Introduction: The United States stock market has always been a hot topic among investors, financial analysts, and market enthusiasts. With its vast array of companies and diverse sectors, the US stock market has attracted investors from all around the world. In this article, we will delve into the total valuation of the US stock market, exploring its current state, historical trends, and future outlook.

Understanding Stock Market Valuation To grasp the total valuation of the US stock market, it's essential to understand the concept of stock market valuation. Stock market valuation refers to the process of determining the current worth of a company or a group of companies based on various financial metrics. The most commonly used valuation methods include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and market capitalization.

Current Total Valuation of the US Stock Market As of now, the total valuation of the US stock market stands at approximately $34 trillion. This figure is derived from the market capitalization of all publicly-traded companies listed on major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ.

Historical Trends Over the years, the total valuation of the US stock market has experienced significant fluctuations. During the dot-com bubble in the late 1990s, the market valuation surged to an all-time high of around $20 trillion. However, the burst of the bubble resulted in a sharp decline in market valuation.

Since then, the US stock market has recovered and reached new heights. The financial crisis of 2008 saw a massive drop in market valuation, but it quickly recovered and continued to grow. Today, the market valuation is higher than ever before.

Factors Influencing Stock Market Valuation Several factors contribute to the total valuation of the US stock market. Some of the key factors include:

- Economic Growth: Strong economic growth tends to drive up stock market valuations, as companies experience higher revenues and profits.

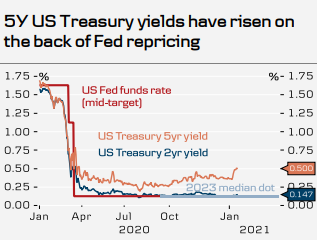

- Interest Rates: Lower interest rates encourage borrowing and investment, which can boost stock market valuations.

- Corporate Profits: Higher corporate profits lead to increased investor confidence, driving up stock prices and market valuation.

- Market Sentiment: Investor sentiment can significantly impact stock market valuations. For instance, during periods of optimism, stock prices tend to rise, leading to higher market valuation.

Case Study: S&P 500 Index The S&P 500 index is a widely followed benchmark for the US stock market. As of the latest data, the S&P 500 index has a total market capitalization of approximately $30 trillion. This represents about 80% of the total valuation of the US stock market.

Future Outlook The future outlook for the US stock market is subject to various factors, including economic conditions, geopolitical events, and corporate earnings. While it's difficult to predict the exact trajectory of the stock market, experts generally believe that the US stock market will continue to grow in the long term.

Conclusion: The total valuation of the US stock market is a significant indicator of the country's economic health and investor confidence. By understanding the factors influencing stock market valuation and historical trends, investors can make informed decisions about their investments. As the US economy continues to grow, the total valuation of the US stock market is expected to reach new heights in the coming years.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....