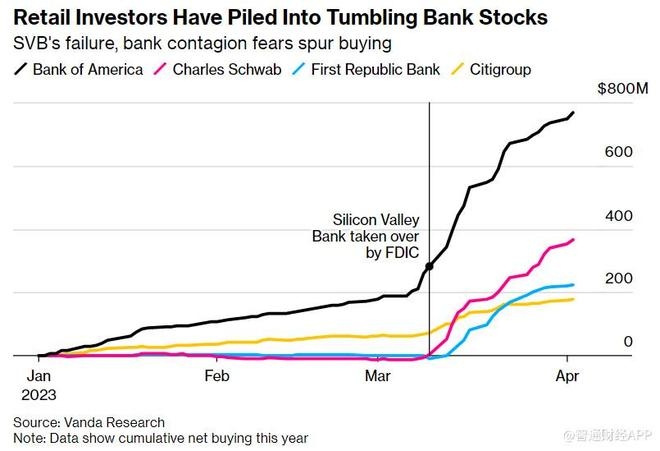

- Market Volatility: The downward trend in stock futures suggests a higher level of market volatility in the coming weeks. Investors should be prepared for potential fluctuations in the market.

- Risk Aversion: The lower stock futures indicate a shift towards risk aversion among investors. This may lead to a flight to safer assets such as bonds and gold.

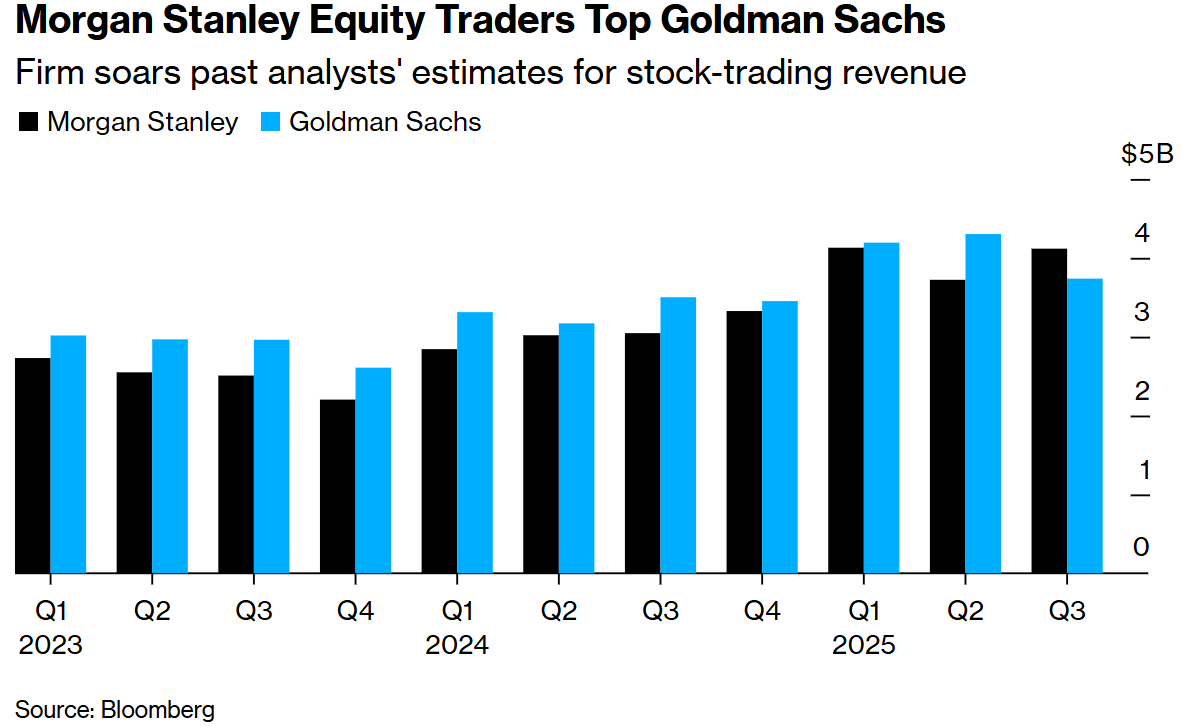

- Sector Impact: Certain sectors, such as technology and consumer discretionary, may be particularly affected by the lower stock futures due to their higher sensitivity to economic conditions.

Case Studies

To further illustrate the potential impact of lower stock futures, let's examine a few case studies:

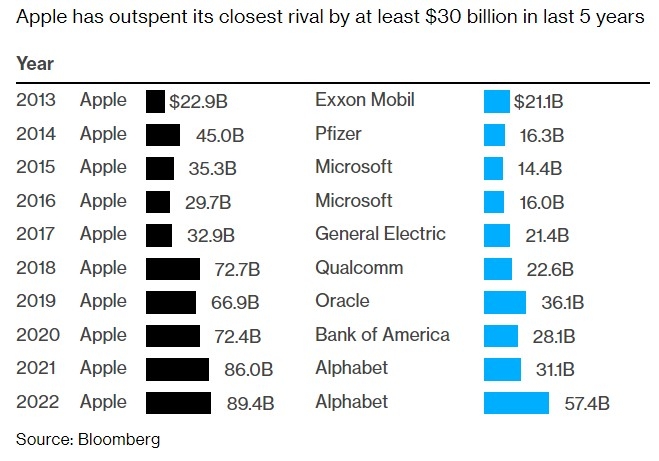

- Tech Sector: The tech sector has been heavily impacted by economic uncertainty and rising interest rates. Companies like Apple and Google have seen their stock prices decline in anticipation of the lower stock futures.

- Retail Sector: The retail sector, which includes companies like Walmart and Target, has also been affected by economic concerns. Lower consumer spending and rising inflation have put pressure on these companies' earnings.

- Energy Sector: The energy sector, which includes oil and gas companies, has seen a mixed response to the lower stock futures. While lower oil prices may benefit some companies, the overall economic uncertainty has created a cautious outlook for the sector.

Conclusion

The lower stock futures ahead of the 2024 market open reflect a cautious approach among investors. As the market grapples with economic concerns, geopolitical tensions, and corporate earnings, it is essential for investors to stay informed and adapt their strategies accordingly. By understanding the underlying factors contributing to the lower stock futures, investors can make more informed decisions and navigate the evolving market landscape.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....