The U.S. stock market, often considered the global benchmark for financial markets, has been on a rollercoaster ride over the past few years. As investors and analysts continue to debate whether the market is poised for a crash, it's crucial to examine the factors that might lead to such a downturn. In this article, we'll delve into the key indicators that could signal a potential market crash and discuss the likelihood of such an event occurring.

Historical Context

Throughout history, the U.S. stock market has experienced numerous crashes, with the most notable being the Great Depression of the 1930s, the dot-com bubble burst in the early 2000s, and the financial crisis of 2007-2008. These events were driven by a combination of factors, including excessive speculation, poor risk management, and regulatory failures.

Current Indicators

Several indicators are currently raising concerns about the potential for a stock market crash:

1. High Valuations

One of the most significant factors contributing to the potential for a market crash is the high valuations of many stocks. The S&P 500, for example, has been trading at record highs, far above its historical averages. This suggests that investors may be paying too much for the stocks they own, making the market vulnerable to a downturn.

2. Record Corporate Debt

Corporate debt levels have reached record highs, with many companies relying on borrowed money to finance their operations and expansions. This excessive debt could become a burden if the economy slows down or if interest rates rise, leading to defaults and a potential stock market crash.

3. Inflation Concerns

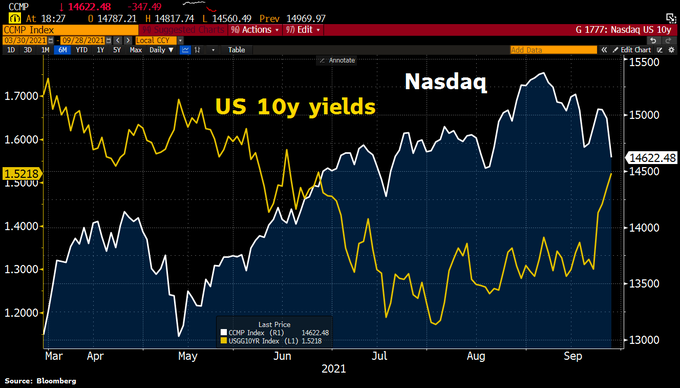

The Federal Reserve has been raising interest rates to combat rising inflation, which has reached levels not seen in decades. Higher interest rates can make borrowing more expensive, leading to a decrease in corporate profitability and potentially triggering a market crash.

4. Geopolitical Tensions

Geopolitical tensions, such as the conflict in Ukraine, have raised concerns about global economic stability. These tensions could lead to supply chain disruptions, increased energy prices, and a slowdown in economic growth, all of which could negatively impact the stock market.

5. Market Speculation

Speculation has been a driving force behind the stock market's recent surge. Many investors are chasing high-growth stocks, leading to inflated valuations and increased volatility. If this speculative bubble bursts, it could lead to a significant market crash.

Case Study: The Dot-Com Bubble

One of the most notable examples of a stock market crash was the dot-com bubble, which burst in 2000. The bubble was driven by excessive speculation and unrealistic valuations of technology stocks. When the bubble burst, the NASDAQ index lost more than 80% of its value, leading to a significant market downturn.

Conclusion

While it's difficult to predict whether the U.S. stock market is ready to crash, the current indicators suggest that there are significant risks. Investors should be aware of these risks and consider diversifying their portfolios to protect against potential market downturns. By staying informed and prepared, investors can navigate the volatile market landscape and make informed decisions.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....